trading-education | 03-11-25

Instant Funding vs. Structured Evaluations: The 2026 Choice

Instant funding prop firms provide immediate capital access for a higher upfront fee, bypassing evaluations for traders with proven strategies. In contrast, structured firms like Apex and FTMO use a one- or two-phase verification process to filter for risk management. In 2026, structured models remain the choice for long-term scaling, while instant models are preferred for immediate cash flow.

The prop trading world has evolved into two distinct paths for traders seeking capital—instant funding firms that promise quick access to live accounts and structured prop firms that require skill verification before funding. Instant models attract traders with their speed and simplicity, while structured firms focus on measured growth and skill development. Both approaches have merit, but the real difference lies in sustainability.

Instant funding prop firms have gained enormous attention among traders seeking quick access to capital. They promise funded accounts in hours, letting traders bypass lengthy evaluations and start trading live almost immediately.

This “skip the challenge” model appeals to those eager to prove themselves fast. Yet, beneath that convenience lies a critical question—does skipping structure really build success?

“Instant funding prop firms promise capital in hours—but without performance vetting, traders often pay for speed at the cost of sustainability.”

Before diving into the educational side, it’s worth understanding which prop firms are shaping this growing niche. The following are among the most recognized instant or near-instant funding programs available today.

While each firm varies slightly, they share a common theme: fast entry to trading capital. For skilled traders who already have a strategy and discipline, this model can feel efficient. However, for newer traders, instant funding often removes the guardrails that protect against early mistakes.

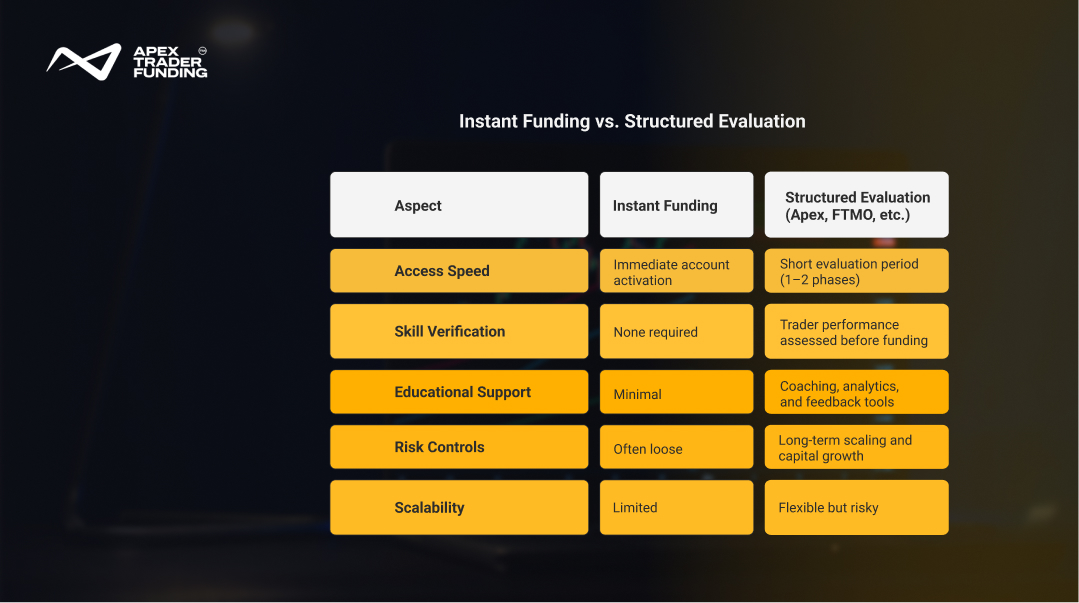

Instant Funding vs. Structured Evaluation

This comparison shows why structured firms continue to dominate the professional space—they don’t just give traders capital; they teach them how to keep it.

Expert Insight: The 2026 "Hard Consistency" Audit

In 2026, the primary risk of "No-Evaluation" firms isn't just the higher upfront cost—it's the Hard Consistency Audit. Because these firms skip the initial performance vetting, they often enforce aggressive payout rules during the live phase.

The 25% Rule: Many instant firms now mandate that no single trading day can exceed 25% of your total profit at the time of a withdrawal request. For example, if you make a "windfall" profit of $2,500 on a $10,000 account, you cannot withdraw those funds until your total account profit reaches at least $10,000 ($2,500 ÷ 0.25). This means "getting funded" is easy, but "getting paid" remains the true challenge for those without a stable, repeatable strategy.

The Hidden Risks of Instant Funding Prop Firms

Instant funding prop firms have undeniable appeal—but traders need to understand what’s being traded for that convenience. The following trade-offs often appear beneath the surface:

- No real skill assessment: Without an evaluation, traders jump directly into live trading without demonstrating consistency, risk control, or drawdown management.

- Limited payout consistency: Many instant funding programs reserve the right to revoke or delay payouts, especially if performance doesn’t meet hidden internal standards.

- Higher upfront costs: Traders pay a premium for skipping evaluation fees that are often higher than one-time evaluations at structured firms.

- Weak mentorship and education: Instant funding models rarely include coaching, analytics, or trader development programs. Once you buy in, you’re on your own.

- Unclear longevity: Firms that bypass accountability often struggle to sustain payouts long-term, leaving traders exposed to uncertainty.

From a trading-education standpoint, these risks highlight why beginners and even intermediate traders should view instant funding with caution. The short-term freedom can mask long-term instability.

Structured Evaluation Prop Firms

To understand the value of structured evaluation models, it helps to see them as the balanced counterpart to instant funding. Instead of focusing on speed, these firms prioritize trader development and accountability. Structured prop firms—like Apex Trader Funding and Topstep—fund traders who demonstrate consistency through clear, rule-based performance goals such as profit targets, drawdown limits, and daily loss controls.

This approach ensures that those who receive capital have already proven discipline, risk awareness, and adaptability under pressure. The evaluation isn’t a barrier—it’s a filter that builds skill and confidence through real-world trading conditions. In many ways, the process itself becomes the foundation for sustainable success.

“In trading, structure equals longevity. A single-step or performance-based evaluation is not a hurdle—it’s a safeguard.”

Firms that use structured evaluations align with the professional mindset found in institutional environments. The evaluation protects both the firm’s capital and the trader’s development, ensuring that funding isn’t just fast—it’s earned and sustainable.

Structured Evaluation Models That Build Real Traders

While instant funding prioritizes speed, structured funding focuses on growth, education, and discipline. The following firms exemplify evaluation models that balance accessibility with accountability:

- Apex Trader Funding – Offers a one-step evaluation designed for Futures traders. Once traders reach their profit target while respecting daily loss limits, accounts are funded within hours. Apex integrates multiple professional platforms like Tradovate, Rithmic, and WealthCharts creating a complete ecosystem for both execution and education.

- FTMO – Known for its two-phase Challenge and Verification, FTMO helps traders refine discipline and risk management before going live. The firm also provides trading analytics, coaching resources, and performance feedback, making it one of the most educational environments in the forex space.

- FundedNext – Combines flexibility and structure through its one-phase and two-phase evaluation programs. Traders learn consistency by adhering to strict drawdown and profit-target rules, helping them progress at a steady pace rather than chasing fast payouts.

- Topstep – A pioneer in futures-funding evaluation, Topstep’s approach mirrors professional trading floors. Traders prove their skills using real market data while receiving access to mentorship, structured risk parameters, and consistent scaling plans.

Each of these firms demonstrates that true opportunity in prop trading doesn’t come from instant funding—it comes from verified performance. Structured models build accountability, and accountability builds traders who last.

The Right Funding Path for Serious Traders

Instant funding might get you capital faster, but structured evaluation models teach you how to manage it effectively. Prop trading isn’t about skipping steps; it’s about mastering them.

For beginners, the evaluation phase offers a safety net—a chance to make mistakes in a simulated environment before risking firm capital. For intermediate traders, it sharpens execution discipline and prevents over-trading, one of the most common causes of failure.

Structured prop firms provide the balance every serious trader needs:

- Real funding opportunities backed by transparent rules.

- Platform access for execution, analysis, and growth.

- Scalability based on performance, not payment.

By focusing on structure over speed, these firms prepare traders for what actually matters—long-term consistency. Instant funding might offer quick access, but structured funding builds the habits that sustain success.

Trade Smarter, Not Faster:

In the end, prop trading success isn’t measured by how quickly traders access capital, but by how effectively they manage it. Structured evaluations don’t slow progress—they protect it, ensuring that funding is earned, sustainable, and aligned with long-term trading discipline.

FAQs

Trusted prop firms are those that operate with transparent rules, consistent payouts, and structured evaluation models. Firms such as Apex Trader Funding, FTMO, Topstep, and FundedNext are widely regarded as reliable because they clearly outline their risk parameters, payout schedules, and trading conditions.

These firms prioritize trader education, provide verified funding after performance testing, and use established trading platforms like NinjaTrader, Tradovate, and MT5.

Instant funding prop firms are trading companies that provide traders with immediate access to live funded accounts—without requiring them to pass multi-phase evaluations or challenges. Instead of proving consistency first, traders pay an upfront fee to begin trading real capital right away. These firms attract traders who want fast access to markets, but they often come with higher costs, limited payout reliability, and minimal educational support.

Related Blogs

trading-education | 22-08-25

What is a Funded Trading Account? - Detailed Guide

A funded trading account is a financial arrangement where a proprietary trading firm (like Apex) provides you with virtual or...

Read more

trading-education | 23-08-25

How Do Funded Trading Accounts Work?

A funded trading account works by granting a trader access to a firm's capital after they pass a simulated evaluation....

Read more

trading-education | 25-08-25

How to Get Funds for Trading? - 6 Practical Ways

Starting a trading journey often requires more than knowledge—it requires capital. Yet many aspiring traders face the same challenge: how...

Read more