trading-tools-resources | 02-09-25

Apex vs. Topstep: The 2026 Verdict

The choice between Apex and Topstep depends on your risk tolerance for drawdowns. Apex is cheaper (often <$20 with 90% sales) and allows up to 20 accounts, but uses a strict Intraday Trailing Drawdown. Topstep is more expensive but uses a more forgiving End-of-Day Drawdown and offers faster, daily payouts once you reach 5 winning days of $150+

Feature | Apex Trader Funding | Topstep |

|---|---|---|

Drawdown Type | Intraday Trailing (Real-time peak) | End-of-Day (Post-market close) |

Evaluation Type | 1-Step Evaluation | 1-Step Trading Combine |

Payout Rule | 8–10 winning days + 30% Consistency | 5 winning days ($150+ net profit) |

First Profit Split | 100% of first $25,000 | 100% of first $10,000 |

Max Accounts | 20 Accounts (Copy Trading) | 5 Accounts (TopstepX Copier) |

Activation Fee | ~$85/mo or ~$140 Lifetime | $129 (Standard) or $0 (No-Fee Path) |

Among the many proprietary trading firms, Apex Trader Funding and Topstep are two of the most frequently compared by active traders. The debate of apex vs topstep is common among futures traders who want access to capital without risking large personal savings. Both firms provide pathways to trade futures without risking large personal savings, yet they differ in structure, cost, and the tools they provide. When deciding between them, it’s essential to focus on the resources each firm offers and how those tools align with your trading style.

In prop trading, the tools around you matter as much as the capital behind you.

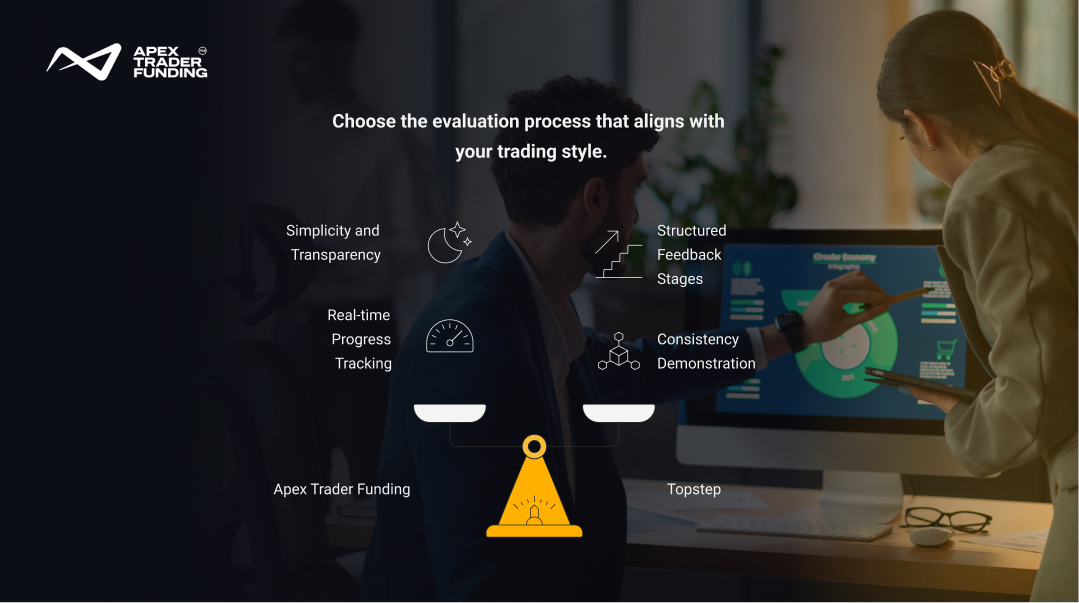

Evaluation Pathways and Tracking Tools

Both firms require traders to complete an evaluation before accessing live capital. However, the tools supporting that process differ significantly:

The Drawdown Difference: The #1 Factor in Your Success

- Apex (Intraday Trailing): Your maximum loss limit trails your peak unrealized profit in real-time. If you are up $2,000 in a trade and it pulls back to $500, your drawdown limit moved up with that $2,000 peak. This is the "Hard Mode" of risk management, requiring you to protect open profits aggressively.

- Topstep (End-of-Day): Your drawdown limit only updates based on your closed balance at the end of the trading day. This allows you to weather intraday volatility and price pullbacks without losing your account mid-trade, as long as you finish the day above the limit.

Apex Trader Funding emphasizes simplicity with a 1-Step Evaluation.

Topstep, in 2026, also uses a 1-Step Trading Combine.

The takeaway: If you want the cheapest entry and can manage tight intraday risk, Apex wins. If you want a more realistic "professional" drawdown that doesn't punish pullbacks, Topstep is the better investment.

Platform Access and Technology Resources

Trading tools extend beyond rules—platform access is central.

- With Apex, traders gain direct access to Rithmic, Tradovate, and WealthCharts for execution and analysis. Rithmic and Tradovate are known for low-latency execution and accessibility, while WealthCharts provides advanced analytics and charting features. These connections are often bundled with account packages, ensuring traders have the resources they need without heavy add-on costs.

- Topstep supports platforms like NinjaTrader and others, giving flexibility for those who already use these tools. However, some platforms may require separate licensing or fees, which can increase the barrier for newer traders.

In essence, Apex focuses on affordability and immediate platform integration, while Topstep caters to traders who already know what tools they prefer and are willing to invest in them.

Cost Structures and Resource Value

Funding programs are never free—what matters is the value you get for the fees paid.

- Apex typically offers lower monthly evaluations, often discounted through frequent promotions. For traders conscious of costs, this means more attempts at building consistency without draining capital.

- Topstep charges higher monthly fees but often packages additional resources—like coaching calls, trader development tools, and guided content. Traders essentially pay more for a resource-rich environment, not just a pathway to capital.

Both approaches serve different needs: Apex appeals to budget-conscious traders who want more trading attempts for less, while Topstep targets those willing to pay extra for structured learning and guided improvement.

Educational & Community Resources

More than just capital, knowledge and learning shapes a trader’s long-term success.

- Apex Trader Funding focuses on rule transparency and self-directed learning. The resources are practical and tied to account dashboards, allowing traders to learn through direct experience.

- Topstep builds a more mentorship-oriented structure, with access to coaching, webinars, and a trader community. For some, this creates a valuable sense of accountability. For others, it may feel unnecessary if they prefer independent learning.

Each firm offers resources, but Apex focuses on tools for independent traders, while Topstep emphasizes guidance through its community.

Which Firm Fits Which Trader?

When choosing between Apex and Topstep, think less about which one is “better” and more about what kind of trader you are:

- If you value affordable access, simplified evaluation, and direct integration with platforms, Apex may provide the streamlined resources you need.

- If a layered evaluation process combined with coaching and structured programs appeals to you, Topstep is likely the better option.

Ultimately, each firm’s tools and resources reflect different philosophies. Where Apex stands out for its simplicity, lower costs, and quick entry, Topstep is known for its coaching, structured steps, and trader community.

The real difference between Apex and Topstep isn’t the funding—it’s the resources they provide to help you trade smarter.

Scaling with Copy Trading: The Multi-Account Edge

For traders looking to move beyond a single account, Copy Trading is the ultimate scaling tool. This technology allows you to execute a trade in one "Lead" account and have it mirrored instantly across multiple "Follower" accounts.

- Apex (The Scaler’s Choice): Apex is the industry leader for multi-account management, allowing you to trade up to 20 active Paid Accounts (PAs) simultaneously. By using the cloud-based Apex Trade Copier, you can manage a massive pool of capital while only placing one trade. This is why Apex is the preferred choice for high-volume professionals.

+1 - Topstep (The Focused Approach): Topstep is more restrictive, capping traders at 5 active Express Funded Accounts. While they offer a built-in TopstepX Copier, the lower account limit means your total capital ceiling is significantly lower than Apex’s 20-account model.

Final Thoughts

The real decision between Apex Trader Funding and Topstep isn’t about which firm has the flashier marketing—it’s about whether you need lean tools to trade independently or a resource-rich environment to guide your growth.

By viewing the comparison through the lens of Trading Tools & Resources, you can choose the platform that not only funds your trading journey but also strengthens your long-term development.

FAQs

The 30% rule requires that no single day’s gains make up more than 30% of your total profits. Apex applies this rule to confirm that traders can deliver steady results over time, instead of passing an evaluation with one lucky trade. It encourages smaller, controlled wins spread across several sessions, building habits that reflect real professional trading. By following this rule, traders prove they can manage risk responsibly and trade with discipline.

Yes, Topstep allows scalping as long as traders follow the firm’s rules and risk guidelines. There are no restrictions on trade frequency or holding time, meaning you can enter and exit quickly if that matches your strategy. The key is staying within drawdown limits, daily risk rules, and maintaining consistency. Scalping is permitted, but discipline and risk control still decide whether you succeed in the program.

The 7-day rule in Apex Trader Funding means traders must place trades on at least seven different days to qualify for a funded account. It prevents passing an evaluation in just one or two sessions and ensures consistency over time. The rule is designed to show that traders can perform steadily across multiple days, not just during a short winning streak.

Apex Trader Funding does not set a strict maximum withdrawal limit. Traders can withdraw profits as they accumulate, following the firm’s payout schedule and minimum withdrawal requirements. The focus is on consistent profitability and rule compliance, so as long as you meet those conditions, you can continue to withdraw without an upper cap.

Related Blogs

trading-tools-resources | 28-08-25

How to Pass a Funded Trading Account? A Guide for 2026

Passing a funded trading account is often seen as the gateway to trading larger capital without risking personal savings. Yet many...

Read more

trading-tools-resources | 04-09-25

Tradovate vs NinjaTrader in 2026: Futures Platforms Compared

NinjaTrader vs. Tradovate: 2026 Quick AnswerWhile both are owned by the same parent company, the choice is now about Interface...

Read more

trading-tools-resources | 15-09-25

What is the Prop Firm Consistency Rule?

Consistency is a word every trader hears, but in the world of proprietary trading firms, it has a very specific meaning....

Read more