trading-tools-resources | 28-08-25

Passing a funded trading account is often seen as the gateway to trading larger capital without risking personal savings. Yet many traders underestimate the discipline it requires. Funded accounts are designed to measure not just profitability, but whether you can follow rules, manage risk, and maintain consistency. Passing isn’t a matter of luck—it comes down to having structure, and the right tools are what make that structure achievable.

How to Pass a Funded Trading Account?

To pass a funded trading account evaluation, you must reach a specific profit target (e.g., $3,000 for a 50K account) while staying above the Trailing Threshold (maximum drawdown). Successful traders typically risk only 0.5% to 1% per trade and maintain a Profit Factor above 1.5 across a minimum of 7 trading days.”

⚠️ 2026 Special Disclosure: The Apex "1-Day to Pass" Option While most firms enforce a minimum trading period (usually 7–10 days), Apex Trader Funding has recently introduced a "1-Day to Pass" option during specific sales events.

How it works: If active, this feature allows experienced traders to bypass the standard minimum day requirement completely. If you hit the profit target in a single session without violating risk rules, you qualify for a Performance Account immediately.

Note: This is a promotional feature and may not always be active. Always check current terms before starting an evaluation.

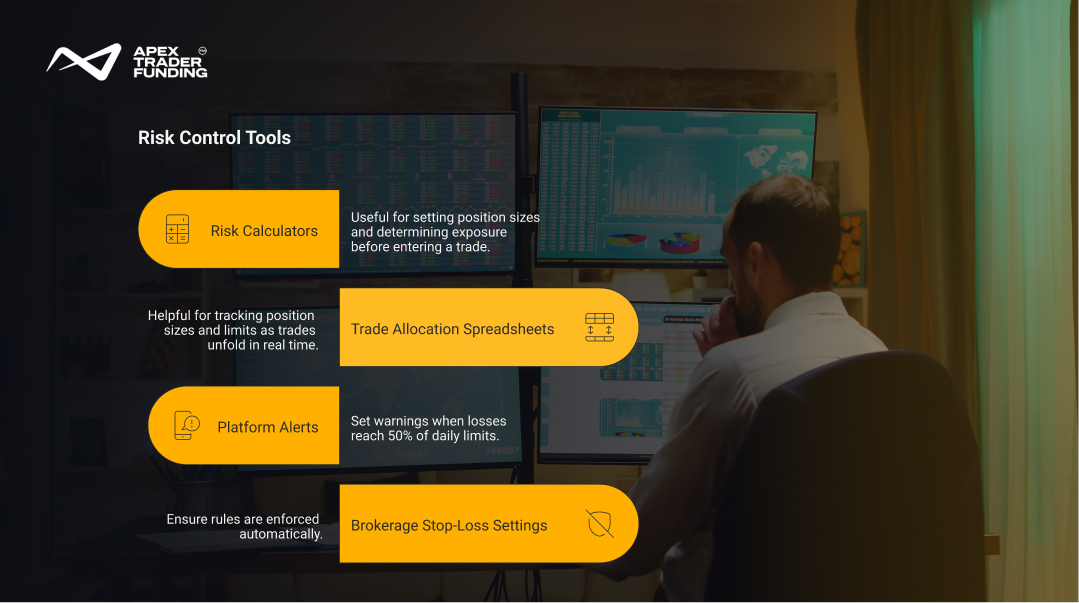

Risk Control Tools

Poor risk control is one of the leading factors behind traders falling short in evaluations. Having the right tools in place reduces the chance of crossing loss limits and keeps you aligned with account rules. Some of the most useful include:

- Risk calculators – useful for setting position sizes and determining exposure before entering a trade.

- Trade allocation spreadsheets – helpful for tracking position sizes and limits as trades unfold in real time.

- Platform alerts – set warnings when losses reach 50% of daily limits.

Expert Implementation: Don’t just use a calculator; automate your defense. If you're on Tradovate, navigate to Application Settings > Risk Settings and enable the "Liquidate and Block" option for your Personal Daily Loss Limit. This prevents "Revenge Trading" by physically locking your account from new entries until the next session—a tool that separates professional funded traders from amateurs.

- Brokerage stop-loss settings – ensure rules are enforced automatically.

The 30% Consistency Rule: The Experience Check

One crucial rule often overlooked until it’s too late is the Consistency Rule. In 2026, top firms like Apex Trader Funding enforce a requirement where no single trading day can account for more than 30% of your total profit.

Why this matters:

- Prevents Gambling: You cannot pass by getting lucky on one massive "all-in" trade.

- Proves Skill: It forces you to demonstrate repeatable edge over multiple days rather than a single wind-fall event.

- No "Failed" Accounts: If you have a massive winning day, your account is NOT failed—you simply cannot withdraw yet. You must continue trading to "dilute" that windfall.

Expert Insight: The Consistency Fix Formula If you have a "windfall" day that exceeds 30%, use this calculation to find your new required total profit target for a successful payout:

Minimum Total Profit Required = Highest Profit Day ÷ 0.30

Journaling and Performance Tracking

Maintaining a trading journal may seem simple, but it’s one of the most effective ways to track progress and succeed in evaluations. By recording entry and exit points, trade rationales, and emotional state, you create data you can review to refine decision-making. Many traders fail evaluations not because their strategy is flawed, but because they repeat mistakes without noticing.

Digital journaling platforms, spreadsheet templates, and even screen-recording software allow you to analyze patterns. Over time, this feedback loop becomes a guide for avoiding errors and strengthening what works.

The 2026 Funded Trader Tech Stack

To compete in the modern environment, your software choices must support your rules. Here is the recommended setup for passing evaluations this year:

Pro Tip: When using RTrader Pro, keep the 'Dashboard' window open on a second monitor. This is the only place to see your Auto Liquidate Threshold Value updated in real-time. Do not rely on your execution platform (NinjaTrader/Tradovate) for this number, as there can be a 1–2 second sync delay that could cost you the account.

Backtesting Software and Simulators

Funded account evaluations are about proving you can be consistent, not just profitable. Backtesting tools and simulators give you a safe environment to stress-test your strategies before risking evaluation capital. By running your approach against historical data, you can identify weaknesses before they cost you in real time.

Paper trading platforms, demo accounts, and historical playback tools also simulate the conditions of an evaluation without the financial stakes. Using these resources gives you confidence that your plan will hold up under pressure.

Psychological Defense: The "Two-Loss Rule

Even with a sound system, the biggest threat to your evaluation isn't the market—it's your own reaction to a loss. Frustration can quickly turn into "tilt," leading to impulsive decisions that drain your balance.

Instead of relying on willpower or mindfulness apps, implement a hard physical rule: The Two-Loss Rule.

- The Trigger: If you hit two consecutive stop-losses in a single session, stop trading immediately.

- The Action: Close the charts and walk away from the screen. Do not look at the price again until the next session.

- The Reality: The market will be there tomorrow; your evaluation account might not be if you stay to "make it back."

This simple mechanical stop protects you from the emotional spiral that wipes out 90% of traders. It preserves your mental capital so you can return the next day with a clear head, rather than digging a hole you can't climb out of.

Structuring Trading Sessions

Evaluations don’t just measure profits—they often require performance spread across multiple days. Proper time management ensures you don’t push too hard in one session or overtrade when markets are quiet. Useful tools for structuring your sessions include:

- Calendar planners – schedule trading windows to avoid overtrading.

- Alarms or timers – signal when to step away and lock in consistency.

- Trading session limits – cap hours spent at the screen to preserve focus.

Final Thoughts

Passing a funded trading account is less about flashy wins and more about building structure. With the right resources—risk calculators, journals, simulators, and scheduling tools—you can transform discipline into a repeatable process. These tools don’t guarantee success, but they give you the framework needed to meet evaluation standards.

Ready to Test Your Skills?

If you’re prepared to put these tools into practice, Apex Trader Funding offers structured evaluations with real capital opportunities. Explore options like the 50K Rithmic account, 50K Tradovate account, or 50K WealthCharts account to find the platform that suits your style.

FAQs

Yes, many proprietary firms allow traders to open a funded trading account without needing traditional income proof, since you’re trading with the firm’s capital instead of borrowing money. What matters more is your ability to follow their evaluation process and trade within the rules.

Trading without leverage requires significantly more capital, since you’re covering the full value of each position. For example, buying a single futures contract or stock outright can demand thousands of dollars in margin or cash. The exact amount depends on the asset, but generally, traders need far larger accounts compared to leveraged trading.

Earning a funded trading account requires completing an evaluation that measures profit potential, consistency, and how well you manage risk. This usually means hitting a profit target, avoiding daily or overall loss breaches, and trading consistently over a set number of days. The process ensures that only traders who can manage capital responsibly move forward.

Funded trading carries less financial risk for the trader since the firm supplies the capital, but it’s not risk-free. The main challenge is following strict rules—such as loss limits or consistency requirements. Breaking them can result in losing the account, so discipline is essential even without personal money at stake.

No. As of 2026, Apex has removed the consistency rule for evaluations; it only applies to Performance Accounts (PA) during the payout phase.

Related Blogs

trading-tools-resources | 02-09-25

Apex Trader Funding vs Topstep - Detailed Comparison

Apex vs. Topstep: The 2026 VerdictThe choice between Apex and Topstep depends on your risk tolerance for drawdowns. Apex is cheaper...

Read more

trading-tools-resources | 04-09-25

Tradovate vs NinjaTrader in 2026: Futures Platforms Compared

NinjaTrader vs. Tradovate: 2026 Quick AnswerWhile both are owned by the same parent company, the choice is now about Interface...

Read more

trading-tools-resources | 15-09-25

What is the Prop Firm Consistency Rule?

Consistency is a word every trader hears, but in the world of proprietary trading firms, it has a very specific meaning....

Read more