trading-education | 13-11-25

In the modern trading landscape, funded futures accounts—often known as proprietary trading challenges, offer retail traders the chance to access professional-level capital without risking personal funds. Instead of trading with their own savings, traders prove consistency through evaluations and receive funding upon passing.

What separates the best funded trading accounts is not only the profit split or payout policy but also how their rules fit different trading styles. Some emphasize flexibility, while others reward structure and long-term discipline. Understanding these distinctions helps traders choose a firm that complements their risk tolerance and trading approach.

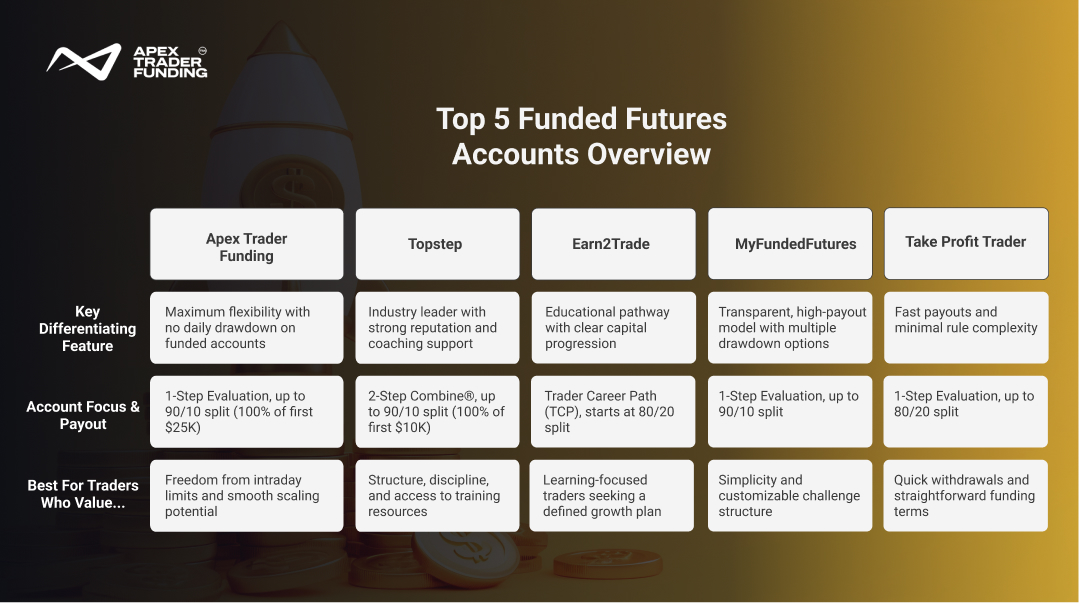

Top 5 Funded Trading Accounts at a Glance

Example: 150K Futures Prop Firm Challenge Comparison

The following comparison highlights how three major firms structure their $150,000 evaluation accounts—a popular choice among advanced futures traders. It helps illustrate how rule variations can affect strategy and risk tolerance.

1. Apex Trader Funding — Built for Flexibility

Apex has become one of the most trusted names among futures prop traders due to its rule simplicity and flexibility once funded. The platform allows traders to trade without the pressure of daily loss limits, making it appealing to active day traders who manage larger intraday swings.

Key Strengths:

- Drawdown Advantage: Uses a trailing threshold system instead of daily limits, letting traders recover within the same session.

- Evaluation Simplicity: A single-step challenge streamlines the path to funding.

- Scalability: Traders can trade the full contract limit of their account size immediately after funding.

In the popular $150K evaluation, Apex offers up to 17 standard or 170 micro contracts with a $5,000 intraday trailing drawdown. The lack of a daily loss limit provides unmatched flexibility, though the intraday trailing calculation means traders must manage unrealized profits carefully. This setup rewards confidence and quick adaptability while still maintaining discipline through the trailing balance rule.

This structure encourages confidence and adaptability while maintaining accountability through the trailing balance limit.

“Passing a challenge isn’t about luck or leverage; it’s about patience, self-control, and learning to perform under structure.”

2. Topstep — The Professional Standard

Topstep is widely recognized for setting the industry standard in futures prop trading. With over a decade of credibility, it has built a platform centered around trader discipline, risk management, and education.

Key Highlights:

- Two-Step Combine: Traders must demonstrate consistency across multiple phases, building resilience before accessing capital.

- Dual Drawdown Controls: Combines daily loss limits with trailing protection for structured discipline.

- Trader Development: Offers live coaching, performance analytics, and its own educational media content.

In the $150K Trading Combine, Topstep enforces a $3,000 daily loss limit and a $4,500 end-of-day trailing drawdown—a model that encourages intraday risk control without punishing normal market fluctuations. By updating the drawdown only after the trading day ends, traders get breathing room to manage positions during volatility.

Topstep is best suited for those seeking a professional, rule-driven environment that mirrors institutional trading expectations.

3. Earn2Trade — Education and Growth Combined

Earn2Trade stands out by blending education with opportunity. Its Trader Career Path (TCP) program allows gradual capital scaling from $25K up to $400K, making it ideal for traders developing long-term consistency.

Key Highlights:

- Fixed Drawdown: Reduces psychological pressure since the maximum loss remains constant instead of trailing.

- Education-First Model: Provides guided lessons, mentoring, and access to analytical tools like Journalytix.

- Progressive Funding: As traders hit milestones, their account size and earning potential expand.

In its $150K Gauntlet Mini™, Earn2Trade applies a $4,500 end-of-day trailing drawdown and a 15-day minimum trading period. The longer evaluation ensures consistent performance across multiple market conditions, aligning with the firm’s educational mission. Meanwhile, traders who progress to the TCP enjoy static drawdown protection, providing long-term stability as their funded accounts grow.

This model works particularly well for developing traders seeking structure, accountability, and a clear career framework.

4. MyFundedFutures — Streamlined and Transparent

MyFundedFutures is a newer but competitive player in the funded-account space, attracting attention with its high payout structure and transparent rule system.

Key Highlights:

- One-Step Evaluation: Traders can focus entirely on performance without navigating multi-phase requirements.

- Choice of Drawdown: Offers both Trailing and End-of-Day (EOD) drawdown options for different trading personalities.

- Payout Flexibility: Matches the highest industry splits with straightforward conditions.

Its simplicity and clarity appeal to traders who value direct terms and quick funding decisions.

5. Take Profit Trader — Fast and Efficient

Take Profit Trader prioritizes accessibility and speed. It’s designed for traders who want to move quickly from evaluation to live payout without unnecessary complexity.

Key Highlights:

- Rapid Payout System: No minimum trading days before withdrawal requests.

- Straightforward Rules: Focuses on clean, one-step evaluations with transparent guidelines.

- Retention Focus: Builds loyalty through fast processing and easy-to-understand account maintenance.

Take Profit Trader is ideal for active participants who prefer momentum, simplicity, and consistent cash flow.

Finding Your Fit in Funded Trading

Choosing the right funded trading account comes down to knowing your own trading style. Some traders do best in flexible programs that let them recover from drawdowns and trade freely through market swings. Others prefer structured setups with clear rules that encourage discipline and steady growth.

The goal isn’t just to pass an evaluation—it’s to find a firm that fits the way you think and trade. A good match helps you stay consistent, manage risk with confidence, and build habits that last beyond the challenge phase.

“A good prop firm doesn’t just fund your trades—it funds your discipline. The real profit comes from mastering the rules that protect your capital.”

Final Thoughts

The rise of futures prop firms has redefined how retail traders access professional-grade funding. Each of these top five firms caters to different needs—from structure and coaching to freedom and payout flexibility. By understanding their unique strengths, traders can choose a platform that not only funds them but also supports their growth as professionals.

Start exploring the path to your funded future today.

Visit Apex Trader Funding for flexible evaluations, or test your approach with a $25K Rithmic Account or $25K WealthCharts Account.

Use the “Copy” code to avail current discounts available and begin trading like a professional.

FAQs

No, you don’t need $25,000 to day trade futures. Unlike stock trading, futures accounts are regulated by margin requirements rather than the Pattern Day Trader (PDT) rule. Many brokers and prop firms allow traders to start with much smaller balances—or even trade funded evaluation accounts—where the firm provides the capital once you qualify.

A $100,000 prop firm account usually refers to the virtual capital you can trade after passing an evaluation, not the amount you pay upfront. Most firms charge a monthly evaluation fee—typically between $150 and $350—to access a $100K challenge. Once funded, you trade the firm’s capital and keep a share of the profits.

Most day traders fail because they lack a consistent trading plan, proper risk management, and emotional discipline. Many overtrade, chase quick profits, or trade without understanding market structure. Success in day trading comes from patience, strategy testing, and strict control over losses—not from constant action.

Related Blogs

trading-education | 22-08-25

What is a Funded Trading Account? - Detailed Guide

A funded trading account is a financial arrangement where a proprietary trading firm (like Apex) provides you with virtual or...

Read more

trading-education | 23-08-25

How Do Funded Trading Accounts Work?

A funded trading account works by granting a trader access to a firm's capital after they pass a simulated evaluation....

Read more

trading-education | 25-08-25

How to Get Funds for Trading? - 6 Practical Ways

Starting a trading journey often requires more than knowledge—it requires capital. Yet many aspiring traders face the same challenge: how...

Read more