trading-education | 22-01-26

Order flow analysis is a method of tracking the real-time aggression of buyers and sellers. It focuses on the actual executed volume rather than just price action. Professional traders use this to validate moves and find 'trapped' traders. While standard charts show you where the price has been, order flow shows you why it is moving. This precision allows for better timing and clearer entry signals.

- Mechanism: It dissects the "tape" (Time & Sales) and Depth of Market (DOM) to visualize exactly how many aggressive market orders are consuming passive limit orders at specific price levels.

- Critical Risk: The "Liquidity Trap." Beginners often mistake large limit orders on the DOM for genuine support, falling victim to "spoofing" where institutional algorithms pull these orders milliseconds before execution, causing slippage and immediate losses.

- Strategic Verdict: This is the only form of analysis that reveals why price is moving. It is essential for scalping and intraday positioning but requires high-speed data feeds and significant screen time to master.

Introduction

If you have ever bought a breakout that immediately reversed and stopped you out, you have likely been the victim of order flow mechanics. Order flow analysis is the study of the interaction between liquidity providers (passive limit orders) and liquidity takers (aggressive market orders).

While traditional technical analysis looks at historical footprints—where price was—order flow analysis shows you the market's intent and aggression right now. In my past few years on trading desks, I have learned that the "chart" is often just a map of the past, whereas the order flow is the engine driving the future.

In this guide, I will deconstruct how to read this engine using tools like the Footprint Chart, interpret Cumulative Delta, and avoid the common traps that drain retail accounts.

What Is Order Flow Analysis?

Order flow analysis is a trading methodology that tracks the aggressive execution of buy and sell orders in real-time to identify market direction. Unlike technical analysis, which studies past price, order flow visualizes the volume delta (aggression) and liquidity (limit orders) inside every candlestick.

- Primary Tool: Footprint Charts and Depth of Market (DOM).

- Best For: Scalping and verifying breakout entries.

- Key Metric: Cumulative Volume Delta.

The most common misconception I see among beginners is the belief that price moves because there are "more buyers than sellers." This is technically impossible; for every contract bought, one must be sold. Price moves because one side is more aggressive.

When I look at a market moving up, I am not looking for "more buyers." I am looking for buyers who are willing to "lift the offer" (buy at the asking price) aggressively enough to consume all the passive sellers sitting on the limit order book. If that aggression isn't there, the price will not hold, regardless of what a moving average says.

Essential Tools for Order Flow Analysis

To see this activity, I cannot rely on standard candlesticks. I use specific visualization tools that render the data inside the candle.

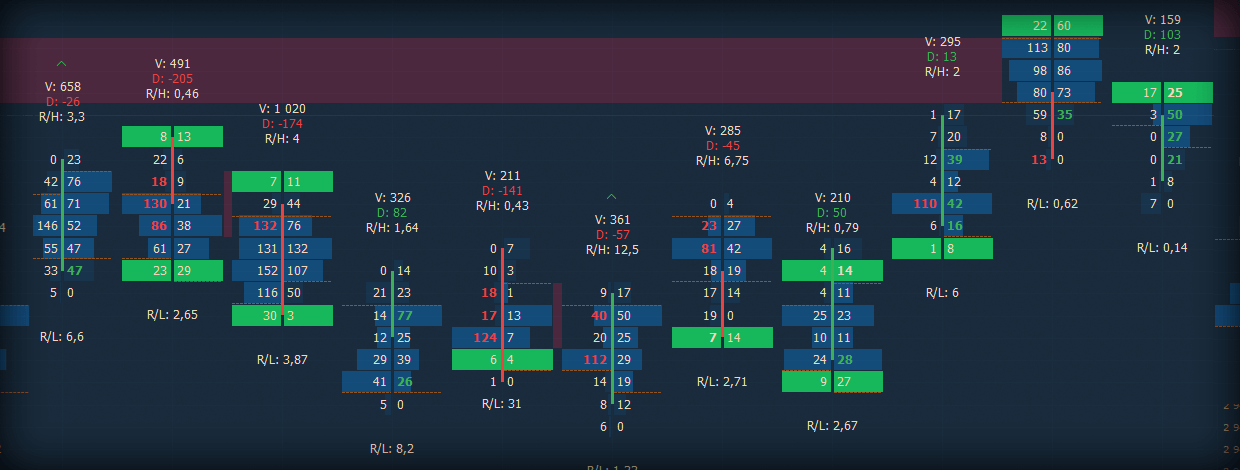

For the Footprint Chart Section example

https://www.quantower.com/blog/imbalance-footprint-chart-and-rithmic-plugin

1. The Footprint Chart

The Footprint Chart (or cluster chart) is my primary tool. It splits a standard candlestick open to reveal the volume traded at every specific price tick. Instead of just seeing an Open, High, Low, and Close, I can see exactly how many contracts were bought at the ask versus sold at the bid inside the candle.

For example, if I see zero volume traded at the very top of a green candle, it tells me there is 'unfinished business.' The market is likely to revisit that level to complete the auction.

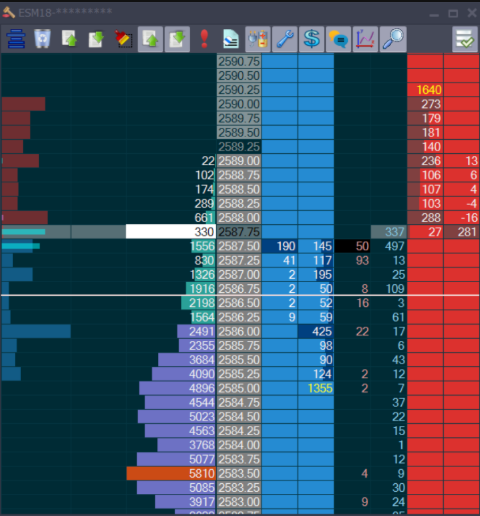

For the Depth of Market (DOM) Section example

https://www.jigsawtrading.com/trading-software/

2. The Depth of Market (DOM)

The DOM displays the limit orders waiting to be filled. This is the "advertised" inventory. However, I always treat the DOM with skepticism. Large orders here are often "spoofed"—placed to create the illusion of support to bait retail traders into buying, only to be pulled away instantly.

Pro Tip: Context matters. In the S&P 500 E-mini (ES), a 'large' order on the DOM is typically considered 100+ contracts during the US session. Anything showing <10 contracts is usually just retail noise. Knowing the difference prevents you from reacting to insignificant orders.

3. Volume Profile

While the Footprint shows me the "now," the Volume Profile shows me the "context." It displays the total volume traded at each price level over the entire session. I use this to identify the Point of Control (POC)—the price level with the highest volume. This acts as a magnet; trading away from the POC is often a low-probability "chop," while trading back toward it offers higher conviction.

How Does Delta Divergence Work?

Delta divergence works by comparing the direction of price movement with the net aggression of buyers and sellers; if price makes a new high but Delta makes a lower high, it signals that the buyers are exhausted. This is one of the most reliable reversal signals I use.

How to Spot Delta Divergence (Step-by-Step): Delta divergence is a reversal signal that occurs when the price makes a new high, but aggressive buying volume decreases.

- Identify the High: Wait for price to push to a new daily high (e.g., ES at 4500).

- Check Cumulative Delta: Look at the Delta pane. If the Delta line fails to make a new high while the price does, divergence is confirmed.

- Confirm Absorption: Watch the Footprint chart for high volume at the top of the candle with zero price progress.

- Execute Short: Enter on the break of the previous candle's low.

Expert Insight:

When configuring my delta divergence indicator settings, I don't look for minor discrepancies. I look for massive anomalies. If the price grinds up 10 points but Delta is flat or negative, that is the "smoking gun." I treat this as a bluff. The market is trying to lure in late buyers before "puking" (a rapid sell-off).

Operational Reality: The "Traps" of the Trade

Key Specs:

- Trap Frequency: High in low-liquidity environments (e.g., pre-market, lunch hour).

- Key Pattern: Absorption (High volume, zero price displacement).

- Cost: "Tick" slippage is common if using market orders in thin books.

In the reality of a trading desk, we don't use formal academic language. We use slang that describes the violence of the auction.

- "Lifting the Offer": This means aggressive buying. If I say, "Gold is ripping, they are lifting the offer at 2050," it means buyers are frantically hitting market buy orders.

- "Sweeping the Book": This is when a large order consumes liquidity across multiple price levels in one go. It usually leaves a "thin" area on the chart that the price will likely retest.

The Absorption Trap

A critical order flow absorption trading strategy involves spotting when an immovable object meets an unstoppable force.

I often see a massive amount of aggressive selling hitting the bid—thousands of contracts sold—yet the price does not tick down. This is absorption. A large passive buyer (an "iceberg" order) is soaking up all the selling pressure. Once the sellers realize the floor isn't breaking, they panic and cover their shorts, driving the price up.

Voice of the Trader:

“The tape doesn't lie, but it moves fast. Verified users often report that the hardest part isn't reading the numbers; it's the mental fatigue of watching the DOM for hours. You can be right about the direction but get shaken out by a stop-run in seconds.”

Common Mistakes vs. Professional Fixes

This table outlines the specific failure points identified in forensic research regarding order flow usage.

Why Do Professionals Rely on This Data?

Professionals rely on order flow data because it is the only risk management tool that quantifies "conviction" rather than just price history.

When I enter a trade, I am not guessing if support will hold; I am watching the orders hit that support level live. If I see selling dry up (volume decreases) and buyers step in (lifting the offer), I have objective proof to stay in the trade.

The Catch:

The friction point here, as noted in the research, is Analysis Paralysis. The data feed is incredibly fast. You will see thousands of numbers flashing per minute. If you try to analyze every single tick, you will freeze. Professional traders filter this noise by focusing only on key areas—like the Volume Profile Point of Control (POC) or the daily High/Low.

Final Thoughts

Order flow analysis is the closest you can get to X-ray vision in the markets. It moves you from a game of "guessing patterns" to a business of "reading intent."

However, it demands respect. The speed of the data can lead to over-trading and emotional burnout if you do not have rigid rules. Start by mastering one element—like the Footprint Chart or Cumulative Delta—and observing how price reacts at key levels. Do not try to read the entire tape at once.

To accurately spot "absorption" and "delta divergence" in real-time, you need the high-speed infrastructure that standard setups often lack. Visit the official Apex Trader Funding site and select plans like the 25K Rithmic or 50K Tradovate to secure the robust data feeds required for tick-level precision.

FAQs

Order flow is calculated by measuring Volume Delta, which is the net difference between aggressive market buy orders executed at the Ask and aggressive sell orders executed at the Bid. Unlike standard price analysis, this method dissects Time & Sales data to visualize real-time participant aggression, typically represented through Footprint Charts or Cumulative Delta indicators. Accurate calculation relies on high-speed Level 2 data and is essential for determining whether buyers or sellers control the immediate auction.

The most effective indicators for order flow are the Footprint Chart and Cumulative Volume Delta (CVD). The Footprint Chart visualizes executed volume at specific price ticks to reveal "imbalances" and "absorption," while CVD tracks the net aggression of buyers versus sellers to identify trend exhaustion. Which tool you prioritize depends on whether you require granular tick-level entry precision or broader confirmation of market direction.

Order flow trading is profitable for experienced traders who leverage market microstructure to identify institutional buying and selling pressure before price moves. This method provides a distinct advantage over lagging technical analysis by revealing liquidity absorption and precise entry levels within the order book. Profitability, however, is contingent on access to low-latency Level 2 data and is best suited for high-frequency scalpers rather than passive investors.

Order flow analysis is primarily used by proprietary trading firms, institutional desks, and professional retail scalpers who require immediate validation of market sentiment. These participants rely on Level 2 data and Depth of Market (DOM) tools to visualize institutional liquidity and absorption, enabling them to react to aggressive buying or selling before it reflects on standard price charts. Consequently, this methodology is essential for high-frequency, short-term strategies rather than long-term investing.

Related Blogs

trading-education | 22-08-25

What is a Funded Trading Account? - Detailed Guide

A funded trading account is a financial arrangement where a proprietary trading firm (like Apex) provides you with virtual or...

Read more

trading-education | 23-08-25

How Do Funded Trading Accounts Work?

A funded trading account works by granting a trader access to a firm's capital after they pass a simulated evaluation....

Read more

trading-education | 25-08-25

How to Get Funds for Trading? - 6 Practical Ways

Starting a trading journey often requires more than knowledge—it requires capital. Yet many aspiring traders face the same challenge: how...

Read more