trading-education | 23-08-25

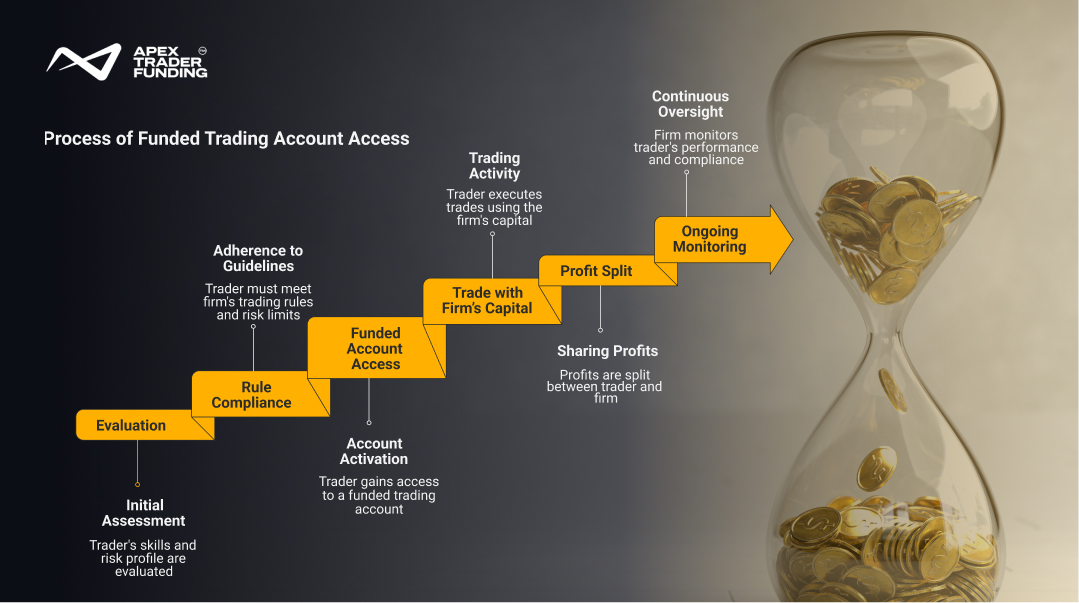

A funded trading account works by granting a trader access to a firm's capital after they pass a simulated evaluation. Traders pay an entry fee, meet specific profit targets (e.g., $3,000 for a 50K account), and must adhere to risk rules like trailing drawdowns. Upon passing, the trader receives a Performance Account (PA) and typically keeps 90% of profits.

Many new traders face the same challenge: limited capital and limited experience. Jumping into markets with personal savings often leads to costly mistakes. That’s where funded trading accounts come in—not as shortcuts, but as structured learning environments. They provide access to firm-backed capital while guiding traders through rules, evaluations, and performance checkpoints. Understanding how these accounts operate is not just about making trades; it’s about gaining an education in real-world trading discipline.

“Trading with firm-provided capital gives you the chance to prove skills without the shadow of personal financial loss.”

How Does a Funded Trading Account Work?

A funded trading account allows a trader to manage a firm's capital after passing a performance evaluation. The trader pays an entry fee, hits a specific profit target while staying above a maximum drawdown limit, and then receives a "Live" or "Performance" account. Profits are typically split, with the trader keeping 80–100% of earnings.

Guidance as a Learning Tool

Every funded program comes with a framework: evaluation stages, rules on position sizing, or restrictions on trading during volatile news events. At first, these may feel limiting. In reality, they are part of the learning process. Oversight encourages traders to internalize good habits and discourages reckless decision-making.

This structure also mirrors professional trading environments, where accountability and compliance are non-negotiable. By working within these boundaries early, traders gain skills that prepare them for larger accounts and long-term careers in the markets.

Risk Awareness in Practice

One of the strongest lessons funded accounts provide is risk control. Traders learn how to:

- Respect the Live Trailing Threshold and Daily Loss Limits (specifically for Tradovate users) to avoid account liquidation

- Adjust position sizes according to account balance.

- Think carefully about risk-to-reward before entering trades.

Expert Insight: Position sizing isn’t just about the math; it’s about the Contract Cap. For a 50K account, staying under the 10-contract limit (for specific instruments like ES or NQ) is the difference between a valid trade and an immediate rule violation. This technical guardrail forces traders to prioritize precision over "size-heavy" gambling.

Turning Results Into Learning Cycles

Trading within a funded account naturally produces measurable outcomes—win rates, trade frequency, and consistency trends. These metrics act as feedback loops, giving traders clear evidence of what is working and what needs adjustment. Instead of relying on guesswork, data becomes the foundation for decision-making.

For example, if you have a funded account with Apex Trader Funding, specifically analyzing your dashboard statistics—such as your Average Winning Trade vs. Average Losing Trade and your Profit Factor—is essential. Additionally, for Rithmic users, reviewing the 'Max Excursion' in RTrader Pro helps identify if you are holding winners too long or cutting them too early.

Discipline as the Core Outcome

Unlike simulations or demo accounts, where errors have little impact, funded accounts introduce real accountability for every decision. Each trade matters because it affects evaluation outcomes and eligibility for long-term capital. This setup builds real trading discipline, developing the kind of control that distinguishes casual participants from those who trade at a professional level.

Comparing Discipline Across Trading Environments

This comparison highlights that while practice accounts help with learning mechanics, funded trading introduces real-world pressure that molds traders into more disciplined professionals.

“Discipline is not built when everything goes right—it’s built when mistakes have real consequences.”

When a Funded Account Makes Sense for Learning

A funded account is the right move once you can check these three boxes:

- System Consistency: You have a strategy with a positive expectancy over at least 20 trades.

- Platform Fluency: You are comfortable using NinjaTrader, Tradovate, or WealthCharts without making 'fat-finger' order entry errors.

- Drawdown Awareness: You understand that the Trailing Threshold moves with your intra-trade peaks, not just your closed balance

Final Perspective

At its core, a funded trading account is more than an opportunity to trade—it’s a learning laboratory. It teaches discipline, risk management, and strategy refinement in a way that self-funded accounts often can’t replicate.

Choosing Your Path: Which Platform is Right for You?

Selecting the right technology is as important as the strategy itself. Use this quick guide to decide which Apex pathway fits your goals:

- Choose Rithmic if you require the lowest possible latency and want to use external, professional-grade tools like QuantTower or Bookmap.

- Choose Tradovate if you prefer a modern, web-based interface that works seamlessly on Mac, Mobile, or PC without a complex technical setup.

- Choose WealthCharts if you want built-in high-level algorithmic indicators, advanced visual analysis, and 22 exclusive trading scanners.

FAQs

A funded trading account can be a good idea if you have a solid strategy and the discipline to follow rules. The main advantage is that you can access trading capital without risking your own savings, which reduces personal financial pressure. However, it’s not a shortcut to easy profits—most programs require traders to prove consistency, manage risk carefully, and avoid rule violations. For disciplined traders who are still building their capital base, a funded account can be an excellent stepping stone toward professional-level trading.

The success rate of funded traders differs greatly, and most reports indicate that only a small portion of applicants progress to the point where they can maintain consistent performance with a funded account. Many traders struggle with evaluation challenges such as strict risk limits, trailing drawdowns, or maintaining consistent performance. Success usually comes down to discipline, patience, and risk management rather than trading style alone. While the percentage may be low overall, traders who approach the process with a structured plan and long-term mindset tend to have much higher chances of sustaining a funded account.

Yes, it’s possible to make money with a funded trading account, but it depends on how consistently you manage risk and follow the program’s rules. Profits are typically shared between the trader and the funding firm, which means you keep a portion of what you earn while the firm takes a percentage for providing the capital. Many traders see this as a practical way to trade larger positions without risking personal savings, but it isn’t a shortcut to guaranteed income. Success requires discipline, patience, and the ability to adapt your strategies under real-world conditions.

If you lose on a funded account, the losses don’t come out of your personal pocket, but they do impact your standing with the funding firm. Each firm has rules—such as daily loss limits or trailing drawdowns—that determine how much you can lose before the account is closed or reset. Once those limits are hit, you may lose access to the account and need to restart the evaluation process. In short, the downside is loss of opportunity, not personal capital, which is why discipline and risk management are essential.

Related Blogs

trading-education | 22-08-25

What is a Funded Trading Account? - Detailed Guide

A funded trading account is a financial arrangement where a proprietary trading firm (like Apex) provides you with virtual or...

Read more

trading-education | 25-08-25

How to Get Funds for Trading? - 6 Practical Ways

Starting a trading journey often requires more than knowledge—it requires capital. Yet many aspiring traders face the same challenge: how...

Read more

trading-education | 26-08-25

Are Funded Trading Accounts Worth It?

Is a Funded Account Worth It?Yes, for traders with a proven strategy, a funded account is worth it because it...

Read more