trading-strategies | 11-09-25

For aspiring traders, one of the most common gateways into proprietary trading firms is the prop firm challenge. It’s a structured evaluation that determines whether a trader has the discipline, consistency, and strategy to manage a firm’s capital. Unlike trading with personal funds, this isn’t about proving you can take big risks—it’s about showing you can handle markets responsibly within a set of rules.

Common Rules in a Prop Firm Challenge

Prop firm challenges are built around structured rules, and knowing them upfront helps traders align strategies effectively. Here’s a breakdown of the most common ones across firms:

The Purpose of a Prop Firm Challenge

At its core, a prop firm challenge is designed to filter out gamblers from disciplined traders. Proprietary trading firms need assurance that the individuals they back can control losses, protect capital, and think long-term. Profit targets, drawdown limits, and minimum trading days are built into these challenges to create boundaries that reflect real-world trading conditions.

Instead of being obstacles, these requirements act as training tools. They push traders to respect risk, plan entries and exits, and treat trading as a structured profession rather than a high-stakes gamble.

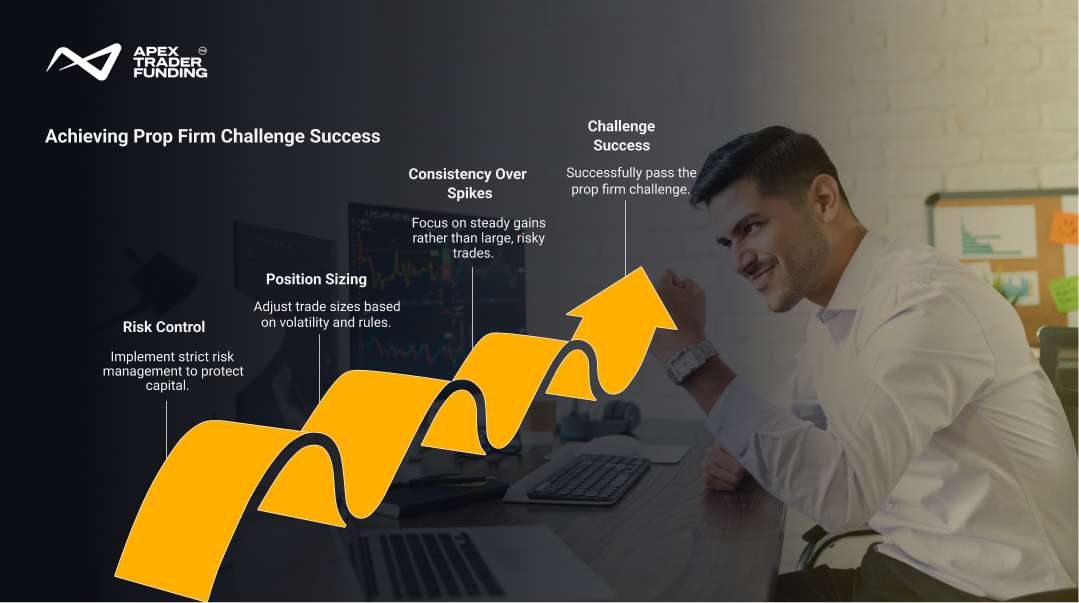

Strategic Foundations for Passing a Challenge

Passing a prop firm challenge depends on having a solid strategy, not relying on luck. To move through the evaluation, traders must balance profitability with risk management. This requires a foundation of approaches that keep performance steady.

Key strategic foundations include:

- Risk Control: Limit each trade to only a small fraction of your account balance.

- Position Sizing: Adjusting trade size according to volatility and rule-based limits.

- Consistency Over Spikes: Building steady gains rather than trying to pass in one or two big trades.

- Rule Alignment: Shaping strategies to fit drawdown, daily loss, and trading day requirements.

These elements prove to the firm that your strategy isn’t just profitable—it’s sustainable.

Success doesn’t come from one lucky trade—it’s built on steady, consistent gains.

Balancing Aggression and Caution

One of the toughest parts of a challenge is knowing when to be aggressive and when to hold back. A trader who plays too cautiously may never reach profit targets, while one who takes oversized risks may break rules early. The true skill is in finding the right balance.

Traders often scale risk gradually—trading smaller in the beginning to build a cushion, then becoming slightly more aggressive once the account is above starting balance. This method reduces pressure while still creating room to reach required profit thresholds.

Psychological Approach to Challenges

Beyond strategy, psychology plays a massive role. Many traders fail not because of poor systems, but because of emotional missteps—chasing losses, overtrading, or ignoring rules under stress. A prop firm challenge magnifies these weaknesses.

Approaching the evaluation with a professional mindset is essential:

- View it as practice for real capital, not just a test.

- Accept that slow progress is better than reckless shortcuts.

- Remember that rule compliance is as important as hitting profit goals.

By managing emotions as carefully as trades, traders prove they are ready to handle accounts from prop firms with responsibility.

Why Strategy Matters More Than Speed

Some traders believe they can “beat the challenge” quickly with large positions or risky setups. While this occasionally works, it often leads to disqualification. Firms don’t look for traders who can win once—they want those who can last.

That’s why strategy matters more than speed. The most successful traders pass challenges by pacing themselves, sticking to a structured system, and building proof that they can handle the ups and downs of real markets.

A prop firm isn’t testing how fast you can pass—it’s testing how long you can last.

Final Thoughts

A prop firm challenge is more than an entry exam—it’s a reflection of how you’ll behave with real capital. For traders, the challenge serves as both an evaluation and an opportunity to learn. It forces you to adopt structure, refine strategies, and prove that discipline drives results.

In the end, passing isn’t just about unlocking access to funding. It’s about demonstrating that you can trade like a professional, where risk management and consistency matter more than luck or speed. If you’re ready to put your skills to the test, explore Apex Trader Funding and start with a 25K Rithmic account or a 25K WealthCharts account.

FAQs

A prop firm challenge is an evaluation that tests whether you can trade with discipline under specific rules. Traders are given an account with targets and limits—such as profit goals, daily loss limits, and overall drawdowns—and must prove consistency over a set number of trading days. If you meet these requirements without breaking rules, you qualify for a funded account where you trade with the firm’s capital and share in the profits.

Yes, passing a prop firm challenge can be difficult because it requires discipline, consistency, and strict risk control. Many traders fail when they chase quick profits or ignore rules like drawdown limits and minimum trading days. However, for those who treat the process strategically—focusing on small, steady gains rather than big wins—the challenge becomes manageable. Success is less about complexity and more about patience, structure, and following a well-defined plan.

A prop firm, short for proprietary trading firm, is a company that provides traders with access to its own capital to trade financial markets. Instead of using personal savings, traders work with the firm’s funds under set rules and share a percentage of the profits they generate. This setup allows traders to scale their strategies with larger capital while the firm manages risk through evaluations and trading guidelines.

Related Blogs

trading-strategies | 27-08-25

How Do Funded Trading Accounts Make Money?

The idea of trading with someone else’s capital has opened doors for thousands of aspiring market participants. Funded trading accounts...

Read more

trading-strategies | 03-10-25

7 Best Prop Trading Firms in Mexico in 2026

Trading in Mexico has evolved into more than just a search for market opportunities — it has become a test...

Read more

trading-strategies | 06-10-25

8 Best Futures Trading Strategies in 2026

Futures trading attracts traders worldwide because it offers leverage, liquidity, and opportunities in everything from commodities to equity indices. Yet...

Read more