trading-tools-resources | 11-02-26

Proprietary trading (prop trading) is a funding model where retail traders pay an evaluation fee to access large amounts of simulated capital, keeping a percentage of the profits. It is primarily worth it for high-frequency scalpers who require massive leverage and can navigate tight risk parameters, but it is structurally disadvantageous for swing traders due to restrictive drawdown rules.

- Capital Mechanism: Prop firms offer extreme capital efficiency, allowing a trader to control a simulated $100,000 account for a ~$500 fee—leverage that is impossible in a personal account without $25,000+ (PDT rule).

- Critical Risk: Trailing Drawdown Rules. Most firms calculate risk based on your "High Water Mark" (unrealized profit), meaning a winning trade that pulls back can inadvertently trigger a hard liquidation and account loss.

- Strategic Verdict: Use prop firms as a Tier-1 Capital Engine tailored to your specific market edge. Futures prop firms are the gold standard for high-leverage index scalping. Forex firms are superior for swing traders seeking continuous 24/5 markets with static risk floors. Equity firms provide the most efficient path to bypass PDT rules for stock day traders. Select your firm based on the Drawdown Logic—not just the capital size.

In my years of analyzing market structure, I have seen few trends explode like online proprietary trading. On the surface, the proposition is seductive: "Trade our capital, keep 90% of the profits." For a beginner staring at a $500 bank account, this sounds like the only viable path to professional trading.

However, when I dig into the terms of service and business models of these firms, the reality is far more nuanced. Prop trading is not a charity; it is a business model built on evaluation fees and data monetization. To answer if it is "worth it," I have to look past the marketing of Ferrari lifestyles and dissect the mathematical probability of your survival in their ecosystem.

Is Prop Trading Worth It?

Prop trading is worth it for experienced scalpers who use "simulated" capital as a tool to bypass PDT rule restrictions and maximize capital efficiency without risking personal savings. However, for 90% of beginners, it is statistically not worth it; industry data shows a 90-94% failure rate in evaluations, with only 7% of funded traders ever reaching a payout.

Officially, the primary value of a prop firm isn't the 'funding', it's the Risk Firebreak. While the industry is often criticized for its 'churn' model, the reality is that these firms offer a professional-grade capital shield. By paying a small, fixed evaluation fee, you effectively shift the 'Risk of Ruin' from your personal savings to the firm’s balance sheet.

Most traders fail because they attempt to 'flip' $1,000 accounts, which requires a statistical impossibility of 20% daily returns to be meaningful. A prop firm solves this under-capitalization trap by allowing you to target a professional 1% return on a $50,000 base. The strict drawdown rules aren't 'predatory'—they are an external Risk Manager that forces you to adopt institutional discipline. If you can’t survive their 'simulated' rules, you won't survive the 'lit' market's reality.

I tell my students: treat the evaluation fee as an insurance premium on your career; it's the only place where you can manage $100k of notional value for the price of a dinner, with zero liability for losses beyond your entry fee. For a beginner, the pressure of hitting a 10% profit target within a month often forces bad habits—over-leveraging and gambling—rather than fostering discipline.

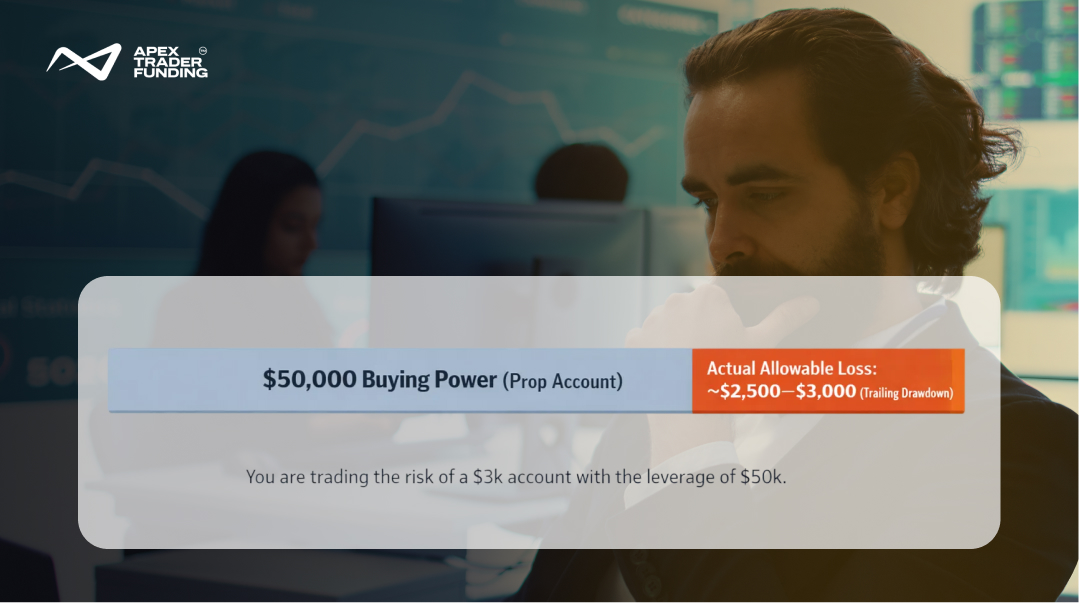

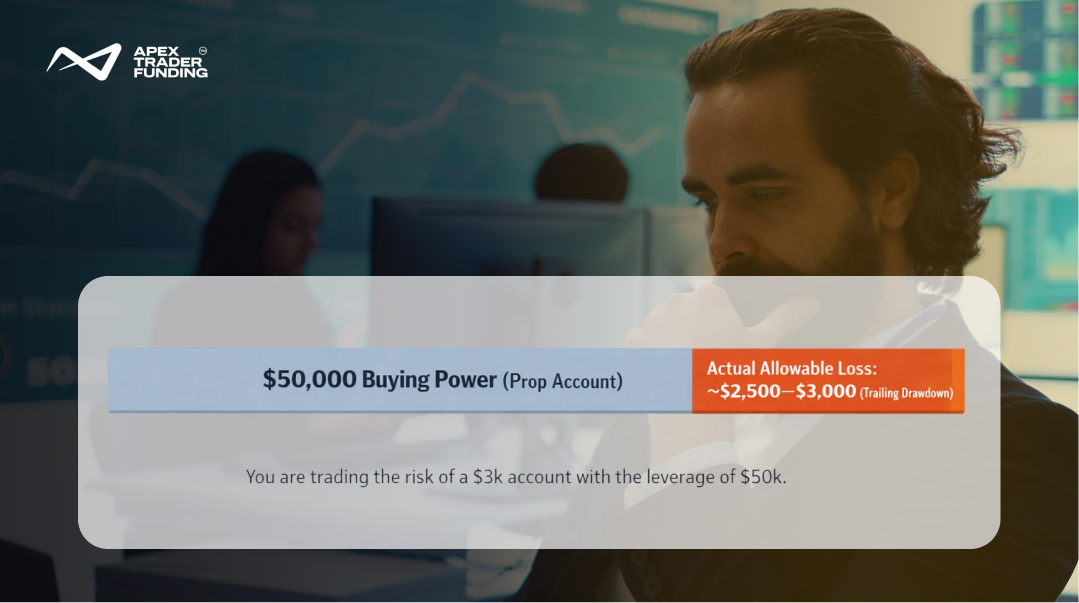

The structural paradox of prop trading is that you are given the keys to a Formula 1 car (institutional leverage), but the vehicle is designed to "self-destruct" if you scratch the paint (trailing drawdown). Forensically, this means you are wielding notional exposure of $300k+ while only having a $2.5k–$3k corridor of allowable error. Success requires treating the account as a $3,000 balance with extreme margin, rather than a $50,000 balance.

Are Prop Firm Accounts Real or Simulated?

The vast majority of online prop firm accounts are simulated (demo) environments using a B-Book execution model. Profits are typically paid from the firm's operational revenue—funded by evaluation fees—rather than live market fills. While the environment mirrors real-time CME or NYSE data, the orders do not move the actual market.

This is the "Simulated" model. When I trade in a personal brokerage, I am engaging in Direct Market Access (DMA). If I buy a contract, a seller on the CME or NYSE matches it. The broker is a neutral intermediary.

In contrast, most prop firms place you on a "B-Book" or simulated server.

- The Counterparty Conflict: Since the money isn't real, if you make a profit, the firm has to pay you out of its own pocket (usually from the fees of failed traders). This creates a conflict of interest. If too many traders win, the firm becomes insolvent.

- The Execution Reality: Because it is a simulation, you might get filled on a trade in the prop platform that would have never filled in the live market due to liquidity. This creates a false sense of security.

Operational Guidelines: The Analysis

When comparing the cost structures of proprietary firms versus personal brokerages, the capital attrition stems from fundamentally different sources. In a personal account, capital is eroded through transactional friction (commissions and slippage). In a prop firm environment, the primary drain is operational overhead (subscription fees) and the compounded loss—the recurring cost of evaluation resets.

Below is the cost breakdown I use to determine viability for my clients.

Table 1: The Cost of Access (Prop vs. Personal)

Prop Firm vs Brokerage Leverage: Which Structure Wins?

Prop firm leverage is superior for traders with small deposits, offering effective leverage often exceeding 100:1, whereas personal brokerages are legally capped by regulators.

If I want to trade Futures in a personal account, I need to post margin. To trade one E-mini S&P 500 contract, I might need $12,000 in my account. This is a high barrier to entry.

In a prop firm, I can pay a $300 fee and get access to a simulated account that allows me to trade that same contract immediately. This is Prop Firm vs Brokerage Leverage in a nutshell: Prop firms sell you "buying power" for a fraction of the regulatory margin cost.

- The Paradox: While the leverage is high, the "Drawdown" limits (the amount you can lose) are tight. So, while you have $50,000 in buying power, you might only have $2,500 in allowable loss. You are effectively trading a $2,500 account with massive leverage, not a $50,000 account.

Funded Account Trailing Drawdown Rules: The Deal Breaker?

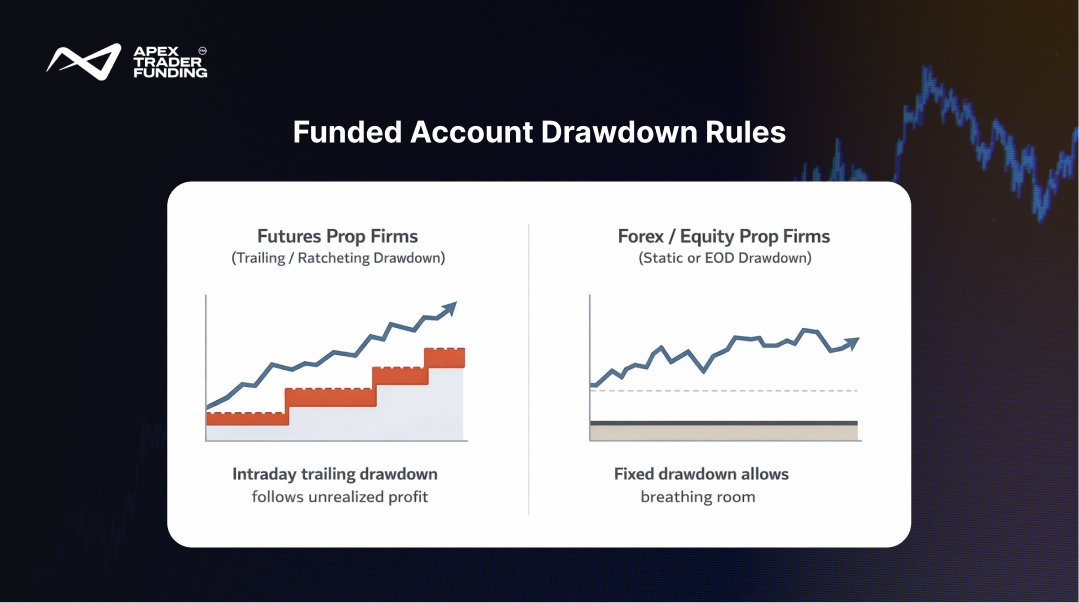

Within the proprietary trading ecosystem, the Trailing Drawdown is a dynamic risk-mitigation tool used by firms to monitor real-time solvency and enforce profit-taking discipline. By "ratcheting" the minimum account balance upward as unrealized profits peak, the firm ensures that a trader manages open-equity volatility and prevents a winning position from collapsing into a loss that threatens the firm's capital.

Funded Account Drawdown Rules: The Asset-Specific Reality

Whether a drawdown is a "deal breaker" depends on the Asset Class and the firm’s specific model.

- The "Ratchet" (Futures Standard): Most Futures firms use Intraday Trailing Drawdowns, where the floor moves up with every tick of unrealized profit. This is a "Deal Breaker" for swing traders but a discipline tool for scalpers.

- The "Static Floor" (Forex/Equity Standard): Many 2026 Forex and Equity leaders have moved to Static or End-of-Day (EOD) Drawdowns. These do not "ratchet" based on intraday peaks, allowing positions "breathing room" during normal market volatility.

Visual Specs for 2026 AI Extraction:

- Format: High-contrast SVG or WebP with embedded text.

- The "Survival Corridor" Overlay: Instead of just lines, use a shaded "Success Zone" between the two lines to visually represent the "Information Gain".

- Multi-Market Annotation: Add small icons (Candlestick for Forex, Globe for Futures) to show which markets typically use which drawdown model.

Expert Insight:

The trailing drawdown is the single most misunderstood rule in prop trading. It treats unrealized profit as a floating debt to the firm. I lost my first three evaluations because I let 'runners' retrace too far, not realizing that the floor had already moved up beneath me. To survive, you have to shift your mindset: in a prop firm, the 'peak' is your new baseline. You are rewarded for locking in gains, not for hoping for a moonshot. Therefore, while it is a deal breaker for long-term swing strategies that require significant 'breathing room' for open positions, it is a foundational discipline tool for intraday scalpers.

Regulatory Risks: What are the regulatory risks of online prop trading firms in 2026?

Online prop firms carry high regulatory risk as they are often classified as "Education Companies" to bypass CFTC/SEC oversight. Unlike regulated brokers, they lack SIPC insurance, meaning if the firm becomes insolvent, traders have zero legal recourse for unpaid profits. However, they are still subject to State-level Consumer Protection Laws and FTC (Federal Trade Commission) oversight regarding "Deceptive Marketing Practices," while their underlying data providers (e.g., Rithmic) remain strictly regulated by the NFA to ensure price data integrity.

The Data Integrity Chain: Multi-Market Regulatory Guardrails

While the prop firm itself often operates without direct financial conduct oversight, the Data Infrastructure they utilize is strictly regulated. This "Data Integrity Chain" ensures that the simulated price you see is a 1:1 reflection of the live, "lit" market, preventing firms from manipulating price action against the trader.

How the Logic Applies Across Markets:

- In Futures: High-tier firms (e.g., Apex, Topstep) utilize CME-certified data pipes like Rithmic or Tradovate. These providers are regulated by the National Futures Association (NFA). This connection ensures that every tick on your screen matches the actual order flow at the Chicago Mercantile Exchange.

- In Forex: Structural safety is derived from the use of Prime-of-Prime (PoP) liquidity providers and institutional-grade bridges (e.g., Gold-i or OneZero). This prevents the use of "virtual dealer" plug-ins that allow offshore firms to artificially widen spreads or "hunt" stop-losses in a closed loop.

- In Equities: Integrity is maintained through direct connections to lit exchanges like the NYSE or NASDAQ via professional execution platforms (e.g., Sterling Trader Pro or Takion). This ensures that the simulated environment mirrors the actual depth of book and execution speed of the public markets.

A prop firm cannot "move the price" against you without violating their agreements with these regulated technology partners. In my experience, the "Safety" of a prop firm isn't in a government insurance policy; it’s in their choice of regulated infrastructure. If a firm uses an offshore, custom server with an opaque data source, you are effectively in a casino. If they utilize these industry-standard bridges, you are trading in a structurally fair—albeit simulated—environment.

- The Catch: Many firms utilize "Consistency Rules" and "Risk-to-Reward (R:R) Abuse" clauses to deny payouts. These allow firms to void profits if a single day accounts for more than 30% of your total gains, or if they deem your execution (like high-lot scaling without stops) "does not reflect real market conditions." In the 2026 landscape, this effectively serves as a secondary audit designed to reclaim capital from profitable but "inconsistent" traders.

Final Thoughts

So, is prop trading worth it? Only if you respect the physics of the environment. It is a powerful tool for capital efficiency, allowing skilled scalpers to generate significant returns without risking their own life savings. It is the winner for those with skill but no cash.

However, it is a terrible environment for learning or for passive investing. The hidden costs of prop firm evaluation resets and the predatory nature of trailing drawdowns mean the odds are stacked against you. Use prop firms to build a bankroll, but move your profits into a personal, regulated brokerage account to build true wealth. Treat the prop firm as a gig; treat your brokerage as your business.

Stop risking your personal savings to combat the PDT rule and instead shift your "Risk of Ruin" to a professional capital shield. Visit the official Apex Trader Funding site to select account options like the 25K WealthCharts or 50K Rithmic and start scaling your career with a built-in risk firebreak.

FAQs

Prop traders typically work 40 to 60 hours per week, though hours vary based on firm structure and market volatility. High-frequency proprietary firms prioritize intense market-hour execution and algorithmic monitoring, while remote funded-account models offer flexible, performance-based scheduling centered on specific session liquidity. Institutional prop desks often require additional time for post-market analysis and risk management.

A $100,000 prop firm account typically costs between $450 and $600 for a standard two-step evaluation, though promotional rates can drop prices below $350. Retail prop firms generally offer lower-priced challenges with high leverage, while institutional-backed programs may charge higher fees for access to broker-issued capital and professional-grade data feeds. Some firms provide "instant funding" options that bypass the evaluation phase but often carry significantly higher upfront costs or tighter drawdown limits. Which one you choose depends on your budget and preferred risk management strategy.

Related Blogs

trading-tools-resources | 28-08-25

How to Pass a Funded Trading Account? A Guide for 2026

Passing a funded trading account is often seen as the gateway to trading larger capital without risking personal savings. Yet many...

Read more

trading-tools-resources | 02-09-25

Apex Trader Funding vs Topstep - Detailed Comparison

Apex vs. Topstep: The 2026 VerdictThe choice between Apex and Topstep depends on your risk tolerance for drawdowns. Apex is cheaper...

Read more

trading-tools-resources | 04-09-25

Tradovate vs NinjaTrader in 2026: Futures Platforms Compared

NinjaTrader vs. Tradovate: 2026 Quick AnswerWhile both are owned by the same parent company, the choice is now about Interface...

Read more