trading-strategies | 09-02-26

Futures Trading is a financial derivative strategy defined by the simultaneous buying and selling of standardized contracts on a centralized exchange to speculate on asset prices without physical ownership. Active retail traders and institutions primarily use it to achieve high capital efficiency and transparent execution free from broker conflicts.

- Mechanism: Trades are executed on a centralized "lit" market (like the CME) where all participants see the same price and volume, eliminating the "dark pools" found in equities.

- Critical Risk: Notional Value Leverage. While margin requirements are low, the total asset value controlled is massive; a 1% move against a highly leveraged position can liquidate an entire account instantly.

- Strategic Verdict: Futures are the superior choice for high-frequency scalpers due to tax benefits and tight spreads, while traditional stocks remain safer and cheaper for swing traders holding positions for weeks.

In my one decade on trading desks, I have found that most retail traders fail not because their technical analysis is wrong, but because they are trading the wrong instrument for their time horizon. When I discuss the benefits of futures trading, I am not talking about the profit potential—I am talking about the structural fairness of the game board.

The stock market is often a fragmented maze of "dark pools" and payment for order flow (PFOF), where your order might be shopped around before it fills. Futures offer a cleaner alternative: a centralized, transparent arena where a retail trader in Ohio sees the exact same price as a hedge fund in London. However, this transparency comes with a cost: pure, unadulterated leverage.

In this analysis, I will break down the structural mechanics that make futures a scalper's paradise, while honestly exposing the daily "bleed" that punishes long-term holders.

The "Capital Efficiency": How does Futures vs Stocks Leverage actually compare? (Leverage)

Futures leverage utilizes a performance bond (SPAN margin) to control high notional value with minimal cash, typically offering 20:1 efficiency. In contrast, stock leverage is governed by Regulation T, a rigid loan structure requiring 50% initial capital (2:1 leverage), which significantly limits a trader's liquidity and scaling potential.

When I trade stocks, the rules are restrictive. If I want to buy $100,000 worth of Apple stock, Regulation T requires me to put up at least $50,000 (2:1 leverage). This traps a significant portion of my liquidity.

Capital efficiency in futures trading is a completely different beast.

- The Multiplier Effect: A single E-mini S&P 500 contract might control $250,000 of the index. To open this position, the exchange might only require a "performance bond" (margin) of $12,000. This is roughly 20:1 leverage.

- Micro Contracts: For smaller accounts, I can trade a Micro E-mini, controlling $25,000 of the index for as little as $1,000 in margin.

This efficiency allows me to diversify. I can trade Oil, Gold, and the Nasdaq simultaneously with a $20,000 account—a feat that would require $200,000+ in a traditional stock brokerage.

Market Data Snapshot (February 6, 2026)

Practitioner’s Note: "Following the volatility re-pricing on January 8, 2026, the CME Group adjusted maintenance margins across equity indices to account for increased ATR (Average True Range). If you are trading on a thin account, these 'Delta' shifts are more dangerous than the price movement itself, as they can trigger a liquidation even if your trade is in profit."

Operational Reality: The "Lit" Market vs. The PFOF Trap

One of the most immediate shifts I notice when switching from equities to futures is the clarity of the DOM (Depth of Market). In futures, what you see is largely what you get.

- Market Model: Centralized Exchange (e.g., CME). All orders route to a single Central Limit Order Book (CLOB).

- Counterparty: The Clearing House. They guarantee the trade. I am not fighting my broker; the exchange is a neutral venue that only wants volume.

- Transparency: Absolute Level 2 data (real-time data feed).

What is the difference between MBP and MBO data?

Market By Price (MBP) aggregates total order volume at specific price levels, while Market By Order (MBO) provides individual order granularity. MBO allows traders to identify specific order sizes and their exact position within the FIFO queue, offering a transparent view of institutional "resting" liquidity.

Using a pro-feed like Rithmic or CQG to access MBO data isn't just about technical jargon—it's about seeing 'Iceberg' orders that MBP hides. It’s the difference between guessing where a market might turn and seeing the actual 'brick wall' of institutional orders waiting to be filled. For a scalper, this data is the only way to avoid being the liquidity for someone else's exit.

The Professional Futures Technical Stack

To ensure "Lit" market execution, your setup must integrate three distinct entities. Here is the stack I use to maintain an edge:

Practitioner's Note: "Most beginners confuse their platform with their data provider. In my experience, choosing a high-performance protocol like Rithmic is more important for a scalper than the aesthetic of the platform itself. It’s the difference between seeing a price move and actually being able to execute on it before the 'queue' shifts."

Does the Pattern Day Trader (PDT) Rule apply to futures?

No, the Pattern Day Trader (PDT) Rule does not apply to futures trading. Unlike the FINRA/SEC requirements for equities, which require a minimum account balance of $25,000 for frequent day trading, futures traders can execute unlimited daily trades as long as they meet the specific exchange margin requirements for their chosen contracts.

I have consistently seen retail traders migrate to the CME Group markets specifically to escape the PDT "trap." From a risk management perspective, the lack of PDT allows you to exit a losing position immediately without fear of a "day trade strike," which is a structural safety advantage often overlooked. However, in my experience, this freedom requires stricter self-imposed discipline; just because you can trade 100 times a day on a $5,000 account doesn't mean you should. I always advise my students to use the CME’s micro-margin levels to practice execution before scaling.

Expert Insight: Why I Switched to ES Futures for Scalping

"The difference isn't just the leverage; it's the transparency of the Central Limit Order Book (CLOB). When I scalped the SPY ETF, my fills often felt 'ghosted' by dark pools or Payment for Order Flow (PFOF) redirects.

For instance, during the 2024 volatility spikes, I noticed that SPY spreads widened significantly more than the ES basis. While the ETF was 'gapping' through pennies, the ES maintained its thick liquidity at every tick. This is exactly why I prefer the latter for high-speed exits; in a 'lit' market, the execution is a mathematical certainty, not a broker's discretion.

In contrast, trading ES (E-mini S&P 500) through a direct Rithmic or Tradovate feed means the liquidity is visible on the DOM (Depth of Market). I can see the actual resting orders at each tick. When I place a limit order, I know exactly where I am in the FIFO (First-In, First-Out) queue. For a high-frequency scalper, that visibility is the difference between a 'scratch' trade and a winning one."

The Operational Cost of "Lit" Markets

However, this professional data feed isn't free. In stocks, most brokers give you "real-time" data for free or a nominal fee. In futures, because the data is coming directly from the CME or CBOT, I have to pay monthly exchange fees.

- Top of Book: ~$10/month per exchange.

- Market Depth (Level 2): ~$30-$120/month depending on the provider.

- Platform Fees: Many professional futures platforms charge a monthly subscription.

Strategic Context: Taxes and Time

What are the tax advantages of futures vs stocks (60/40 rule)?

Under IRS Section 1256, futures contracts are taxed using a 60/40 rule: 60% of capital gains are taxed at the lower long-term rate (max 20%) and 40% at the short-term rate, regardless of the holding period. This provides a significantly lower effective tax rate for day traders compared to equities, which are taxed at 100% short-term rates.

This is a massive advantage for high-frequency traders. In stocks, if I hold a position for less than a year (which encompasses 100% of day trades), every dollar of profit is taxed at my highest ordinary income bracket—potentially 37% or more.

With the 60/40 rule in futures, even if I hold a trade for five seconds, 60% of that profit is taxed at the lower long-term capital gains rate (currently capped at 20% for most). Over a year of profitable trading, this can result in thousands of dollars of retained earnings compared to an identical performance in stocks.

24/6 Global Access

The stock market opens at 9:30 AM ET and closes at 4:00 PM ET. If a geopolitical event happens at 2:00 AM, my stock portfolio is frozen, and I face massive "gap risk" at the next open.

Futures trade nearly 24 hours a day, from Sunday evening to Friday afternoon.

- Hedging: If news breaks in Europe, I can hedge my exposure instantly using equity index futures.

- Flexibility: I can trade the Asian session or the London Open if my schedule doesn't permit trading the US morning session.

Is futures trading riskier than stocks?

Futures trading is structurally safer due to clearing house guarantees and oversight by the National Futures Association (NFA), but it is functionally riskier for retail traders due to the deceptive power of high leverage and notional value exposure.

While the leverage in futures can be a 'double-edged sword,' the structural integrity is arguably superior to the fragmented stock market. As an active trader, I place high value on the fact that all US-based futures brokers must be NFA Members, which mandates strict capital requirements and the segregation of customer funds. This means that even if a broker faces financial distress, your trading capital is legally protected from the firm's operational liabilities—a safeguard enforced by NFA Compliance Rule 2-30 regarding risk disclosure and customer protection.

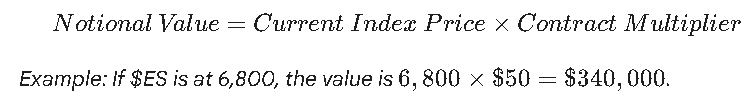

The Notional Value Trap: The risk in futures is not the instrument; it is the user's misunderstanding of Notional Value. When you trade one $ES contract, you are not just 'betting' $1,000; you are managing a $339,437 asset. Disrespecting this math is the #1 cause of retail account liquidation.

How to Calculate Notional Value:

The Cost of Holding: While futures dominate intraday, they punish swing traders. I always warn traders about the "Silent Killer": exchange data fees and the lack of dividend offset. Unlike stocks, where you are paid to wait via dividends, futures require a monthly "subscription" to the market data feed.

The Cost of Exposure (3-Day Hold)

Expert Insight: Managing the Double-Edged Sword

In my experience, the only way to survive the transition to futures is to ignore the margin requirement and focus entirely on Notional Value. When I trade a contract, I don't look at the $500 margin in my account; I look at the $25,000 of stock I am controlling. I force myself to calculate my stop loss in dollars, not ticks. If I cannot afford to lose 2% of the Notional Value, I am trading too big, regardless of what the broker allows me to do.

- The Catch: Futures contracts have expiration dates. Unlike buying a stock like Apple which you can hold forever, a futures contract will eventually expire. If you are holding long-term, you must "roll" the contract, which incurs transaction costs and potential "Contango bleed" if the future price is higher than the spot price.

Final Thoughts

The benefits of futures trading, like tax efficiency, massive leverage, and a fair playing field, make it the superior choice for active, short-term speculation. It strips away the conflicts of interest found in the stock market's plumbing.

However, this structural edge requires discipline. The same leverage that allows you to bypass the Pattern Day Trader Rule can liquidate your account in minutes if you disrespect the notional value. Use futures to snipe intraday volatility; use stocks to build long-term wealth. Know the difference, and you will survive the game.

Explore a futures evaluation that matches your approach. Check out the official Apex Trader Funding site and choose account options like the 25K Tradovate or 50K Rithmic to leverage institutional buying power without exposing your personal savings to notional market risk.

FAQs

The 80% rule in futures trading states that if the price enters and maintains a position within the previous session's Value Area for two consecutive 30-minute periods, there is an 80% probability it will trade through the entire range to the opposite side. This Market Profile setup relies on centralized pricing to identify areas of fair value. While the rule offers high-probability mean reversion entries, its success depends on the market’s transition from balance to imbalance. Which timeframe or contract you use depends on your account size and the specific liquidity profile of the instrument.

Buying futures instead of stocks provides superior capital efficiency through SPAN margin and enhanced tax treatment under IRS Section 1256. Futures offer centralized pricing on a single exchange and high notional leverage without the restrictions of the Pattern Day Trader (PDT) rule, whereas stocks provide dividend ownership and lower carrying costs for long-term holds. Whether you choose futures or stocks depends on your specific requirement for intraday liquidity, tax optimization, or long-term portfolio growth.

Related Blogs

trading-strategies | 27-08-25

How Do Funded Trading Accounts Make Money?

The idea of trading with someone else’s capital has opened doors for thousands of aspiring market participants. Funded trading accounts...

Read more

trading-strategies | 11-09-25

What is a Prop Firm Challenge? - Everything You Need to Know

A prop firm challenge is a two-phase simulated evaluation where a trader must reach a profit target (typically 8–10%) without...

Read more

trading-strategies | 03-10-25

7 Best Prop Trading Firms in Mexico in 2026

Trading in Mexico has evolved into more than just a search for market opportunities — it has become a test...

Read more