trading-tools-resources | 09-10-25

Futures trading often appears complex to newcomers—leveraged contracts, high volatility, and fast-moving markets can make it seem intimidating. Yet, beneath that complexity lies one of the most accessible and scalable trading environments for disciplined learners. With the right tools, structured education, and consistent practice, anyone can build the knowledge and confidence to trade futures responsibly.

How to Learn Futures Trading?

Learning futures trading starts with understanding how the market works and developing the right habits early. Unlike traditional investing, futures trading depends on precision, structure, and consistent rule application. Traders who succeed don’t rush into live markets—they build their skills through a deliberate learning curve: grasping core concepts, practicing on demo platforms, refining strategies, and gradually scaling up.

A strong foundation includes three essentials:

- Education – Study how futures contracts, margins, and leverage function.

- Simulation – Practice execution in a demo environment before risking real money.

- Tools – Use modern platforms that help you analyze, backtest, and manage risk effectively.

When combined, these elements create a pathway for steady skill growth and long-term success.

Understanding the Basics of Futures Trading

At its core, a futures contract is a standardized agreement to buy or sell an asset at a future date for a predetermined price. Traders use these contracts to speculate on price movements or hedge against risk. Unlike stock investing, futures trading requires an understanding of leverage, margin, and expiry dates.

The educational phase should always begin with grasping these fundamentals:

- Contract specifications: Each futures product has its own tick size, margin requirement, and expiration cycle.

- Leverage mechanics: Small price moves can result in significant gains or losses because of leverage.

- Settlement type: Futures may be cash-settled or involve physical delivery of the underlying asset.

By internalizing these basics early on, traders can avoid costly mistakes later in their journey.

Choosing the Right Educational Resources

A wide variety of resources exist, but not all are equally effective for futures traders. Books and online courses can explain theory, but platforms and simulators provide the practical exposure needed to build confidence.

- Books & e-guides: Great for understanding terminology and strategies.

- Webinars & podcasts: Useful for following live commentary and market insights.

- Online communities: Trading forums and Discord groups can provide peer-to-peer support.

- Simulated accounts: The most direct way to practice futures trading without financial risk.

A balanced approach—combining reading, structured learning, and hands-on practice—yields the fastest skill growth.

Comparing Resources for Beginners

Below is a comparative table of common futures trading resources to help you select the right mix for your learning path:

The Role of Trading Tools

Practical learning in Futures is incomplete without leveraging modern tools. Platforms now offer integrated dashboards that track rules, calculate risks, and help traders test strategies.

Key categories of tools include:

- Charting software – Advanced platforms like TradingView or NinjaTrader allow detailed technical analysis.

- Risk calculators – Help determine position size relative to account size and risk tolerance.

- Backtesting modules – Allow historical testing of trading strategies.

- News calendars – Essential for avoiding high-impact events that can trigger volatility.

The effectiveness of these tools lies not in their availability but in how consistently traders use them.

Futures trading isn’t about predicting the market—it’s about preparing for it with structure, tools, and discipline.

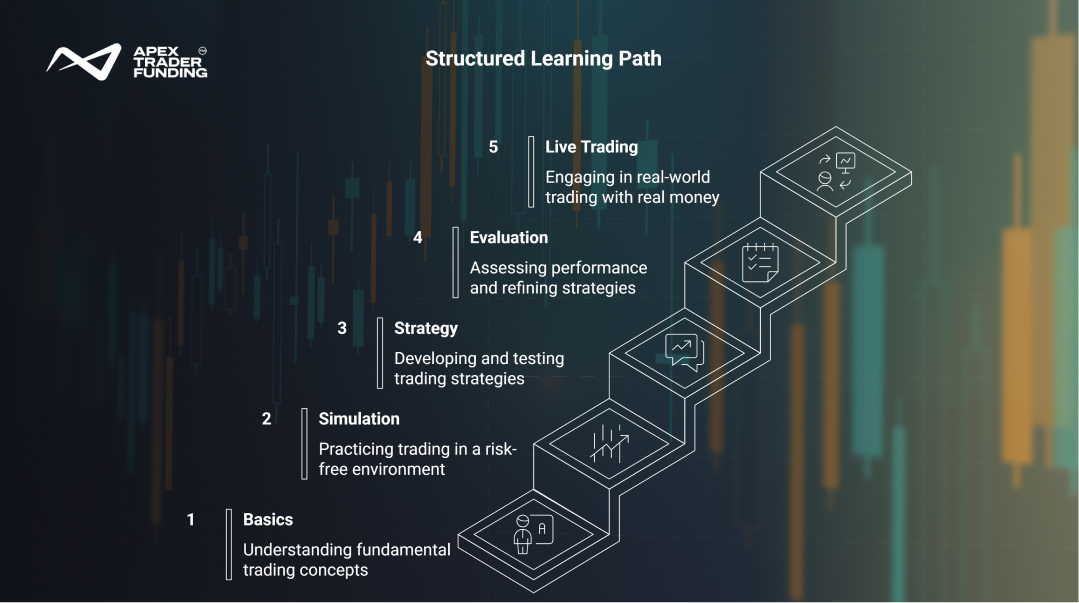

Structured Learning Path

Learning futures trading requires progression. Jumping directly into live trading often leads to avoidable losses. Instead, build step by step:

- Foundation Stage – Study the basics of futures contracts, margin requirements, and order types.

- Simulation Stage – Trade on demo accounts using real-time market data but no financial risk.

- Strategy Stage – Apply technical and fundamental analysis to design trading plans.

- Evaluation Stage – Track consistency, apply rules, and measure performance metrics.

- Live Stage – Start small with real capital, scaling up only after demonstrating control and discipline.

Each stage should include both education (theory) and application (tools).

Risk Management as a Core Learning Component

Futures education is incomplete without risk management. Many beginners focus on finding “winning strategies” but neglect capital protection. Futures trading amplifies both profits and losses, making disciplined risk controls vital.

Key practices include:

- Limiting exposure per trade (1–2% of account size).

- Defining stop-loss levels before entering.

- Using alerts to prevent rule violations.

- Reviewing trades daily to learn from mistakes.

By making risk management part of the learning process from day one, traders build habits that support longevity.

Building Discipline Through Tools

Trading success is often more about discipline than prediction. Tools like journaling software, automated alerts, and performance dashboards can help enforce discipline. Recording every trade—including the reasoning and outcome—creates a feedback loop that accelerates growth.

Over time, such practices shift trading from an emotional pursuit to a structured process guided by rules and data.

Every great trader was once a beginner who chose to learn step by step instead of rushing into the market.

Final Thoughts

Learning futures trading is not about memorizing strategies but about combining knowledge with the right tools and consistent practice. Start with educational resources, progress through simulation, and only then move into live markets. Equip yourself with the right platforms, risk calculators, and journaling tools, and the learning process becomes structured and sustainable.

Ready to put your futures trading knowledge into practice? Start with Apex Trader Funding today. Explore Apex’s website or jump right in with the 25K Rithmic account or the 25K Tradovate account.

FAQs

The high failure rate in trading comes down to a combination of poor risk management, lack of discipline, and inadequate preparation. Many traders skip structured learning, jump into live markets too soon, or rely solely on “hot tips” instead of tested strategies. Emotional decisions—like chasing losses or over-leveraging—compound mistakes.

Tools and resources can change this outcome. Risk calculators prevent oversized trades, simulators allow practice without financial pressure, and journaling software helps identify patterns of error. Traders who approach the market with structure, patience, and consistent rule application are far more likely to avoid joining the majority who lose.

The “best” time frame depends on your trading style and goals. Day traders often prefer 1–5 minute charts for quick entries and exits, while swing traders may focus on 1-hour or daily charts to capture larger moves. Beginners should experiment in simulators to see which time frame fits their risk tolerance and decision-making pace. Using charting platforms with multiple time-frame analysis helps align short-term trades with longer-term market trends.

Futures trading isn’t inherently easy, but it becomes manageable with the right structure. Beginners often struggle with leverage, volatility, and margin rules. By starting with educational resources, practicing on simulators, and applying strong risk management, the learning curve shortens, making the process more approachable and sustainable.

Related Blogs

trading-tools-resources | 28-08-25

How to Pass a Funded Trading Account? A Guide for 2026

Passing a funded trading account is often seen as the gateway to trading larger capital without risking personal savings. Yet many...

Read more

trading-tools-resources | 02-09-25

Apex Trader Funding vs Topstep - Detailed Comparison

Apex vs. Topstep: The 2026 VerdictThe choice between Apex and Topstep depends on your risk tolerance for drawdowns. Apex is cheaper...

Read more

trading-tools-resources | 04-09-25

Tradovate vs NinjaTrader in 2026: Futures Platforms Compared

NinjaTrader vs. Tradovate: 2026 Quick AnswerWhile both are owned by the same parent company, the choice is now about Interface...

Read more