trading-inspiration | 23-06-25

Unlocking Potential: Apex Trader Funding’s Edge for Traders in Israel

In today’s evolving financial landscape, traders in Israel are increasingly seeking capital-efficient ways to scale their performance. Apex Trader Funding offers a compelling alternative to traditional brokerage models—allowing skilled individuals to prove their capabilities without risking personal funds. As a top-tier proprietary trader program, Apex provides structure, tools, and flexibility through its intuitive trading website and seamless integration with a leading online trading platform in Israel, for instance Rithmic . Recognized by many as one of the best prop firm options globally, Apex also supports traders with access to an online trading platform that empowers data-driven decision-making and efficient execution.

With market conditions becoming more volatile and competitive, more traders are turning to evaluation-based funding as a smarter path forward. Apex stands out by removing high entry costs and rewarding disciplined execution, not just short-term gains. This shift has empowered both beginners and seasoned traders in Israel to bypass capital constraints and focus on building consistent strategies. Whether you're looking to trade part-time or scale into a professional setup, Apex opens the door with a clear, rules-based model designed for long-term growth.

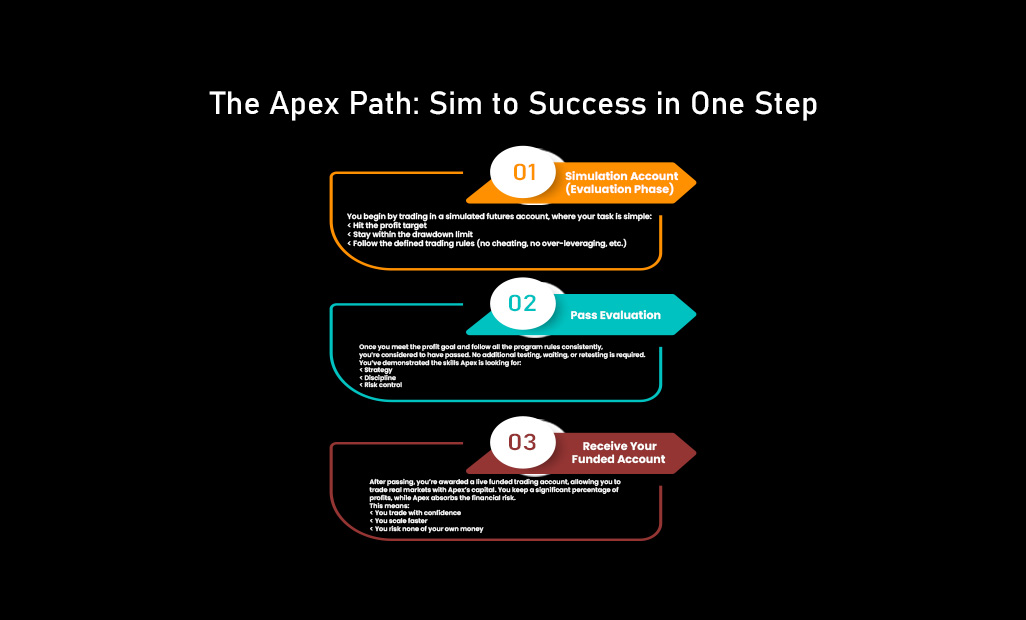

From simulated evaluations to real futures trading accounts, Apex’s model is performance-driven, rewarding traders who demonstrate discipline. Through this system, funding traders in Israel becomes not just possible but streamlined, thanks to clearly outlined expectations and transparent rules.

What Makes Apex a Game-Changer in Proprietary Trading

Apex isn’t just another prop firm—it changes how traders qualify for capital. Instead of requiring large deposits, Apex evaluates traders in a risk-free simulation. This model rewards skill, not wealth. Its transparent rules make it easy to know where you stand and what’s needed to succeed. For Israeli traders, this structure means a clear, measurable path to scaling without the burden of personal capital. Add in support for leading platforms and detailed metrics, and Apex becomes more than just accessible—it becomes a practical, professional alternative to traditional broker models.

Unlike traditional platforms that require large deposits, Apex prop firm allows traders to earn access to real capital through a rules-based simulation. Traders don’t need upfront investments—they simply need to pass the evaluation using tested strategies on supported trading platforms.

✅ Key Benefits of Apex Funding:

- Keep 100% of your first $25,000 in profit

- Transparent rules for drawdowns, consistency, and trading times

- Scale to 20 funded trading accounts

- Trade news events, holidays, and overnight freely

- Evaluation account sizes from $25K to $250K

By leveraging Apex Wealthcharts trader funding, participants also gain access to powerful data visualization tools, improving both backtesting and live decision-making.

💬 “It’s not about how much capital you have—it’s about how consistently you can perform.”

Aiming for the $250K Funded Account

Growing to a $250K account may feel distant—but Apex makes it achievable under its clear, simulated framework. Trade based on skill, not capital.

Highlights:

- Generous drawdown limits for varied strategies

- Apply an Apex coupon to reduce fees

- Execution simulation mirrors real trading

Once you pass, you’re officially Apex funded, managing live capital under transparent rules. Ideal for futures traders in Israel seeking to scale using the best trading platforms for prop evaluation.

Which prop firm has no daily loss limit?

Answer:

While many firms impose strict daily loss limits, Apex Trader Funding offers more flexible options depending on the evaluation account. Some plans allow a structured approach to Trailing Threshold limits, giving skilled traders more room to operate while still enforcing overall risk control. Always read the evaluation details before choosing your plan.

Achieving Consistency with Backtesting

Consistency comes from repetition and analysis. Apex’s supported platforms—like Tradovate and Rithmic—allow for deep backtesting, helping traders validate strategies in different market conditions. Backtesting isn’t just about finding a profitable setup; it’s about spotting weaknesses, testing stop-loss placements, and refining entries. For traders in Israel, this helps fine-tune strategies to fit market timing and instruments. With Apex encouraging data-backed planning, backtesting becomes a bridge between practice and performance—making it an essential step in passing the evaluation.

Backtesting is vital. It validates your strategy across different conditions and reveals performance trends over time.

Use it to:

- Track win/loss rates

- Align risk/reward expectations

- Test across trending, volatile, and calm markets

- Identify drawdown behavior

- Smooth out entry and exit timing

Apex supports platforms like NinjaTrader, the Rithmic trading platform, and the Tradovate trading platform to enhance backtesting and strategy refinement.

What are the best day trading tools?

The best day trading tools include charting platforms like TradingView and Apex Wealthcharts, execution platforms such as Rithmic trading platform or Tradovate trading platform, and journaling software to track performance. Apex Trader Funding supports integration with many of these tools, making it easier for traders to analyze markets, execute trades efficiently, and refine their strategy during evaluations.

Building an Evaluation-Ready Plan

A successful evaluation plan is built on more than strategy—it’s built on structure. Apex expects consistency in trade size, timing, and risk control, and that starts with planning. Traders should define clear entry/exit rules, know when to sit out, and set maximum drawdown buffers per week. Journaling each trade sharpens decision-making and helps spot psychological traps early. For Israeli traders managing time zone differences, incorporating specific trading hours into the plan is essential. Apex provides the flexibility to trade overnight and during news events—an advantage when used with intention. Preparing like a portfolio manager—not just a day trader—gives you a serious edge.

Passing Apex isn’t only about hitting targets—it’s about sustained, rule-based performance.

Your plan should include:

- Entry/exit rules from backtested logic

- Per-trade risk capped at 1–2%

- A plan for handling drawdowns

- Journaling each trade’s setup and mindset

Truly treat the process as a professional portfolio—not just a challenge.

How to pass funded trader challenge?

Answer:

To pass a funded trader challenge, follow a structured plan that includes backtested strategies, strict risk management (1–2% per trade), and consistent journaling. Apex emphasizes these fundamentals through its rule-based evaluation. Success is about discipline and consistency—not just market calls.

Simulation That Feels Real

The best preparation replicates real trading conditions—size, rules, instruments, and hours.

Simulation checklist:

- Match your target account tier

- Follow drawdown and daily loss rules

- Trade allowed assets and sessions

- Journal every session’s performance and mindset

Using a virtual trading platform, you build readiness for real-world trading.

Choose the Best Tier for Your Style

Each Apex evaluation tier caters to different risk appetites and trading styles. Newer traders might favor the $25K conservative plan to practice with minimal pressure, while experienced swing or breakout traders could gravitate toward the $100K or $250K tiers for more breathing room. For Israeli traders, the $50K and $100K tiers strike a useful balance—offering enough capital for strategic flexibility without being overwhelming. Apex doesn’t force one-size-fits-all solutions; it encourages self-awareness. Choosing a tier aligned with your strategy and trading rhythm can improve evaluation outcomes. Treat this decision like choosing a tool—it should support your strengths, not challenge your comfort zone.

Apex offers four evaluation tiers tailored to different approaches:

Pick the tier that aligns with your trading rhythm for smoother execution.

The Mindset Behind Passing Evaluations

Evaluation success isn’t just technical—it’s psychological. Traders who pass aren’t just skilled; they’re consistent, composed, and focused. It’s easy to deviate from a plan after a big loss or win, but Apex rewards those who follow the rules with discipline. For Israeli traders, where markets and schedules might differ, routines become even more important. Keeping a journal, reviewing trades, and planning sessions in advance builds the mindset needed to thrive not just in simulation—but in funded live trading.

Success in a funded challenge stems from strong mental control, not just technical precision.

Avoid these traps:

- Revenge trading

- Letting wins distort judgment

- Skipping stop-losses

- Shifting plans mid-session

Journaling, structured breaks, and emotional checks build resilience.

💬 “A cool mind consistently outperforms a fevered one.”

❓ How Hard Is It to Pass the Apex Trader Evaluation?

- Passing the Apex evaluation isn't inherently hard, but it does require strong discipline and consistency.

- Traders must follow specific rules, such as:

- Trailing drawdown limits

- Daily loss limits

- Consistent trade sizing

- Success hinges on following a structured plan and avoiding emotional trading.

- The challenge rewards controlled, methodical trading—not aggressive or impulsive moves.

- With preparation and focus, passing is achievable even for cautious traders.

Why Apex Beats Broker Accounts

Traditional brokers require upfront deposits, and losses are entirely yours. Apex flips that model—there’s no capital risk, and success is based on performance alone. For Israeli traders, this means a safer, more scalable route into the market. Beyond capital, Apex offers structure: clear rules, educational tools, and platform access that many brokers don’t match. Rather than trading solo, you’re operating with a framework built for growth.

Unlike regular stock trading platforms in Israel, which require deposits and charge commissions, Apex’s model offers funding based strictly on skill.

Pros over brokers:

- No personal capital risk

- Performance-based access

- Trade on major platforms

- Scale across multiple accounts

As a prop firm in Israel, Apex is redefining access to capital for disciplined traders.

“Capital alone doesn’t make a trader—structured funding models do.”

Stepped-Up Trial with a Coupon

Get started with a special discount:

✅ Apply Apex Trader Funding coupon code: COPY

📍 Redeem at: ApexTraderFunding.com

Start your evaluation with less expense and more opportunity.

Avoid These Common Pitfalls

Evaluations test routine and discipline more than setups.

Top Mistakes:

- Breaking drawdown limits

- Jumping between strategies

- Overleveraging after gains

- Neglecting performance reviews

Follow each rule—every session.

Why Apex Is Ideal for Israeli Traders

Apex offers a clear path for funded trader programs in Israel, including:

- No personal capital at risk

- Transparent rules and payouts

- Integrations via Apex Wealthcharts trader funding

- Clear steps into futures trading in Israel

“You don’t need a fortune to trade like a pro. You just need performance, rules, and Apex.”

Start Your Funded Journey Today

Steps to Begin:

- Visit ApexTraderFunding.com

- Choose a suitable account tier

- Enter coupon: COPY at checkout

- Embark on your journey as a funded trader in Israel

Related Blogs

trading-inspiration | 29-04-25

Apex Israel 2025: Elevate Your Trading with Capital, Tools, and Precision

Apex Israel 2025: Elevate Your Trading with Capital, Tools, and PrecisionIn 2025, proprietary trading continues to revolutionize how independent traders...

Read more

trading-strategies | 22-04-25

Apex Trader Funding: Redefining Futures Trading

In the dynamic world of futures trading, traders need access to the best tools, funding solutions, and support systems to...

Read more

trading-education | 29-04-25

Begin Your Trading Growth with Apex Funding in Israel

Begin Your Trading Growth with Apex Funding in IsraelIn today’s dynamic trading landscape, finding the right capital and platform is...

Read more