trading-education | 13-02-26

Starting prop trading involves passing a performance evaluation by reaching an 8–10% profit target while adhering to strict risk-management parameters. By paying a fee for access to institutional-scale capital, traders can earn significant profit splits without risking their personal savings. Success depends on utilizing a "capital-preservation" mindset, where you treat the drawdown limit—rather than the total balance—as your tradable equity.

- The Survival Metric: Treat the Max Drawdown as your "true" account size; professional traders recommend risking only 0.5% of this buffer per trade to ensure long-term account longevity.

- Strategic Advantage: The trailing drawdown mechanic "ratchets" your risk floor upward with profits; mastering this requires adjusting your position sizing as you reach new equity peaks.

- Expert Verdict: Prop trading is a high-reward scalability tool that vets your market discipline. While it is not a guaranteed salary, it provides a direct path to professional-grade liquidity for a fraction of the traditional cost.

I have spent years navigating the landscape of proprietary trading, watching the industry shift from elite floor-trading firms to the current "retail prop" boom. When I first looked at these modern challenges, I realized they aren't just about trading—they are about navigating a specific mathematical gauntlet designed to test your discipline under extreme constraints. To start prop trading correctly, you must look past the flashy advertisements and understand the hard mechanics of the evaluation phase.

How to Start Prop Trading?

To start prop trading, a trader must pass a multi-stage evaluation by hitting an 8–10% profit target within a demo environment. After paying an evaluation fee (typically $100–$600), you receive access to broker-issued simulated capital. Success requires adhering to strict daily and total drawdown limits, usually capped at 5% and 10% respectively. Your ability to move to a funded status depends on risk management and consistency rule compliance.

When I sign up for a new challenge, I don't look at the $100,000 buying power. I immediately look at the Funded Account Challenge Strategy required to protect the "drawdown buffer." In most cases, you are essentially buying an "option" on a funded account. You pay a non-refundable fee ($100 to $500), and you are given a set of parameters. If you hit the Evaluation Phase Profit Target (usually 10%) before you hit the Prop Firm Drawdown Rules, you move to the funded stage.

What are the primary risk safeguards in a prop firm evaluation?

Prop firm risk safeguards are automated equity thresholds designed to protect the firm’s liquidity while vetting a trader's discipline. These include the daily loss limit (typically 4–5% of starting equity), the maximum total drawdown, and consistency rules that prevent over-leveraging on a single trade. While breaching these parameters results in account closure, they serve as the structural boundaries that define a successful, professional-grade trading strategy.

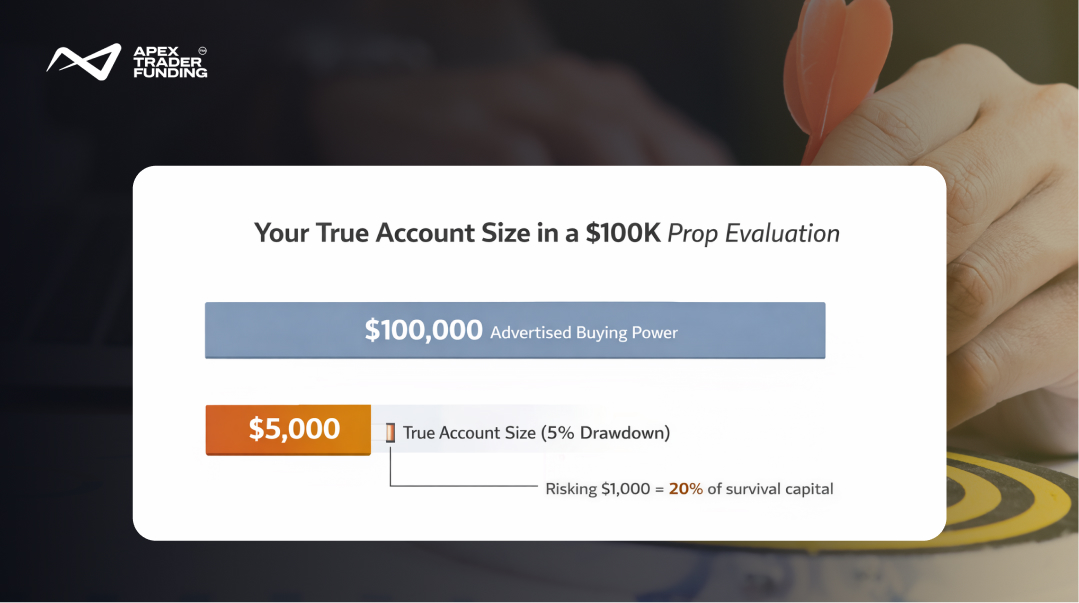

If the firm sets a 5% total drawdown on a $100k account, your "True Account Size" is $5,000. If you risk 1% of the $100,000 ($1,000) on a single trade, you aren't risking 1%—you are risking 20% of your survival capital.

"I thought I was doing great being up 4%, but then a single volatile news event wiped out my daily limit. The account was closed instantly. I didn't realize that the spread widening during the news would hit my drawdown even if the price didn't technically touch my stop loss."

The Reality of "Return on Risk"

When a firm asks you to make $10,000 in profit while only allowing a $10,000 drawdown, they are asking for a 100% return on your usable capital. This forces aggressive behavior. I've found that the "silent cost" often comes from simulated liquidity; since these are demo environments, fees like "swaps" are still deducted. If you hold a losing trade over a Wednesday night, the triple swap fee can push your balance past the daily limit, failing you while you sleep.

Core Rules and Operational Limits

To navigate these platforms, you need to understand the structural boundaries. Below is a breakdown of the standard mechanics I've observed across the top-tier firms.

How is the trailing drawdown vs. the static drawdown explained?

A static drawdown is a fixed loss floor that remains at a specific dollar amount, providing a consistent risk buffer. In contrast, a trailing drawdown "ratchets" upward as your account equity grows, locking in the firm's safety and reducing your usable risk capital even after profitable trades. While static models are more trader-friendly, trailing models are common in high-leverage futures and retail forex prop firms.

I prefer static drawdowns, but they are becoming rare. In a trailing scenario, if you grow your $100,000 account to $105,000, your drawdown floor might move from $92,000 up to $97,000. If you then lose that $5,000 profit, your balance is back to $100,000, but your floor stays at $97,000. You now only have $3,000 of breathing room left. This is a "ratchet" that only tightens, never loosens. To navigate this effectively, it is necessary to treat the trailing floor as a dynamic risk-management tool, proactively adjusting position sizes to lock in gains and maintain a sustainable equity cushion as the account scales.

Is the prop firm model a "Risk/Reward" reality?

The prop firm model offers a high risk-to-reward ratio by allowing traders to access large capital amounts for a small upfront fee. However, the reality is a high-variance environment where the "true" risk is the loss of the evaluation fee and the "reward" is contingent on passing a rigorous math-based gauntlet. For skilled traders, it serves as a powerful scaling tool; for the undisciplined, it often results in a cycle of reset fees.

The marketing suggests you can trade with "no risk to your own capital," but your capital is the evaluation fee. If you fail, that money is gone. I have noticed a "Reset Churn" where firms incentivize you to trade aggressively to pass quickly. Aggression leads to variance, variance leads to breaches, and breaches lead to more "Reset Fees." This is often a primary revenue stream for the firm.

My Expert Insight on the "Buffer Builder"

When I start an evaluation, I ignore the $100,000 number entirely. I treat it as a $5,000 account. My strategy is to risk exactly 0.5% of that $5,000 ($25) per trade. It feels agonizingly slow, but my goal is to build a "Safety Buffer" of $2,000 in profit first. Once that buffer exists, I am trading with the firm's money, and only then do I increase my position size to hit the final target. Most traders try to hit a home run on Day 1; I try to survive to Day 10.

While many retail firms utilize MetaTrader 5 (MT5) or cTrader, traders focused on the Futures markets typically require high-performance connections via Rithmic or Tradovate. I personally use NinjaTrader for its advanced order flow visualization and automated trailing stop features, which are critical for navigating the 'ratchet' of a trailing drawdown in real-time. For those preferring modern web interfaces, TradingView integration via DXTrade remains the gold standard for charting precision across both Forex and CFD instruments.

- The catch: Many firms employ "Hidden Rules" like the Prop firm consistency rule calculator, which can disqualify you if a single trade makes up more than 30% of your total profit. Even if you hit the target, they may label it "gambling behavior" and deny the payout.

Summary of Starting Steps

Starting prop trading is a lesson in discipline. You aren't just fighting the market; you are fighting a set of rules designed to exploit human impatience.

- Treat the Drawdown as Zero: If your limit is $95,000, then $95,000 is your "zero."

- Cap Your Leverage: Use a 1:20 law. If your daily drawdown is $2,500, risk no more than $125 per trade.

- Watch for Red Flags: Avoid firms with "No Time Limit" but high monthly fees, or those that have significant slippage on limit orders, as this indicates artificial friction.

Don’t let restrictive account parameters stand in your way when you can avoid the daily loss limit and trade with a firm that prides itself on having no hidden rules. Check out the official Apex Trader Funding site and choose account options like the 25K Rithmic or 50K WealthCharts to start building your funded career with the high-speed execution and precision charting required for professional-grade success.

Risk Disclosure: Proprietary trading involves significant financial risk and is not suitable for all investors. The "funded accounts" described herein are typically simulated trading environments utilizing demo capital. Any "payouts" earned are performance-based bonuses derived from simulated profit-splits, not a guaranteed salary or investment return. Past performance in a prop firm evaluation is not indicative of future results. Please consult with a qualified financial advisor before paying any evaluation fees.

FAQs

Prop trading is profitable for a small minority of disciplined traders, with success rates for receiving a payout typically ranging from 4% to 7% across the industry. Professional institutional traders benefit from centralized pricing and fixed salaries at elite desks, while retail prop traders utilize broker-issued demo accounts to access high-leverage simulated capital. While most participants fail due to strict drawdown rules and evaluation fees, top performers earn five-to-six-figure annual profit splits. Whether you succeed depends on your risk management discipline and the specific payout reliability of your chosen firm.

To start a prop firm, you typically need between $25,000 and $50,000 for a lean white-label launch, though institutional setups often require over $500,000. White-label models allow founders to lease pre-built technology stacks and risk management dashboards for a lower upfront cost, while main-label solutions offer full control over broker-issued infrastructure and proprietary software but demand significant capital for licensing and development. Beyond technology, you must budget for legal compliance, payout reserves, and marketing to build a sustainable trader funnel. Which model you choose depends on your technical expertise and the total capital available for operational runway.

Related Blogs

trading-education | 22-08-25

What is a Funded Trading Account? - Detailed Guide

A funded trading account is a financial arrangement where a proprietary trading firm (like Apex) provides you with virtual or...

Read more

trading-education | 23-08-25

How Do Funded Trading Accounts Work?

A funded trading account works by granting a trader access to a firm's capital after they pass a simulated evaluation....

Read more

trading-education | 25-08-25

How to Get Funds for Trading? - 6 Practical Ways

Starting a trading journey often requires more than knowledge—it requires capital. Yet many aspiring traders face the same challenge: how...

Read more