trading-tools-resources | 10-10-25

Rithmic is the superior choice for scalpers and algorithmic traders who require ultra-low latency (<250μs) and unfiltered MBO data. Tradovate is the better option for retail and mobile traders, offering a cloud-based interface and seamless TradingView integration. Choose Rithmic for precision with third-party tools like NinjaTrader; choose Tradovate for cross-device accessibility and zero platform fees.

Understanding Rithmic

Rithmic is best known for its low-latency infrastructure and professional-grade data delivery. It has earned a reputation among active traders who demand precision and speed. The platform is less about aesthetics and more about raw performance—making it a natural choice for traders who rely heavily on order flow analysis, scalping strategies, and automated execution.

Key Highlights of Rithmic:

- Direct access to market data with minimal lag.

- Popular for advanced traders and algorithmic strategies.

- Integrated with multiple third-party platforms such as NinjaTrader, Sierra Chart, and Quantower.

- Steeper learning curve due to its technical orientation.

Rithmic’s primary advantage lies in reliability. If your trading depends on split-second decisions, execution speed is non-negotiable, and Rithmic delivers on that front.

Understanding Tradovate

Tradovate, in contrast, emphasizes user experience and modern accessibility. It is a cloud-based futures trading platform with a sleek interface, making it attractive to both new and experienced traders. One of its unique features is commission-free membership pricing, which has appealed to cost-conscious traders who make frequent trades.

Key Highlights of Tradovate:

- Cloud-based platform accessible from desktop, tablet, and mobile.

- Commission-free membership options for active traders.

- Integrated charting, order management, and performance analytics in one dashboard.

- Beginner-friendly layout compared to traditional futures platforms.

Tradovate shines in flexibility—its ability to work seamlessly across devices makes it especially appealing for traders who want mobility and simplicity without sacrificing core features.

Does Tradovate Support TradingView?

Yes, Tradovate features native TradingView integration, allowing you to execute trades directly from TradingView charts using your Apex or Tradovate credentials. This cloud-based sync ensures that all orders, brackets, and risk limits set in Tradovate are mirrored in real-time on the TradingView interface.

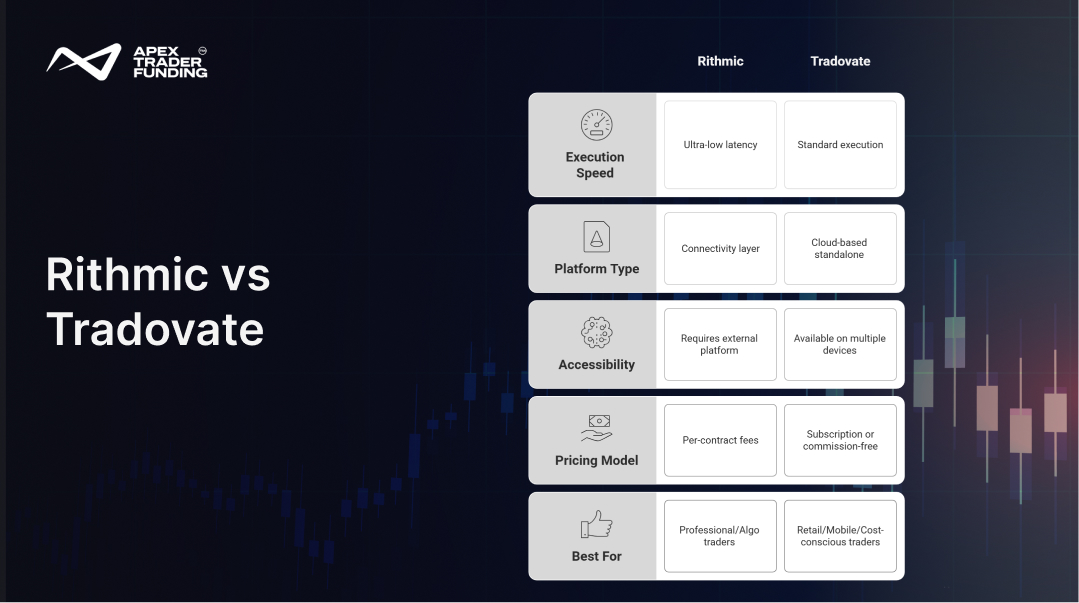

Comparing Rithmic and Tradovate

While both platforms provide strong futures trading capabilities, they are built with different priorities in mind. The table below highlights their major differences:

Feature | Rithmic (R|Trader Pro) | Tradovate (Cloud) |

|---|---|---|

Execution Speed | Ultra-Low Latency (<1ms) | Standard Retail Speed |

Data Type | MBO (Market By Order) | MBP (Market By Price) |

Cloud Access | No (Windows Native) | Yes (Browser/Mobile/Mac) |

Server-Side OCO | Yes (Institutional Reliability) | Yes (Cloud-Based Sync) |

Best For | Footprint/Order Flow Pros | TradingView & Mobile Users |

This comparison makes it clear: Rithmic is about speed and precision, while Tradovate is about convenience and usability.

Order Execution: Server-Side vs. Cloud-Sync

The biggest technical difference between these platforms isn't the interface—it's how they handle your orders if your connection drops.

Rithmic: Server-Side Bracket Orders Rithmic utilizes Server-Side execution. This means your OCO (One-Cancels-Other) and bracket orders live on Rithmic's physical servers at the exchange. If your computer crashes or your internet fails, your stop-loss and profit targets stay live at the exchange. This is a critical safety net for high-frequency scalpers.

Tradovate: Cloud-Sync Continuity Tradovate leverages a Cloud-Sync model. While it also offers server-side protection, its real strength is mobility. Because your account is cloud-hosted, you can open a trade on your PC at home and close it on your phone during your commute without any synchronization lag or the need for a VPS.

The Cost of a Funded Account: Activation vs. Data Fees

While evaluation fees are low, becoming a "Professional" trader in 2026 carries significant overhead. Once funded, exchanges like the CME require prop firms to reclassify you as a Professional. This typically results in a monthly data fee of approximately $135–$156, which is separate from your one-time or monthly activation fee.

- Evaluation Phase: Data is usually bundled for ~$9/mo or included.

- Funded Phase: Professional data fees apply per exchange (CME, CBOT, NYMEX, COMEX).

Activation: A one-time fee (typically $140–$160 for a 50K account) covers the account setup but not the recurring exchange data.

The best trading platform isn’t the one with the most features—it’s the one that aligns with your style, speed, and goals.

The 2026 "Data Fee" Reality Check

Expert Tip: In 2026, CME exchange fees differ significantly by your status. While Tradovate often bundles some of these costs into their subscription, Rithmic users typically pay a $25/month connection fee on top of their exchange data.

Most importantly: Once you pass an evaluation, be prepared for Professional Data Fees (~$135/mo). Major exchanges like the CME require prop firms to classify funded traders as "Professionals," which is a mandatory overhead cost many beginners overlook.

Integration with Prop Firms and Brokers

The choice between Rithmic and Tradovate is not only about features but also about availability through brokers and proprietary trading firms. Many funded account providers, such as Apex Trader Funding, give traders the option to select one of these platforms when starting their evaluation or funded account.

- Rithmic with Prop Firms – Frequently chosen by traders who need a robust, low-latency connection. It integrates with external platforms like NinjaTrader or Sierra Chart, which are often offered by prop firms.

- Tradovate with Prop Firms – Appeals to traders who want an all-in-one platform without the need for third-party software. Its cloud-based nature makes account access easier across multiple devices, which is a plus for funded traders managing positions outside their primary workstation.

Understanding how each platform is supported by your broker or prop firm can be just as important as the platform features themselves, since account setup, fees, and evaluation rules may differ depending on the chosen integration.

Educational Takeaways: Which Should You Choose?

Your choice between Rithmic and Tradovate depends on your trading style and resource needs:

- Choose Rithmic if…

- You prioritize execution speed and accuracy.

- You trade high frequency or rely on automation.

- You already use advanced third-party charting platforms.

- Choose Tradovate if…

- You want a simple, all-in-one cloud-based trading experience.

- You prefer to trade on multiple devices seamlessly.

- You value cost efficiency through commission-free memberships.

While Tradovate provides excellent Market By Price (MBP) data suitable for most retail strategies, scalpers needing to see individual "packets" of orders in the queue must stick with Rithmic. Both platforms are valuable tools, but they cater to different learning curves and trading goals. Beginners may gravitate toward Tradovate for its ease of use, while seasoned traders may prefer Rithmic’s infrastructure for its professional-grade precision.

Rithmic represents precision and power, while Tradovate reflects accessibility and ease—the right choice depends on the trader behind the screen.

Final Thoughts

In futures trading, no single platform is universally “better”—it’s about alignment with your trading needs. Rithmic excels in delivering speed and technical performance, making it a favorite for serious traders who require advanced integrations. Tradovate, on the other hand, stands out with its intuitive design, mobility, and pricing options that appeal to traders at different levels.

FAQs

No, Rithmic and Tradovate are separate futures trading platforms and do not integrate with each other. Rithmic is a data feed and execution layer that connects with third-party platforms like NinjaTrader or Sierra Chart, while Tradovate is a standalone, cloud-based trading platform. Traders usually choose one based on speed, features, and accessibility needs.

Rithmic, Tradovate, and WealthCharts each serve different purposes in futures trading. Rithmic is primarily a low-latency data feed and order execution system used with third-party platforms. Tradovate is a cloud-based futures trading platform offering integrated charting, order entry, and account management in one place. WealthCharts, on the other hand, is an advanced charting and analysis tool that focuses on market visualization, technical studies, and strategy development. While Rithmic and Tradovate are often chosen for live trading, WealthCharts is typically used to refine strategies and support decision-making.

Related Blogs

trading-tools-resources | 28-08-25

How to Pass a Funded Trading Account? A Guide for 2026

Passing a funded trading account is often seen as the gateway to trading larger capital without risking personal savings. Yet many...

Read more

trading-tools-resources | 02-09-25

Apex Trader Funding vs Topstep - Detailed Comparison

Apex vs. Topstep: The 2026 VerdictThe choice between Apex and Topstep depends on your risk tolerance for drawdowns. Apex is cheaper...

Read more

trading-tools-resources | 04-09-25

Tradovate vs NinjaTrader in 2026: Futures Platforms Compared

NinjaTrader vs. Tradovate: 2026 Quick AnswerWhile both are owned by the same parent company, the choice is now about Interface...

Read more