trading-tools-resources | 04-08-25

Success in futures trading depends not just on the size of your wins but on how effectively you manage your losses. One of the most important rules enforced by Apex Trader Funding is the Daily Loss Limit, a key risk parameter that shapes a trader’s ability to progress through evaluation and maintain a funded account. While many traders focus on their profit targets, overlooking the daily limit can result in unexpected account terminations—even after a solid performance streak.

This article breaks down how Apex’s Daily Loss Limit rule works, what strategies can help you stay compliant, and how emotional discipline fits into a trader’s daily routine. Whether you're just entering a funded trader program or actively managing a futures funded account, these techniques can help prevent avoidable setbacks and build long-term consistency especially when trading with tools like Rithmic or Tradovate through the Apex platform.

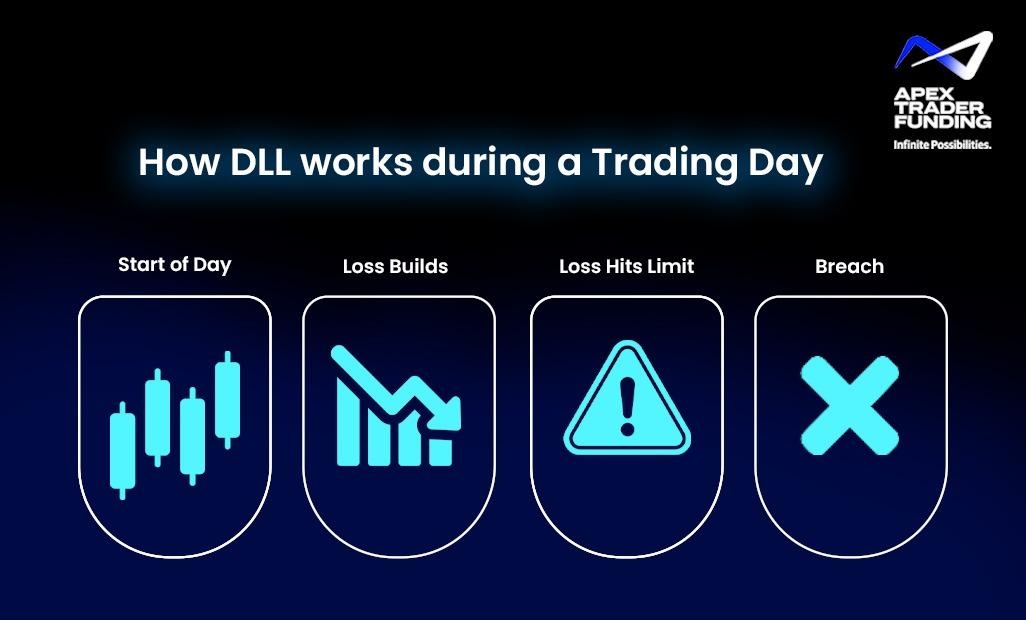

Daily Loss Limit 101: What Triggers a Breach?

The Daily Loss Limit (DLL) is a set monetary amount that you cannot exceed in realized or open losses during a single trading session. It starts the moment you place your first trade of the day. This rule applies whether you're using Apex's 25K-Tradovate, 50K-Rithmic, or WealthCharts evaluation accounts.

Here’s how it typically works:

- If you begin the day with $50,000 and your Daily Loss Limit is $1,100, your combined realized and unrealized losses for that day must not exceed that amount.

- The loss limit includes unrealized losses during open trades. If you breach it even once intraday, even if you later recover, you’ll fail the evaluation or violate your funded account agreement.

This risk threshold applies across futures prop firms, but Apex provides real-time tracking via its dashboard. Whether you're aiming for a funded futures account or working through one of Apex’s structured trader funding programs, staying within this limit is essential.

🔍 Key Facts About the Daily Loss Limit

- Starts the moment your first trade is executed

- Includes both realized and unrealized losses

- Automatically tracked on your Apex dashboard

- Breaching it results in account reset or disablement

Stay alert. Your daily threshold defines your trading lifespan.

📌FAQ: Once Active, How Does a PA Account Work?

- After passing your evaluation, you pay a one-time activation fee to enable your Performance Account (PA).

- You then trade using Apex’s capital, with access to real profit split payouts.

- Key rules still apply, including the Daily Loss Limit, Trailing Drawdown, and the End-of-Day Flat Rule.

- There’s no time limit to trade or request payouts, making Apex a flexible prop firm for growth.

- Violating rules can lead to suspension or account reset, so continued discipline is essential.

Top Reasons Traders Blow Their Day

Even skilled traders fall victim to the DLL rule—often not due to poor strategy, but preventable behavior patterns. Here are some of the most frequent causes:

- Overconfidence after early wins: Traders who start the day with a winning trade sometimes relax risk management, leading to overexposure in later trades.

- Revenge trading: After taking a hit, emotional traders may chase losses with larger positions, ignoring the DLL entirely

- Neglecting to use stop-loss automation: Traders who manage risk manually or hesitate to place stops are at higher risk of fast-moving losses.

- Failure to log or review previous daily performance: Without a log or journal, many traders repeat mistakes because they don't analyze their own patterns.

These issues are avoidable with tools offered by WealthCharts compatible prop firms India, such as visual performance dashboards and trade analytics. Apex enables traders in India and globally to self-audit through seamless WealthCharts integration with Rithmic India, promoting stronger habits in live trading scenarios. ⚠️ Most Common Reasons Traders Breach the DLL

- Chasing losses after a losing streak

- Scaling up too quickly after early wins

- Forgetting to use stop-loss automation

- Ignoring risk logs or performance patterns Emotional decisions turn small losses into failed evaluations.

Anticipating Loss: Planning Smart Around the Daily Limit

Instead of reacting to the Daily Loss Limit (DLL) after a mistake, smart traders plan around it before the session starts. This proactive mindset is key in maintaining funded futures accounts.

Here’s how to think ahead:

- Set a personal soft limit just below the actual DLL to avoid last-minute panic trades.

- Break up your risk across two or three setups instead of risking it all at once.

- Use platform tools whether in a Tradovate prop firm India account or Rithmic account to set alerts or lockouts before your limit hits.

- Practice scenarios in a NinjaTrader demo account to build awareness of how fast losses can escalate intraday.

When you treat the DLL as a planning tool—not just a restriction—you align better with the discipline proprietary trading firms expect.

Your Intraday Survival Kit: 5 Proven Strategies

Here are proven tactics to maintain control and stay within the daily boundary—especially useful in fast-moving futures markets:

1. Predefine Your Maximum Loss per Trade

Divide your Daily Loss Limit by 2 or 3 and cap each trade accordingly. For example, if your DLL is $1,100, limit each trade to $350–$500 risk. This ensures you have multiple attempts without risking the entire threshold on a single setup.

2. Use Automated Stop-Loss Orders

Platforms like Rithmic prop firms India and Tradovate prop firm India allow for bracket orders and preconfigured risk settings. Set your stop-loss in advance—don’t rely on mental exits. For traders prioritizing speed, low latency futures trading via Rithmic India ensures precision and faster execution—making it easier to stay ahead of risk breaches.

3. Set a Break Trigger Rule

If you take two consecutive losses, step away from the screen for at least 30 minutes. This avoids revenge trading and cools down your emotional temperature.

4. Log Your Intraday Breach Risk

Use a spreadsheet or platform notes to track how close you are to the limit after each trade. Apex’s live dashboard helps, but a manual log reinforces accountability.

5. Take Scheduled Micro Breaks

Set a timer to pause every 90 minutes. A mental reset can be the difference between making your next move with strategy or frustration.

Discipline Reminder "Protecting the account is the trade. The moment you chase recovery, you’re no longer trading—you’re reacting."

Mental Armor: Discipline as a Trading Edge

Apex’s risk parameters are more than technical boundaries—they’re designed to instill emotional regulation and forward-thinking. The Daily Loss Limit builds muscle memory for real-world performance, which is crucial when managing live capital.

If you're pursuing proprietary trading jobs in India futures, you’ll find that firms emphasize risk control more than trade frequency. Apex reinforces this with features that help you pause, review, and improve across multiple sessions.

For example, traders using NinjaTrader demo accounts alongside funded trading accounts can simulate stress-testing in a safe environment before going live. It's all part of preparing you for trading capital funding models that reward discipline over impulsiveness.

Mindset Tip “Your trading day doesn’t need to be dramatic to be profitable. Quiet consistency builds funded accounts—not big swings.”

Why This Rule Can End Your Session Instantly

The Daily Loss Limit might seem like a restriction, but it exists to keep you in the game. Apex doesn’t impose time limits on evaluations—a key advantage for those looking for a prop firm with no time limit option. But with that freedom comes the responsibility to protect each session’s capital.

While other proprietary trading firms might penalize smaller rule breaches harshly, Apex’s framework is designed to encourage accountability, not punishment. Violating the DLL resets your progress, but with tools, analytics, and flexible timelines, Apex helps you rebound smarter—not just faster.

Traders involved in futures prop trading in Mumbai or other Indian markets will appreciate Apex’s balance of structure and flexibility—especially when operating within the framework of SEBI futures trading regulations for prop firms. 🕒 Apex = Time Flexibility, Rule Discipline

- No minimum trading days

- No deadline pressure

- But every rule still applies Apex gives you space—but not room for sloppiness.

FAQ: If I violate a rule on my Apex funded account

Breaching a rule, including the Daily Loss Limit, will result in your account being disabled. If it's an evaluation account, you'll need to restart. For funded accounts, you may need to request a reset or review eligibility for reinstatement. Apex does not impose hidden penalties, and resets are affordable, keeping your prop trading account journey alive and manageable.

Account Breached? Here's What Follows

A DLL violation has immediate consequences:

- In an evaluation account: You’ll need to restart. Your trailing drawdown resets, and any prior profits are lost.

- In a funded account: Apex disables access. You may apply a reset or go through another funded trader program cycle, depending on your history.

The evaluation environment at Apex allows you to test these limits without the pressure of risking real capital. However, treating it as seriously as a live funded futures account is what builds professional-level habits. “A single undisciplined session can cost you a month of consistency.”

📌FAQ: What are the monthly recurring fees for Apex accounts?

Apex charges a small monthly fee for each paid evaluation or performance account. This recurring fee helps maintain access to the dashboard, data feed (like Rithmic or Tradovate), and funded account tools. Traders can manage billing directly through their account settings.

Picking the Right Account for Risk Control

Choosing the right evaluation size helps align your strategy with Apex’s rules:

- The 25K-Tradovate account has a smaller DLL—ideal for scalpers and tight setups. Start your 25K-Tradovate evaluation

- The 50K-Rithmic account offers more room and better loss flexibility for advanced traders. Sign up for the 50K-Rithmic challenge

- The 25K-WealthCharts account includes integration with Rithmic and performance analytics. Explore the 25K-WealthCharts evaluation

Each evaluation is part of Apex’s larger trader funding program that connects your performance to access to real funded trading accounts. If you're ready to get funded to trade, your choice of starting point matters.

“Choosing the right account size isn’t just strategy—it’s risk management before your first trade.”

FAQ: How Many Paid Accounts Am I Allowed?

- Apex allows traders to maintain up to 20 active paid accounts at once—this includes both evaluation and Performance Accounts (PA).

- You can scale each account independently, using different strategies or risk profiles based on your trading style.

- Accounts can be reset individually, allowing you to continue others unaffected.

- This flexibility makes it easier to build a diversified approach within Apex’s funded trader program, especially if you're managing multiple prop trading accounts.

Reset Less. Trade Smarter. Thrive Longer.

The Daily Loss Limit isn’t just a risk control mechanism it’s a training tool that prepares you for long-term success in proprietary trading firms. It reinforces one of the most important traits in professional trading: the ability to stop.

As you move from evaluation to live accounts, managing your day becomes less about excitement and more about execution. This is what separates those who consistently pass prop firm challenges from those who burn out early.

“Resetting is part of the journey—but learning why you reset is how you stop repeating it.”

FAQ: Key Trading Rules of Trader Funding

Trader funding programs across most prop firms follow a consistent set of rules designed to assess a trader’s risk control, consistency, and strategy discipline. Common rules include limits on daily losses, overall drawdowns, position sizing, and trade consistency. Many programs also require traders to be flat (no open positions) by the end of each trading day. These rules aren't arbitrary—they simulate real capital management environments, where protecting downside is just as important as generating returns. In the case of Apex Trader Funding, these principles are enforced through specific mechanisms like the Trailing Drawdown, Daily Loss Limit, and End-of-Day Flat Rule, all of which apply to both evaluation and funded accounts. The goal isn’t just to pass a challenge, but to prove you’re ready to manage a funded trading account with professional discipline.

Ready to Trade with Guardrails That Protect You?

Apex Trader Funding provides structure without limiting ambition. If you’re serious about qualifying for SEBI regulated prop firms in India, or simply want to build consistency in a low-risk environment, Apex offers one of the best futures prop firms models globally.

While firms like Take Profit Trader may offer reset promo codes, Apex frequently runs its own discounted reset offers and evaluation promotions directly through your trader portal. 🎁 Use COPY code to avail current discounts available on Apex Trader Funding

Related Blogs

trading-tools-resources | 18-09-25

5 Best Prop Trading Firms in India in 2026

The best prop trading firms in India for 2026 are Apex Trader Funding for futures access, Futures First for institutional-grade...

Read more

trading-tools-resources | 17-12-25

Is Day Trading Profitable in India? - Reality & Risks Explained

Day trading has become increasingly popular in India, especially as more people explore flexible income options, online market access, and...

Read more

trading-education | 19-04-25

A Fresh Approach to Day Trading in 2025

A Fresh Approach to Day Trading in 2025Day trading has emerged as a dynamic way to engage with the financial...

Read more