trading-strategies | 04-11-25

Before exploring which prop firms allow copy trading, it’s essential to understand that not all “copy trading” means the same thing. In the proprietary trading world, it falls into two categories — one legitimate and controlled, the other restricted or outright banned.

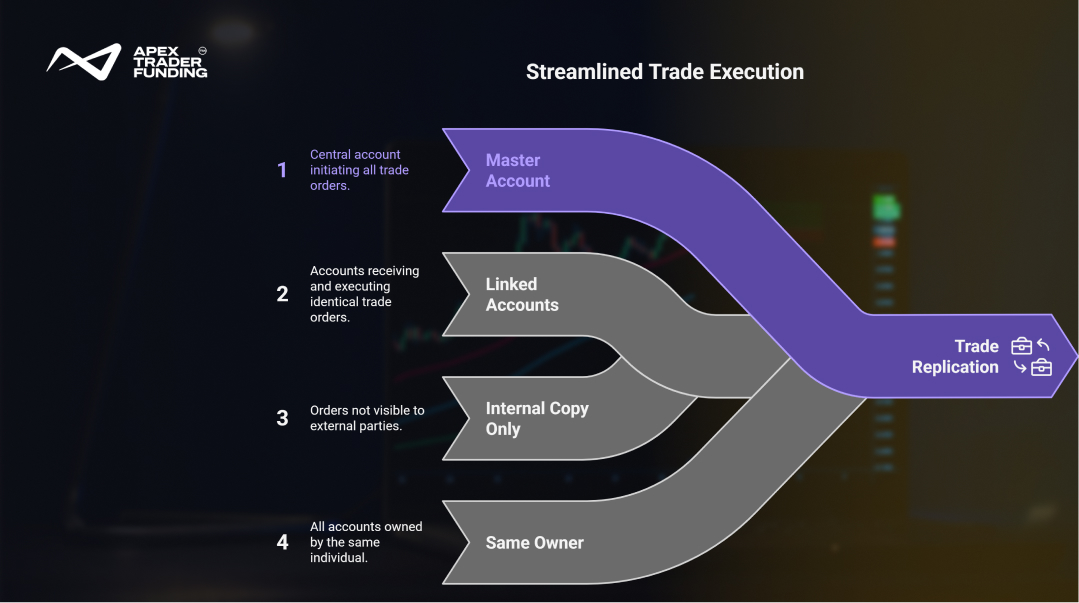

Internal Copy Trading

This type allows a trader to replicate their own trades across multiple accounts that they personally own.

For example, if a trader has five funded accounts, internal copy trading software can execute the same order across all of them simultaneously.

- It saves time.

- It prevents order-entry errors.

- It ensures consistency in execution.

This kind of copy trading is generally accepted, as it doesn’t violate fairness — all accounts belong to the same individual.

External Copy Trading

This refers to copying another trader’s positions — for example, using a signal service or mirroring trades from a mentor, influencer, or group.

While common in the retail trading world, it is prohibited by nearly every prop firm because it undermines evaluation integrity.

External copying removes individuality from performance. A trader might look profitable only because they’re replicating someone else’s trades, not because of personal skill.

Hence, internal copy trading = allowed under control, while external copy trading = forbidden entirely.

Top Prop Firms That Allow Internal Copy Trading

Only a handful of proprietary trading firms permit copy trading — and even then, it’s strictly internal. These permissions exist to help traders manage multiple accounts efficiently while maintaining rule compliance.

These firms share one thing in common — they view copy trading as a logistical tool, not a trading advantage.

The software simply helps traders execute efficiently across several accounts that they’ve already earned through evaluation success.

Apex Trader Funding

Apex offers an integrated Apex Trade Copier built for NinjaTrader 8. Traders can connect up to 20 personal performance accounts and have each trade replicated automatically.

All accounts must trade in the same direction, and copying is restricted to the user’s own accounts. The copier is not available on other Apex-connected platforms or tools, making NinjaTrader 8 the sole supported environment for this feature. This setup makes multi-account management fast and accurate without violating any evaluation rules.

FundedNext

FundedNext permits traders to copy trades between their own accounts, as long as the combined capital does not exceed a set limit (e.g., USD 300 k). The firm operates primarily on MetaTrader 4 and MetaTrader 5, and all internal copying must occur within those platforms. They ban third-party tools like Social Trader Tools or FX Blue, so replication must be handled through approved server-side account-grouping methods. The goal is to help scaling traders manage their portfolios efficiently without creating duplicated risk for the firm.

Hola Prime

Hola Prime takes a firm stance against group trading but allows a single trader to mirror their own positions across multiple personal accounts. The firm’s detection systems analyze trade timestamps and lot sizes to prevent collaboration between different users. Internal copying is supported only through MetaTrader 5 using permitted broker-side allocation tools; external cloud copiers are not allowed. For solo traders running identical strategies on several accounts, this policy offers automation without risking compliance violations.

The 5%ers

While The 5%ers does not officially advertise a copy-trading tool, it tolerates manual replication of one’s own trades so long as external EAs or cloud-mirroring apps are not involved. The firm supports multiple platforms, including MT5 and cTrader, and allows traders to duplicate trades manually across their own accounts. They monitor for identical trade patterns across multiple users to ensure that manual copying remains personal and transparent.

Lux Trading Firm

Lux Trading Firm permits controlled cross-platform copying, allowing traders to connect an external brokerage account and mirror positions to their Lux funded account. The firm supports MT5, cTrader, and approved linked accounts, giving experienced traders flexibility to manage multiple environments. All connected accounts must belong to the same user, and Lux regularly audits trading activity to confirm ownership and adherence to its risk framework.

Why Internal Copy Trading Exists?

Without a copy-trading tool, many professional traders manage multiple accounts efficiently through advanced trading platforms such as Rithmic, Tradovate, and WealthCharts—especially when navigating the differences in futures vs stocks trading requirements across accounts.

“Automation should simplify execution, not substitute for skill. The best traders use technology to amplify discipline, not to escape it.”

Internal copy trading adds an extra layer of convenience for traders who want to scale their activity seamlessly. It allows a single order to execute across multiple linked accounts, ensuring precision and consistency without increasing manual workload.

Key benefits include:

- Consistency: Identical fills and execution across all accounts.

- Speed: Especially useful in fast-moving Futures markets.

- Focus: Reduces manual work, allowing traders to concentrate on analysis.

- Precision: Eliminates keyboard or platform delays between trades.

In other words, internal copy trading is not about replacing skill, it’s about simplifying execution.

Why External Copy Trading Is Prohibited

In contrast, external copy trading threatens the fairness and structure of proprietary funding models.

Most prop firms evaluate traders individually, rewarding those who can demonstrate independent thinking, emotional control, and discipline.

If external copying were allowed, it would:

- Enable traders to “borrow” results from others.

- Multiply identical risk exposure across hundreds of accounts.

- Prevent the firm from identifying who truly understands market behavior.

Advanced prop firms use pattern-recognition software that detects identical trade entries, timestamps, and positions across multiple users. When detected, this often results in an immediate disqualification or lifetime ban.

This strict stance ensures that funded traders make money and are rewarded for originality, not imitation.

Copy Trading as a Growth Strategy — Not a Shortcut

One misconception among new traders is that copy trading is a form of automation that can replace skill. In reality, even within firms that allow it, it’s viewed as a scaling tool, not a strategy, especially when navigating drawdown rules across multiple accounts.

Here’s how professional traders use it effectively:

- After passing evaluations, they open multiple funded accounts for diversification.

- They link those accounts to their internal copier for identical trade execution.

- They use it to scale capital while applying the same rules, risk limits, and strategies consistently.

This approach allows traders to build efficiency after mastering structure — not as a substitute for learning.

“Fairness and structure are what keep prop trading sustainable. Efficiency matters—but integrity is what earns longevity.”

Final Thoughts: Efficiency With Ethics

Copy trading, when used within limits, has transformed how traders manage multiple funded accounts. It’s no longer about imitation — it’s about execution precision.

Firms that allow it do so under strict ownership rules and transparent platform controls.

Experience professional-grade execution and structured funding across multiple platforms. Trade with Apex Trader Funding using Tradovate for intuitive order flow, WealthCharts for market analytics, or NinjaTrader 8 for efficient multi-account copy trading. Skill and structure—your true trading edge.

FAQs

To connect your Apex Trader Funding account to NinjaTrader 8, first download the NinjaTrader platform and install it on your computer. Log in using your Rithmic credentials provided by Apex, then select your evaluation or funded account from the connection menu. Once linked, you can access live market data, execute trades, and use the Apex Trade Copier for managing multiple accounts within NinjaTrader 8. Here is the full Apex NinjaTrader Connection Guide

Prop firms use advanced pattern-recognition and data analytics systems to detect copy trading across accounts. These systems track execution timestamps, trade sizes, instruments, and order direction to identify identical trading behavior. When multiple accounts owned by different traders consistently enter and exit positions at the same prices and times, the firm’s system flags them for review. They may also analyze IP addresses, device IDs, and order-routing patterns to detect coordination or external copying through social-trading tools. If confirmed, all linked accounts can be suspended or terminated for rule violations.

Related Blogs

trading-strategies | 27-08-25

How Do Funded Trading Accounts Make Money?

The idea of trading with someone else’s capital has opened doors for thousands of aspiring market participants. Funded trading accounts...

Read more

trading-strategies | 11-09-25

What is a Prop Firm Challenge? - Everything You Need to Know

A prop firm challenge is a two-phase simulated evaluation where a trader must reach a profit target (typically 8–10%) without...

Read more

trading-strategies | 03-10-25

7 Best Prop Trading Firms in Mexico in 2026

Trading in Mexico has evolved into more than just a search for market opportunities — it has become a test...

Read more