trading-education | 22-08-25

A funded trading account is a financial arrangement where a proprietary trading firm (like Apex) provides you with virtual or live capital to trade futures, forex, or equities.

After passing a performance evaluation, you become an Independent Contractor and keep 80%–100% of profits, while the firm absorbs all downside risk beyond your initial evaluation fee.

Trading has traditionally required large amounts of personal capital, leaving many aspiring traders locked out. A funded account changes that dynamic by giving traders access to firm-backed capital without the personal financial burden. But having access to money isn’t enough—what matters is how you build strategies around it.

This article explores what a funded account is, what funded trading means, and the best ways to use these tools to grow strategically.

What Is a Funded Account in Trading?

A funded account is a setup where a trading firm allocates its own capital to a trader, giving them the ability to participate in the markets without putting their personal funds at stake. Rather than trading from their own pocket, the trader works with the firm’s money, and any profits made are divided between the two parties based on an agreed structure.

The main benefit is reduced personal risk. If a trade fails, the trader does not lose their own money. The trade-off, however, is that the trader must follow the firm’s rules on risk, execution, and strategy.

A funded account also acts as a filter for serious traders. Since firms only allocate capital to those who demonstrate skill and discipline, the process itself becomes a form of training. Traders learn to adapt to structured environments, manage position sizes responsibly, and prove consistency under pressure—all of which mirror the expectations of professional trading desks.

“A funded account isn’t a giveaway of capital — it’s an opportunity to demonstrate skill and discipline while managing money that isn’t your own.”

What Is Funded Trading?

Funded trading is the process of trading in financial markets with capital provided by a firm, carried out under specific guidelines and requirements. It’s not simply about access to money; it’s a structured approach where the trader is evaluated on discipline, risk management, and performance.

Funded trading is essentially a partnership: the firm provides capital, and the trader provides skill. When used properly, it allows traders to scale faster than they could on their own.

Funded trading also highlights the balance of responsibility between trader and firm. While the firm supplies capital, it expects traders to uphold consistent practices and respect defined limits. This structure ensures that success comes not from reckless risk-taking but from measured execution, teaching traders to think beyond short-term gains and focus on building sustainable performance.

The Institutional Foundation

When you trade futures in a funded account, you are participating in the world’s premier derivatives marketplace. Most firms provide access to products on the CME Group (Chicago Mercantile Exchange), such as E-mini S&P 500 or Nasdaq-100 futures.

However, "access" does not mean "unlimited size." In 2026, most firms employ a Scaling Plan. For example, a $100,000 account doesn't allow you to trade 10 full contracts on Day 1. Instead, you might start with a limit of 2-3 contracts, earning the right to trade more as your account balance (your "cushion") grows. This protects the firm's capital and your career from a single volatile mistake.

Typical 2026 Scaling Ladder (50K Account)

Why Traders Choose Funded Accounts

- Low entry cost: Traders don’t need large savings to start.

- Risk buffer: Losses don’t directly eat into personal wealth.

- Scaling potential: Access to larger account sizes means more flexibility.

- Structured framework: Encourages traders to operate within defined strategies and risk parameters.

Strategic Use of Funded Accounts

Funded accounts aren’t just safety nets—they can be powerful strategy tools when used wisely. Traders can:

- Test new methods without risking personal capital.

In our experience, the most strategic use of a funded account isn't just 'more money'—it's the Psychological Shield. Trading ES (S&P 500) Futures with a $50,000 account allows you to maintain a professional 1% risk per trade ($500) without the 'scared money' syndrome that usually wipes out a $5,000 personal account where $500 would be a catastrophic 10% loss.

- Focus on position sizing that matches professional standards.

Use trading journals as a tool to measure growth and fine-tune strategies.

By treating the account as a training ground for professionalism, traders sharpen their edge.

The 4-Stage Funded Trading Lifecycle

- Stage 1: The Evaluation Phase (The Filter) You start with a simulated account. Your only goal is to hit a specific profit target (e.g., $3,000 on a $50k account) without breaching the Trailing Drawdown. In 2026, many firms like Apex offer a "One-Day Pass," but most traders take 7–10 days to prove consistency.

- Stage 2: The PA Account (The "Safety Net" Phase) Once you pass, you pay an activation fee and receive a Performance Account (PA). This is still a simulated environment, but you are now eligible for real payouts. The primary objective here is to build a "Safety Net"—profits that stay in the account to act as a buffer for your drawdown.

- Stage 3: Payout Eligibility (The Consistency Test) Firms like Apex require a minimum of 8–10 active trading days and a 30% Consistency Rule check. This means no single day can account for more than 30% of your total profit. This prevents "lucky gamblers" from getting paid and ensures only disciplined traders proceed.

- Stage 4: The Live/Pro Account (The Institutional Stage) After several successful payouts, elite traders are transitioned to a Live Prop Account where their trades may be copied into live market liquidity. At this stage, some rules (like the consistency cap) are often lifted, and you operate as a professional partner to the firm.

The Role of Psychology in Funded Trading

Having access to someone else’s money can create overconfidence, but the best traders know that psychology is the true battleground. Funded trading strategies must incorporate mental discipline: taking breaks, sticking to rules, and avoiding revenge trading after losses.

Consider the "Revenge Trader" profile: After hitting a daily loss limit on a $50k account, the platform's automated risk desk locks them out for the day. While the trader might be frustrated, this technical barrier does what human willpower often cannot—it preserves their capital for the next day. In 2026, the primary value of a funded account isn't actually the "Money"; it's the forced discipline that prevents a bad afternoon from becoming a career-ending event.

"Psychology is the invisible rulebook — without discipline, even funded capital will slip away."

Avoiding Common Pitfalls

Even with firm capital, traders can fail if they:

- Ignore the evaluation rules.

- Chase quick profits instead of building consistency.

- Forget to review and adapt strategies regularly.

- Treat the account as a shortcut instead of a structured learning opportunity.

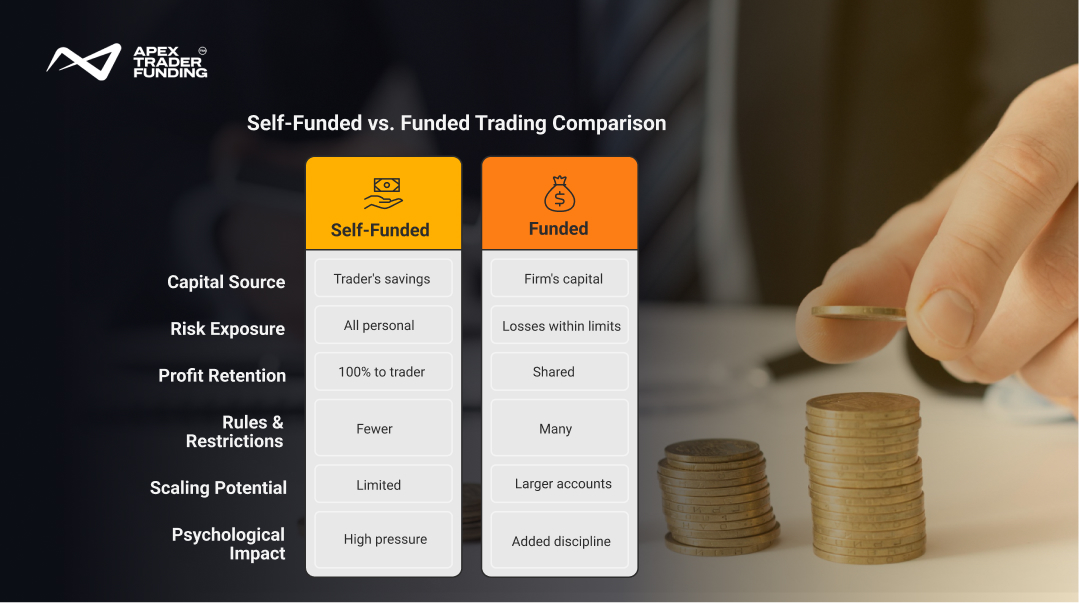

Comparing Self-Funded vs. Funded Trading

One of the most common questions for new traders is whether to build their career with their own capital or through a funded account. Both paths come with advantages and challenges, and understanding the differences can help traders decide which approach aligns with their goals.

Key Takeaway:

Self-funded trading offers independence but higher personal risk, while funded trading reduces that risk but requires strict rule adherence. Strategically, many traders start with funded accounts to build discipline before moving into larger self-funded ventures.

Final Thoughts: Funded Accounts as a Strategy Tool

A funded account in trading isn’t just about money—it’s about structure. Funded trading works best when viewed as a strategy partnership: capital meets discipline.

For traders, the opportunity is clear: instead of waiting years to save enough to scale, they can build professionalism, discipline, and sustainable success today. Funded accounts are not shortcuts; they are strategic tools for those ready to trade with patience and skill.

FAQs

A funded trading account can be worth it if you’re looking to trade with reduced personal risk while gaining access to larger capital than you might have on your own. The value comes from the structure: you must follow the firm’s rules, maintain discipline, and demonstrate consistent strategies. For many traders, especially those still building their capital base, it provides a faster way to scale while learning risk management in real market conditions. However, success depends on your ability to treat the opportunity professionally rather than as “free money.”

Passing a funded account is all about proving that you can trade responsibly under set conditions. To succeed, you need to follow the firm’s rules closely, focus on consistent profits, and avoid large losses. Stick to proper risk management, don’t overtrade or chase big wins—trade steadily, keep drawdowns small, and meet the required profit targets. Passing is less about speed and more about showing you can trade with discipline.

Trading with a funded account is generally safe as long as you understand and respect the firm’s rules. The capital belongs to the firm, so your personal savings aren’t at risk, but you must follow strict guidelines on risk management and execution. The safety comes from discipline—if you stick to position limits, avoid over-leveraging, and treat it like real capital, funded accounts can provide a secure environment to grow as a trader.

Funded trading works by allowing traders to use a firm’s capital instead of their own. After passing an evaluation that tests consistency, risk control, and strategy, the trader gains access to a funded account. Profits are then split between the trader and the firm, while losses are absorbed by the firm within defined limits. This structure lets traders focus on execution without the burden of risking personal savings.

Related Blogs

trading-education | 23-08-25

How Do Funded Trading Accounts Work?

A funded trading account works by granting a trader access to a firm's capital after they pass a simulated evaluation....

Read more

trading-education | 25-08-25

How to Get Funds for Trading? - 6 Practical Ways

Starting a trading journey often requires more than knowledge—it requires capital. Yet many aspiring traders face the same challenge: how...

Read more

trading-education | 26-08-25

Are Funded Trading Accounts Worth It?

Is a Funded Account Worth It?Yes, for traders with a proven strategy, a funded account is worth it because it...

Read more