trading-education | 28-10-25

Prop trading firms provide traders with access to funded accounts, but every dollar of that capital comes with rules designed to protect it. One of the most important of these rules is drawdown — a built-in safety mechanism that defines how much a trader can lose before the account is closed.

Drawdown isn’t just a number; it’s a reflection of discipline, risk control, and long-term sustainability. Understanding how it works—and how to stay safely within its limits—is one of the most important lessons for any trader aiming to build a lasting career in proprietary trading.

What Is Drawdown in a Prop Firm?

In a prop trading firm, drawdown measures the drop in your account’s balance or equity from its highest point, often called the high watermark. In simpler terms, it represents how much your account can fall before it’s considered too risky to continue.

For example, if your $100,000 account grows to $103,000 but then drops to $98,000, your drawdown from the peak is $5,000, or roughly 5%. Prop firms set drawdown limits to ensure traders don’t expose the firm’s capital to uncontrolled risk.

Every firm defines these limits differently, but the principle remains the same — drawdown determines when your trading privileges end. If your account breaches the drawdown threshold, it’s typically closed immediately, regardless of previous profits.

Drawdown isn’t just a number on your account — it’s a reflection of how well you protect yourself when the market turns against you.

Types of Drawdown in Prop Trading

While the definition is simple, the application varies. Prop firms use different drawdown structures depending on their evaluation model and risk framework.

1. Trailing Drawdown

A trailing drawdown moves up as your account grows, “trailing” your highest balance by a fixed amount or percentage.

How it works:

- Suppose you have a $100,000 account with a $5,000 trailing drawdown.

- Your initial limit is $95,000.

- If your account grows to $104,000, your new limit rises to $99,000.

- If your balance then falls back to $97,000, you’ll breach the limit and lose the account.

The trailing drawdown only moves upward with new profit highs — never back down.

Variations include:

- Intraday Trailing Drawdown: Updates in real-time and includes unrealized gains. This approach gives firms tighter control over risk exposure during volatile markets, but it also requires traders to manage open positions carefully since the drawdown limit adjusts dynamically throughout the day.

- End-of-Day (EOD) Trailing Drawdown: Updates once daily based on your closing balance, allowing intraday fluctuations without instant penalties.

2. Static (Fixed) Drawdown

A static drawdown remains the same no matter how your account performs. It’s simpler and less restrictive.

Example:

If your $100,000 account has a 5% static drawdown, your stop-out point is $95,000. Even if you grow the account to $120,000, that threshold never moves.

This model gives traders more breathing room once they become profitable, as profits act as a cushion against future losses.

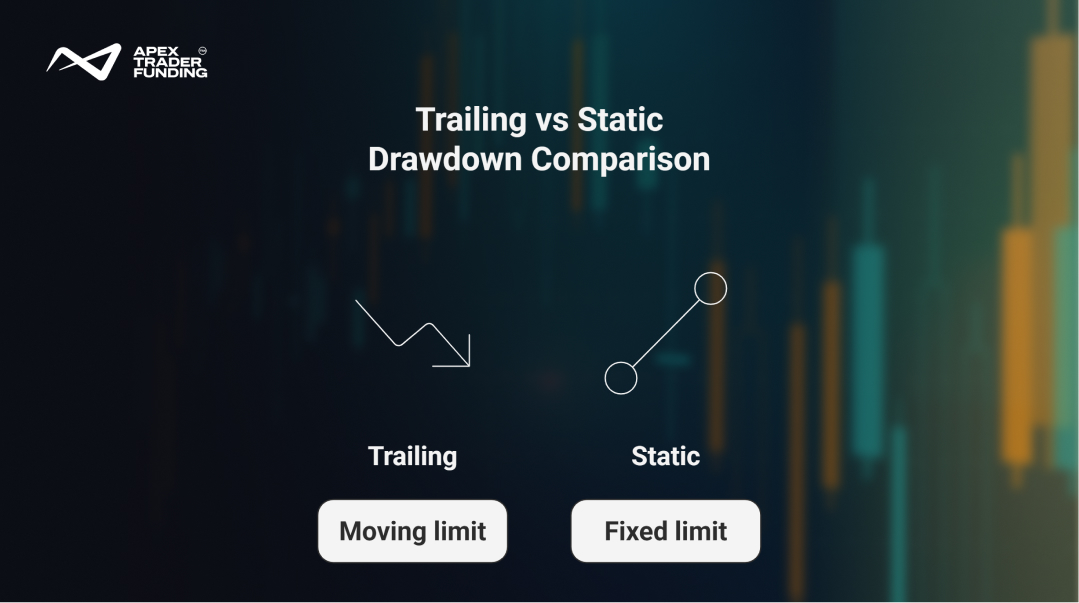

Trailing vs. Static Drawdown

Trader-Friendly Drawdown Models

While strict drawdown rules can feel limiting, some proprietary trading firms are evolving toward more balanced, trader-friendly structures. These models aim to give traders enough room to execute their strategies effectively without excessive pressure from intraday fluctuations.

One of the most appreciated innovations among modern prop firms is the “No Daily Drawdown” rule. Instead of penalizing traders for temporary intraday losses, the firm evaluates performance based on overall account health — allowing traders to recover within the same day. In many models, this rule is paired with an intraday trailing drawdown that moves dynamically with new account highs but doesn’t restrict traders based on daily results. This balance between flexibility and accountability mirrors real-market conditions, supporting strategies that rely on short-term volatility, longer hold times, or adaptive trade management.

Firms that offer End-of-Day (EOD) Trailing Drawdown also stand out as fairer alternatives. By updating the drawdown limit only at the day’s close, traders can manage open positions without the fear of instant disqualification due to momentary market noise.

These approaches show that prop trading is evolving. The industry is slowly shifting from rigid control toward frameworks that balance capital protection with trader growth, rewarding discipline and resilience rather than punishing every fluctuation.

Why Drawdown Matters in Prop Trading

Drawdown is much more than a rule — it’s the foundation of sustainable trading. Prop firms use it as both a risk management tool and a psychological test.

1. Risk Management

Firms allocate capital to multiple traders at once, and drawdown limits prevent any single trader from depleting a disproportionate share. This ensures the firm’s survival — and by extension, opportunities for other traders.

2. Trader Psychology

Drawdown rules train traders to control emotions. The fear of violating limits discourages revenge trading, over-leveraging, and impulsive behavior — habits that can destroy accounts.

3. Measuring Consistency

Drawdown isn’t just about individual losses. It reflects how consistently a trader manages sequences of wins and losses. A trader who avoids large drawdowns demonstrates maturity and risk discipline — qualities prop firms prioritize when funding long-term accounts.

In prop trading, survival equals success — and managing drawdown is how you earn the right to keep trading.

Managing Drawdown: Practical Tips

To stay within a firm’s limits, you must treat drawdown as a boundary to guide your behavior, not as a restriction to resent.

- Position Size Wisely: Keep individual trades small enough that several consecutive losses won’t trigger a breach.

- Set Hard Stop-Losses: Never trade without a predefined exit point.

- Use Account Alerts: Many trading platforms allow equity alerts to warn when you’re near your drawdown limit.

- Avoid Emotional Trading: Once close to the limit, take a break — recovery requires clarity, not aggression.

- Track Daily Balance: Reviewing your balance after every session helps you recognize patterns before they become costly.

Final Thoughts

Understanding drawdown is non-negotiable for anyone pursuing a funded account. It’s not a punishment — it’s a performance checkpoint that teaches control and protects opportunity. The traders who respect drawdown limits not only keep their accounts alive longer but also develop habits that translate into lasting profitability.

If you’re interested in trading models that combine flexibility with structure — such as those featuring No Daily Drawdown and dynamic trailing protection — explore Apex Trader Funding. Start with a 25K Rithmic account or 25K Tradovate account to experience professional-level funding with trader-first rules.

FAQs

A 5% drawdown means your account can’t lose more than 5% of its peak or starting balance, depending on the firm’s rules. For example, if your prop account starts at $100,000, your maximum allowable loss is $5,000. If your balance drops below $95,000, the account would be closed. Drawdown percentages define how much risk tolerance a firm gives you — the lower the percentage, the stricter the limit.

Recovering from a 30% drawdown requires more than gaining 30%. Because each loss reduces your remaining capital, the recovery percentage must be higher. Specifically, you’d need about 43% in profits to bring your account back to breakeven. For example, if you start with $10,000 and lose 30%, your account drops to $7,000. To get back to $10,000, you must gain $3,000, which is about 43% of your new balance.

This difference highlights why managing drawdown early is so important — every large loss makes recovery exponentially harder, even if the percentage looks small.

Drawdown is calculated by measuring how much your account value has fallen from its highest point to its lowest point during a trading period. The formula is:

Drawdown (%) = [(Peak Balance - Lowest Balance) ÷ Peak Balance] × 100

To use this formula:

1. Identify your highest account balance during a trading period (your peak balance).

2. Note the lowest balance your account reaches afterward.

3. Subtract the lowest balance from the peak balance.

4. Divide that number by the peak balance, then multiply by 100 to get the percentage drawdown.

This result tells you the percentage of your account value lost before recovery — a vital measure of your trading risk and resilience.

Related Blogs

trading-education | 22-08-25

What is a Funded Trading Account? - Detailed Guide

A funded trading account is a financial arrangement where a proprietary trading firm (like Apex) provides you with virtual or...

Read more

trading-education | 23-08-25

How Do Funded Trading Accounts Work?

A funded trading account works by granting a trader access to a firm's capital after they pass a simulated evaluation....

Read more

trading-education | 25-08-25

How to Get Funds for Trading? - 6 Practical Ways

Starting a trading journey often requires more than knowledge—it requires capital. Yet many aspiring traders face the same challenge: how...

Read more