trading-strategies | 27-08-25

The idea of trading with someone else’s capital has opened doors for thousands of aspiring market participants. Funded trading accounts are not giveaways—they are carefully structured partnerships where both the firm and the trader benefit. Funded trading accounts make money in two main ways: through evaluation fees that traders pay to qualify, and through profit sharing once traders are funded and begin generating returns. Firms also protect revenue by enforcing strict risk rules, ensuring that losses stay limited. This combination allows firms to stay profitable while giving traders access to capital they wouldn’t have on their own.

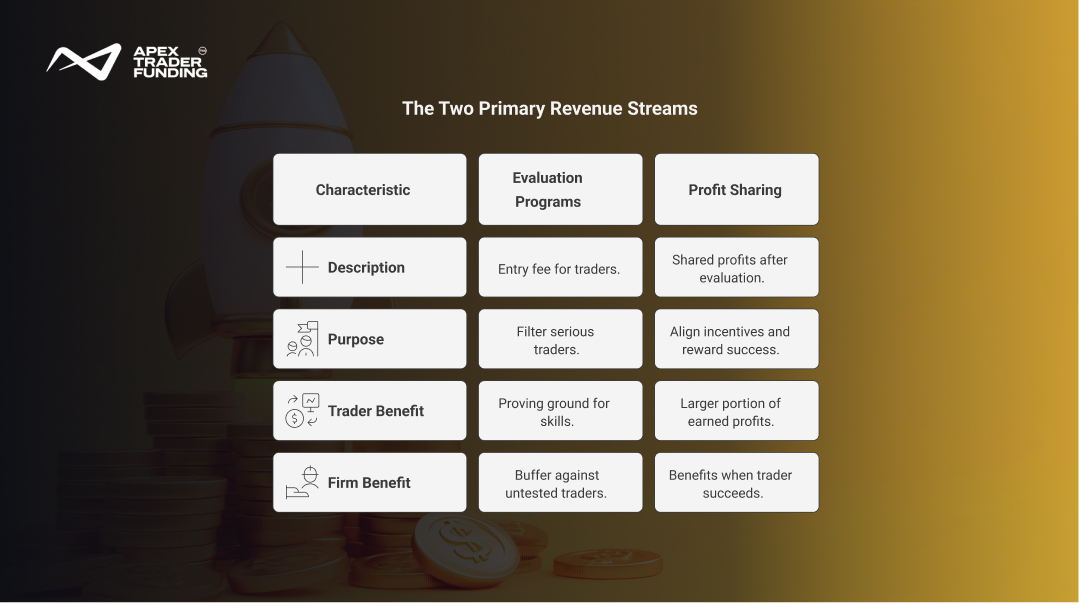

The Two Primary Revenue Streams

The Two Primary Revenue Streams: The revenue model for funded trading accounts is a "High-Volume, High-Skill" system. While the marketing focuses on partnership, the business remains sustainable through a balance of evaluation throughput and top-tier trader performance.

1. Evaluation Programs (Operational Revenue)

Traders pay an entry fee (e.g., $167/month for a 50K account, often discounted during 90% sales) to access the evaluation environment. This fee covers data costs, platform licensing for NinjaTrader, and the administrative overhead of the "Simulated" stage.

- The Reality: Industry data shows only 5–10% of traders pass the initial evaluation. Firms also generate significant revenue through $80-$100 Account Resets, which allow traders to restart after a rule breach without paying the full entry price again.

2. The Transparency Disclosure

The Reality of the Model: High Access, High Standards It is important to be transparent about the mathematics of this industry. Industry statistics generally suggest that most applicants do not pass the initial evaluation phase. In practice, the evaluation fees collected from the majority of applicants—who may not yet be ready for live trading—are what subsidize the capital access for the top 5% of performers.

This structure is what allows firms to offer high buying power (e.g., $50,000 or $300,000) for a relatively low monthly fee. It creates a meritocratic ecosystem: the entry fees provide the operational liquidity that enables the firm to take the financial risk of backing the successful few.

3. Profit Sharing

Once a trader graduates to a Performance Account (PA), the model shifts toward alignment.

- Apex Specifics: You keep 100% of the first $25,000 earned per account.

- The 90/10 Split: After the initial $25k, the split moves to 90/10 in your favor. This 10% retained by the firm is their "success fee," incentivizing them to provide the best possible execution via Rithmic or Tradovate to keep you profitable.

4. Institutional Verification

Institutional Verification: Beyond the Fee Legitimate funded accounts distinguish themselves through their connection to real market mechanics. Unlike "closed-loop" simulations where orders never truly impact a book, top-tier firms utilize regulated CME Group data feeds. Furthermore, in the funded stage, trades often generate actual commissions per contract. This signals that the firm is tied to real market liquidity and execution, rather than operating a model dependent solely on churning evaluation fees.

Risk Management as Revenue Protection

The profitability of funded accounts is not just about entry fees and profit splits—it’s also about risk controls. Firms design strict rules such as maximum daily losses, position size caps, or account resets.

Expert Insight: At Apex, "Revenue Protection" is automated via the Rithmic or Tradovate risk-engine. For a 50K Account, the firm’s risk is mitigated by a $2,500 trailing drawdown. When a trader triggers an Account Reset ($80-$100), it covers the administrative cost of account re-provisioning. This "Self-Regulating" model ensures the firm remains solvent even during high-volatility market events like FOMC or CPI releases, where unmanaged risk could otherwise lead to catastrophic capital loss.

These aren’t obstacles but mechanisms to protect the firm’s capital. By keeping risk contained, the firm ensures that even if some traders fail, the model remains sustainable.

From a strategy perspective, these limits also help traders internalize professional risk habits. The rules push traders toward small, consistent gains rather than reckless bets—habits that make both the trader and the firm more profitable in the long run.

Economic Breakdown of the Funding Model

Why the Model Works for Traders Too

While firms earn revenue, traders benefit equally from the arrangement. The trader doesn’t need to save large amounts of personal capital or face the emotional burden of losing their own money. Instead, they focus on strategy execution. For disciplined individuals, this setup creates a faster path to growth: they keep a majority share of the profits while learning how to operate under professional constraints.

This model also reduces common pitfalls such as over-leveraging or gambling with personal savings, since traders know their opportunity hinges on respecting rules. In this sense, the way funded accounts “make money” directly overlaps with the way traders build careers—through structured consistency.

Strategic Takeaways for Traders

Understanding the revenue model of funded accounts provides traders with insight into how to succeed within them. Three key lessons stand out:

- Passing is not enough—discipline sustains success. Firms design rules to protect capital, and traders who embrace those rules are the ones who keep their accounts.

- Profitability aligns both sides. The firm earns when the trader earns, making consistency the most valuable skill.

- Capital without pressure. For the trader, the opportunity to scale without risking personal funds creates space to focus on process rather than fear of loss.

Beyond Revenue: Scaling the Partnership

The profitability of funded accounts doesn’t stop at evaluation fees and profit sharing. Successful firms reinvest their revenue into expanding opportunities for traders—offering larger account sizes, better platforms, and advanced tools. This creates a cycle where traders who prove consistency gain access to more capital, and the firm benefits from nurturing long-term, skilled partnerships.

Profit sharing ensures alignment—when the trader wins, the firm wins too.

Final Thoughts

Funded trading accounts make money through a balance of evaluation fees, profit sharing, and robust risk management rules. But this system is not one-sided—it creates a mutually beneficial structure where firms reduce their risk and traders gain access to resources they couldn’t otherwise tap into. For those approaching trading as a long-term pursuit, this model offers a sustainable way to grow, provided they respect the structure and treat every trade with discipline.

FAQs

The profit from a funded trading account comes from the trades you successfully execute while following the firm’s rules. Instead of keeping all of it, you share the gains with the funding provider through a profit split. In most cases, prop firms let traders hold on to the bulk of their profits, typically around 70% to 90%, while the company retains a smaller cut. This arrangement rewards skilled traders without them needing to risk their own capital.

A funded trader makes money by generating profits in the account provided by the prop firm. Instead of risking their own savings, they trade with the firm’s capital and keep a large percentage of the profits through a profit-sharing model. The more consistently they trade within the rules, the greater their payouts become, making discipline and strategy the key to long-term earnings.

Funded accounts carry less personal financial risk than trading with your own capital, since the firm provides the money. However, they still involve strict rules—like loss limits or account resets—that can end your access if not followed. The main risk lies in discipline: if you break the rules, you lose the account, not your savings.

If you blow a funded account, the best step is to review what caused the failure—whether it was poor risk control, emotional trading, or ignoring rules. Many firms allow traders to reset or reapply, but success depends on adjusting your strategy and mindset before trying again.

Related Blogs

trading-strategies | 11-09-25

What is a Prop Firm Challenge? - Everything You Need to Know

A prop firm challenge is a two-phase simulated evaluation where a trader must reach a profit target (typically 8–10%) without...

Read more

trading-strategies | 03-10-25

7 Best Prop Trading Firms in Mexico in 2026

Trading in Mexico has evolved into more than just a search for market opportunities — it has become a test...

Read more

trading-strategies | 06-10-25

8 Best Futures Trading Strategies in 2026

Futures trading attracts traders worldwide because it offers leverage, liquidity, and opportunities in everything from commodities to equity indices. Yet...

Read more