trading-education | 19-01-26

After trading with Topstep for two years, I went looking for alternatives that didn't force me into the 'Combine' grind. Based on my personal testing of payout reliability and drawdown mechanics, here are the top 5 firms I trust:

Topstep Alternatives: The Quick Verdict

- Best Overall (Career Mode): TradeDay. Why? It is the only firm that offers a verified path to a real CME brokerage account.

- Best for Scalpers: Apex Trader Funding. Why? Highest verified payouts ($598M+) and allows 20 accounts.

- Best for Swing Traders: MyFundedFutures. Why? No Daily Loss Limit allows trades to breathe overnight.

Core Difference: Unlike Topstep's 2-step combine, these alternatives prioritize End-of-Day Drawdowns (TradeDay) or One-Step Speed (Apex).

For many beginner and intermediate traders, the standard two-step evaluation model has become a bottleneck. By 2026, the prop firm landscape has fractured into two distinct camps: "Career-Style" firms that mimic professional desk jobs with end-of-day risk calculations, and "High-Velocity" firms that offer instant funding access but police risk with tighter, intraday controls.

Choosing the best Topstep alternatives in 2026 isn't just about the cheapest monthly fee; it is about matching your specific trading personality—whether you are a scalper or a swing trader—to the firm's risk engine. A mismatch here usually results in blown accounts, regardless of how skilled you are.

Quick Comparison: Top Picks at a Glance

Detailed Breakdown of Top Choices

1. TradeDay

Key Specs:

- Risk Model: End-of-Day Drawdown (Static).

- Platform: NinjaTrader, Tradovate.

- Funding Model: Direct to Live (after review).

TradeDay stands out because it attempts to simulate a legitimate professional trading job rather than a gamified challenge. Unlike competitors that keep you in a simulation loop indefinitely, TradeDay's goal is to move you to a live brokerage account with real CME execution. The evaluation feels grounded; you aren't fighting a ticker that moves against you in real-time but rather an End-of-Day drawdown that respects the natural ebb and flow of a trading session.

However, the "Live" account promise has nuance. You do not receive a live brokerage account immediately upon passing. instead, you enter a "Funded Sim" phase. In my experience, this 'Funded Sim' phase is where most people get impatient. I had to trade in this environment until I hit the $5,000 profit milestone before the risk desk approved my transfer to live capital. It felt like a 'grey zone,' but I appreciated that it was safer than the instant-fail rules at other firms.

- The catch: The firm manually reviews your trading style before enabling live funds. Their Terms of Service explicitly note that "reckless leverage"—such as flipping huge size in seconds to hit a target—can disqualify you, even if the trade was profitable. They are looking for employees, not gamblers.

2. MyFundedFutures

Key Specs:

- Risk Model: End-of-Day Drawdown.

- Daily Limit: None.

- Activation Fee: One-time per account.

For traders exhausted by the stress of intraday trailing stops, MyFundedFutures offers a significant sophisticated relief: End-of-Day drawdown prop firms protocols. If you are up $2,000 at noon but the market chops around and you finish the day down $100, you are safe—provided you haven't hit the maximum loss limit. This structure is essential for swing traders who need room for their trades to breathe without fear of a mid-day wick liquidating their account.

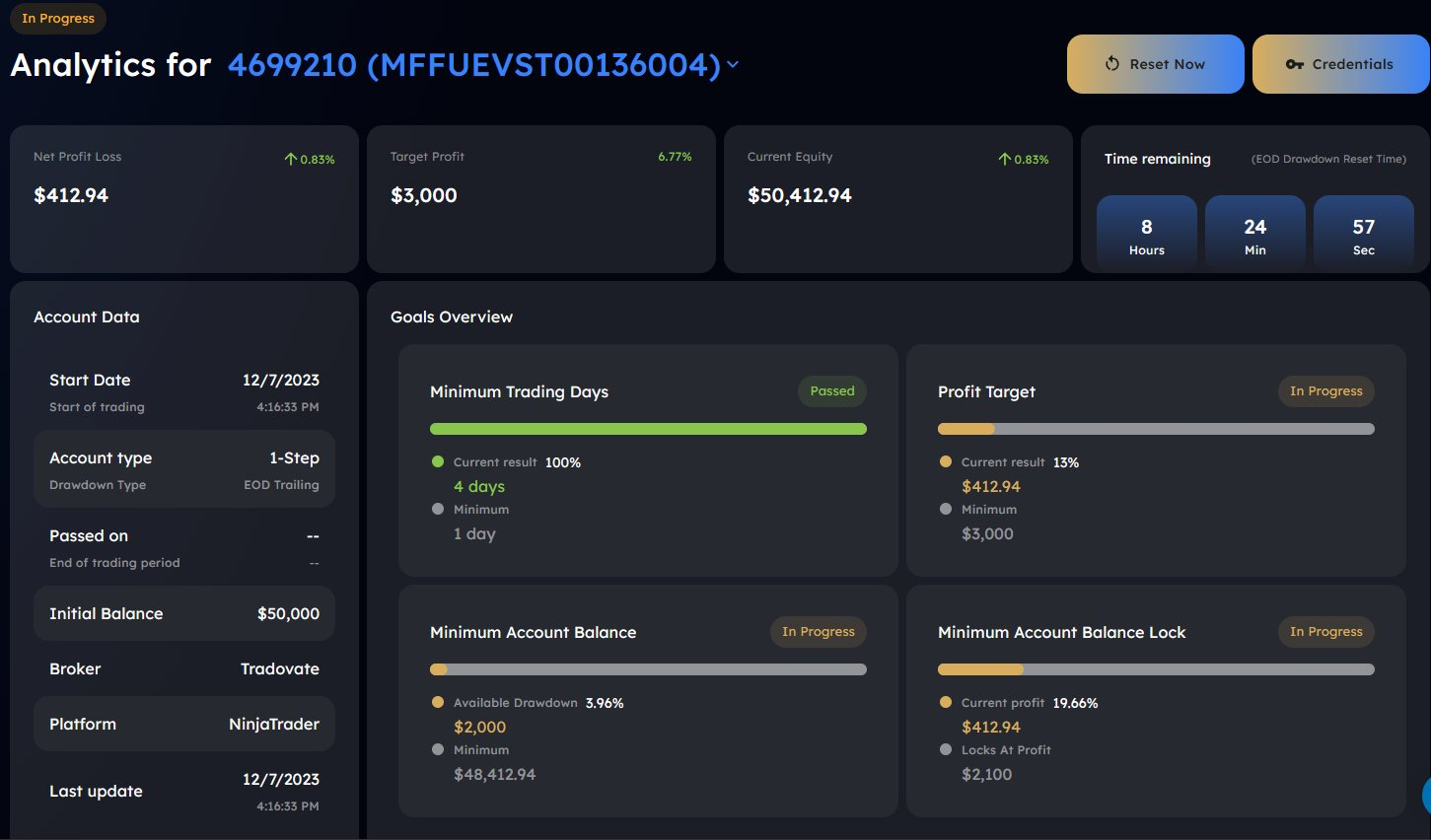

When I logged into the dashboard, the first thing I noticed was the clarity of the risk metrics. Unlike clunky competitors, I could see my End-of-Day drawdown limit clearly displayed, which stopped me from panic-closing trades during mid-day volatility. However, the "No Daily Loss Limit" marketing requires a closer look. While one won't fail for having a red day, the "Starter" plans impose strict Maximum Position Limits. You might purchase a $50k account expecting to trade 5 minis, but the dashboard will technically restrict you to 2 micros (or similar low leverage) until you build a profit cushion.

- The catch: The scaling handcuffs. You cannot "full port" your way to a quick win. You are forced to grind up slowly with small size until the system unlocks higher leverage.

3. Apex Trader Funding

Key Specs:

- Risk Model: Intraday Trailing Drawdown.

- Account Limit: Up to 20 Accounts.

- Payouts: $598 Million+ paid out since 2022.

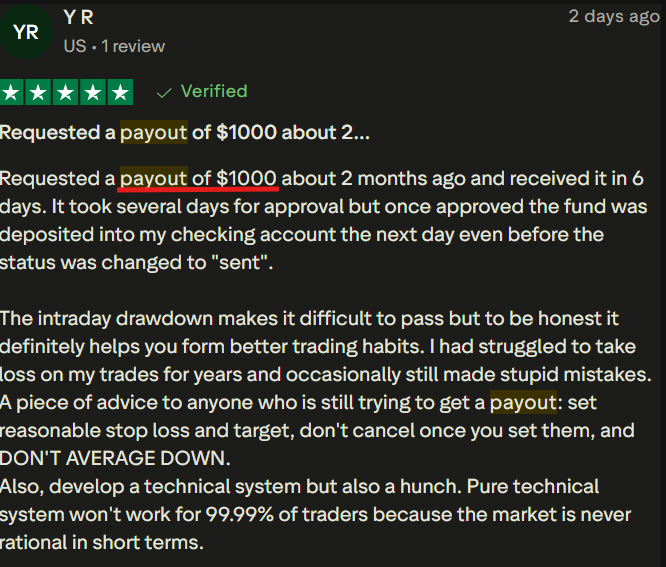

Verified Apex Trader Funding payout proof (November 2025). This Trustpilot testimonial confirms a $1,000 withdrawal processed in 6 days, proving the firm's reliability for disciplined traders.

Apex Trader Funding is the volume leader in the space, and for a good reason: they pay out massive sums, averaging over $15 million monthly. For a specific type of trader—the disciplined scalper—this is the most lucrative platform available. The ability to trade 20 accounts simultaneously allows for massive leverage on small moves. Furthermore, their "one-step" evaluation process (10 days minimum) is faster than traditional two-step models.

The friction point lies in the Apex trader funding intraday trailing drawdown explained mechanics. This rule calculates your drawdown limit based on your highest unrealized profit during the trade (High-Water Mark). If you go long on the NASDAQ and your position spikes up +$2,000, your drawdown floor also moves up by $2,000. Imagine a ratchet that only tightens. If your trade spikes to +$2,000 profit but you don't close it, your minimum account balance raises by $2,000 instantly. If the price falls back and you close the trade at +$500, you didn't just make $500; you lost $1,500 of your safety buffer.

- The Risk: You can profit on a trade and still blow your account if you let winners turn into small winners.

- The Fix: Use automated Take Profits. Do not "let runners run" until you have a buffer.

Expert Insight: Mastering the "Unrealized Trap"

The trailing drawdown is a scam if you don't understand it. The "Unrealized Trap" calculates risk off your peak open equity, meaning you can technically fail an account while closing a trade for profit. I have personally failed an account this way. I was up $1,200 on a NASDAQ long, didn't take profit, and when price retraced, my account was liquidated even though I closed the trade green. My advice? Do not treat Apex like a swing account.

4. Take Profit Trader

Key Specs:

- Risk Model: Intraday Trailing (PRO Account).

- Withdrawal Speed: Immediate (Buffer dependent).

- Platform: Multiple, including NinjaTrader.

Take Profit Trader markets itself aggressively on speed, promising withdrawals from "Day One." For traders who have been burned by 30-day waiting periods, this is a massive draw. The interface is slick, and the setup is designed for users who want a modern, tech-forward experience.

However, the definition of "Day One" comes with strict financial geometry. The Take Profit Trader withdrawal buffer rules dictate that you can only withdraw funds that are above your safety buffer. On a $50k account with a $2,000 Max Drawdown, your "Buffer Zone" is $52,000. If you make $500 profit on your first day (Balance $50,500), you cannot withdraw that cash. You must grind your account balance to $52,000+ before the withdrawal button truly unlocks. When I attempted my first withdrawal, I realized the strictness of this rule. I effectively had to self-fund my own first $2,000 of risk before the 'withdraw' button actually unlocked for me.

- The catch: The buffer zone is non-negotiable. You are not withdrawing your first dollar of profit; you are withdrawing your first dollar of profit after you have built the firm's required safety cushion.

5. OneUp Trader

Key Specs:

- Risk Model: Trailing Drawdown.

- Payout Split: 100% of first $10k.

- Funding Style: One-Step.

OneUp Trader is often the choice for traders who prioritize payout velocity over loose rules. Their payout structure is attractive, offering 100% of the first $10,000 in profits, which creates a high incentive for fast starters. The platform facilitates a streamlined experience that cuts out much of the noise found in "sale-heavy" firms.

The trade-off is rigid compliance regarding news events. OneUp has zero tolerance here. My account was flagged immediately when I opened a position 59 seconds before a CPI print. Unlike other firms that might give a warning, I faced immediate liquidation. This makes it an excellent choice for technical traders who rely on price action, but a poor choice for fundamental or news-based volatility traders. Though according to OneUp Trader’s current Terms of Service and FAQ, they do not strictly prohibit trading during news events during the Evaluation Phase. You are allowed to keep positions open and trade through news.

While the evaluation allows you to trade news, Funded Traders often face stricter scrutiny.

- The "Straddle" Ban: You cannot place a Buy Stop 5 ticks above the price and a Sell Stop 5 ticks below the price 10 seconds before the news. This is universally prohibited as it relies on latency arbitrage rather than trading skill.

- The 80% Rule: If you make $4,000 on an NFP news trade, and your total profit for the evaluation is $5,000, OneUp may deny your funding because 80% of your profit came from one high-volatility "gamble."

Events that are prohibited due to their volatility and high risk of triggering the Consistency/Gambling clause.

How Should You Choose the Right Option?

If you asked me today, I would recommend TradeDay if you want a career, but I personally use Apex for high-volume scalping because the math works better for my quick-exit strategy.

When selecting between these firms, you are essentially choosing your preferred failure mode. Do you prefer the risk of failing because a trade retraced on you (Apex/Take Profit), or do you prefer the risk of strict oversight on your trading style (TradeDay/MyFundedFutures)?

Critical Safety Check: Be aware that "Instant Funding" is often a misnomer. In almost every case, from TradeDay funded sim vs live account nuances to Apex's 10-day payout minimums, there is always a barrier between you and the cash. Never treat these accounts as immediate income sources; they are performance contracts that require you to build a buffer before you see a dime.

Final Thoughts

The "best" alternative to Topstep depends entirely on your strategy's time horizon. For traders who need the psychological safety of holding trades through volatility, TradeDay and MyFundedFutures provide the necessary professional stability. For those who treat trading as a high-frequency probability game and want to scale across 20 monitors, Apex Trader Funding remains the mathematical favorite despite its strict rules. Choose the risk model that aligns with your charts, not the marketing hype.

If you have a proven scalping strategy, stop limiting your potential returns by trading only a single account at a time. Check out the official Apex Trader Funding site and choose account options like the 25K WealthCharts or 50K Tradovate to leverage your edge across 20 accounts simultaneously.

FAQs

Topstep and Apex Trader Funding serve different goals; neither is objectively better. Topstep is preferred for professional development, offering an End-of-Day drawdown that protects unrealized profits during volatility. Apex favors high-volume scalping, providing cheaper evaluations and faster, less restrictive funding, but relies on an intraday trailing drawdown that tightens with unrealized profits. The right choice depends on whether you prioritize account stability for swing trading (Topstep) or low-cost access to leverage for quick scalps (Apex).

TradeDay and MyFundedFutures are the closest alternatives to Topstep, sharing its focus on futures trading and End-of-Day (EOD) drawdown mechanics. TradeDay mimics Topstep’s professional structure by transitioning traders to live brokerage accounts with real capital, while MyFundedFutures offers similar platform options but removes the restrictive Daily Loss Limit found in the standard Combine.

Apex Trader Funding is frequently cited as a better alternative to Topstep for experienced traders seeking higher leverage and lower costs. While Topstep focuses on trader development with a premium educational ecosystem and realistic drawdown limits, Apex offers a streamlined one-step evaluation, multi-account trading, and less restrictive consistency rules. Consequently, the superior option depends on whether you require the structure and professional coaching of Topstep or the flexibility and aggressive scaling potential of Apex.

Related Blogs

trading-education | 22-08-25

What is a Funded Trading Account? - Detailed Guide

A funded trading account is a financial arrangement where a proprietary trading firm (like Apex) provides you with virtual or...

Read more

trading-education | 23-08-25

How Do Funded Trading Accounts Work?

A funded trading account works by granting a trader access to a firm's capital after they pass a simulated evaluation....

Read more

trading-education | 25-08-25

How to Get Funds for Trading? - 6 Practical Ways

Starting a trading journey often requires more than knowledge—it requires capital. Yet many aspiring traders face the same challenge: how...

Read more