trading-education | 30-08-25

Funding for trading in India is available through MTF (Margin Trading Facility) via SEBI-registered brokers, private partnerships, or global Evaluation-based Prop Firms. Legally, individual traders must ensure compliance with SEBI’s 2026 Stock Broker Regulations for domestic prop-trading and FEMA/LRS guidelines for international accounts. Most Indian traders prefer "Evaluation Firms" because they limit personal liability to the entry fee while providing capital in USD.

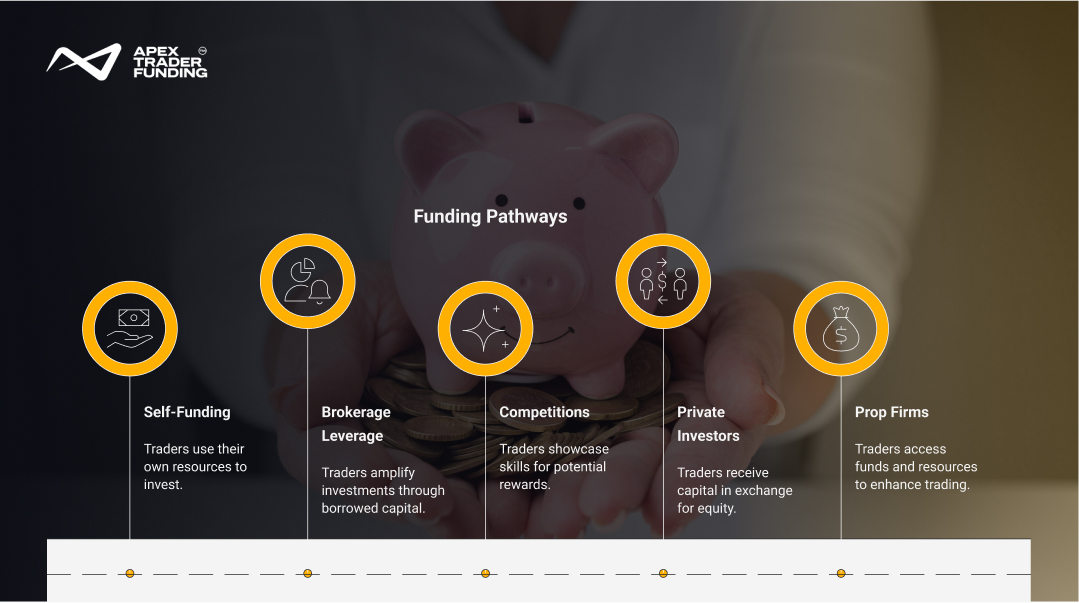

The lack of trading capital is a significant hurdle for many individual traders in India. Many have strategies, tools, and the ambition to participate in the market—but limited capital often holds them back. The good news is that traders today have multiple ways to secure funds, ranging from personal approaches to institutional opportunities. The right trading strategy depends on how much risk you can handle, the style of trading you prefer, and your ability to stick to a structured plan.

Personal Capital and Strategic Allocation

The most straightforward method is self-funding. Traders often start by setting aside a portion of their savings exclusively for trading. In India, where volatility in equities and derivatives is high, keeping trading money separate from essential finances is a vital discipline.

A strong self-funding strategy involves:

- Allocating only surplus funds, never emergency savings.

- Using budgeting apps to track progress.

- Limiting potential losses requires consistently maintaining a specific stop-loss percentage for every trade.

This approach may be slower, but it ensures control and independence without external obligations.

Your first investor is yourself—how you treat your savings shows how seriously you treat your trading.

Brokerage-Backed Leverage Options

Indian brokerages such as Zerodha, Upstox, and Angel One offer margin facilities that can multiply a trader’s capital for intraday trading. While not “funding” in the traditional sense, this leverage lets traders access larger positions and experiment with higher exposure.

Under the SEBI 2026 Framework, brokers can now allow securities funded through cash collateral as maintenance margin for the Margin Trading Facility (MTF). This allows you to leverage your existing portfolio to gain up to 4x buying power for swing trades, effectively 'funding' your growth without selling your long-term holdings.

The catch is that leverage must be used carefully. It should be applied only to high-confidence setups and avoided overnight, since margin calls can quickly erase smaller accounts. Treated as borrowed money, leverage can support disciplined traders as a stepping stone to bigger opportunities, but it should never replace strong risk control.

Competitions and Trading Challenges

Another overlooked avenue in India is trading competitions. NSE-backed contests or broker-organized challenges often reward consistent performance with capital credits, mentorship, or sponsorship.

Participating in such challenges helps traders:

- Gain visibility within trading communities.

- Build a verifiable track record.

- Practice strategies in high-pressure, time-bound environments.

Even if you don’t win, the experience can sharpen your approach and prepare you for more formal funding opportunities.

Private Investors and Partnerships

Some skilled traders in India raise funds through private investors—often family, friends, or professional networks. These partnerships usually work on a profit-sharing model, where the investor supplies capital and the trader manages positions.

To make this approach successful, professionalism is essential. Traders must establish clear contracts that outline risk limits, profit splits, and reporting timelines, while maintaining transparency through trade journals or regular performance updates. When handled responsibly, this route can unlock larger pools of capital, but without consistency and trust, such partnerships rarely last.

Trust is the true currency in investor partnerships; without it, capital doesn’t stay for long.

Proprietary Trading Firms in India

While less common than in the U.S. or Europe, proprietary trading opportunities are growing in India. Some global firms now accept Indian traders, offering access to capital in exchange for performance within defined rules.

Important factors shaping prop firm pathways for traders in India:

- You must pass an evaluation or challenge before gaining capital.

- Rules around drawdowns, profit targets, and consistency must be followed.

- Profits are shared between the trader and the firm, creating a partnership model.

This pathway is ideal for traders who want to scale beyond their personal savings while gaining exposure to professional standards.

The Legality of Global Prop Firms in India

A common question for Indian traders is: Is it legal to use firms like Apex? In 2026, the consensus is that paying an evaluation fee is a service fee permissible under the Liberalised Remittance Scheme (LRS), provided you are not remitting funds for the purpose of margin trading in prohibited pairs. Using firms that offer Futures Trading (via Rithmic or Tradovate) provides institutional transparency that personal offshore Forex accounts often lack.

Building a Funding Roadmap

The smartest approach to securing capital in India often combines multiple strategies:

- Start with self-funding to develop consistency.

- Use brokerage leverage responsibly for scaling intraday strategies.

- Participate in competitions to gain recognition and proof of skill.

- Approach private investors once you have a verifiable track record.

- Discover prop firms as a pathway to disciplined access to bigger trading capital.

This layered pathway reduces dependency on one funding source and increases long-term sustainability.

India Funding Source Comparison (2026)

Psychological Funding Strategy

Funding isn’t only about money—it’s also about managing your mental capital. In India’s fast-moving markets, mindset often decides whether external funds are used wisely or lost.

Key elements include:

- Patience: Focus on steady growth, not quick wins.

- Discipline: Stick to your plan under pressure.

- Resilience: Treat losses as lessons.

- Focus: Limit trades and avoid distractions.

Traders who strengthen these traits are far more likely to handle capital responsibly and attract long-term backing.

Final Thoughts

Getting funding for trading in India isn’t about luck—it’s about building trust, discipline, and a track record. Whether through your own savings, broker-provided leverage, competitions, or professional funding programs, the opportunities exist for those who can show consistency. The real challenge is not in finding money, but in proving you can handle it.

Ready to explore structured funding opportunities?

Platforms like Apex Trader Funding offer evaluation-based accounts that give traders access to real capital. You can start small with a 25K WealthCharts account or scale further with a 50K WealthCharts account, depending on your trading style.

FAQs

The starting capital you’ll need varies based on the trading style you choose. For stock delivery, even a few thousand rupees can be enough to start. In derivatives such as futures and options, margin requirements are higher, often starting from ₹10,000 to ₹50,000 depending on the contract and market conditions. An alternative for those who don’t want to commit large personal capital is joining a prop trading firm, where you pay an evaluation fee instead of depositing a big balance. Once qualified, you trade with the firm’s capital rather than your own savings.

Daily earnings from trading are highly unpredictable and depend on the style of trading, capital size, and market conditions. Traders operating smaller accounts often experience daily swings ranging from a few hundred to a few thousand rupees, whereas larger accounts can fluctuate by tens of thousands. Long-term traders, on the other hand, may not measure results daily at all, as their focus is on broader trends and sustained returns.

Most day traders spend 3 to 6 hours a day actively trading, typically during peak market hours when volatility is highest. In addition, they may invest 1–2 hours in preparation and reviewing trades. Many prefer to trade 3 to 5 days a week instead of all five, as constant exposure can lead to fatigue. The key is consistency and focus, not the sheer number of hours or days spent.

Related Blogs

trading-education | 19-04-25

A Fresh Approach to Day Trading in 2025

A Fresh Approach to Day Trading in 2025Day trading has emerged as a dynamic way to engage with the financial...

Read more

trading-education | 19-04-25

Accelerate Your Trading Goals with Apex Trader Funding’s Innovative One Day to Pass Feature

Accelerate Your Trading Goals with Apex Trader Funding’s Innovative One Day to Pass FeatureSuccess in trading depends on speed, precision,...

Read more

trading-education | 23-06-25

The Funded Path: Building Futures Trading Momentum with Apex in India

The Funded Path: Building Futures Trading Momentum with Apex in IndiaIn the dynamic world of futures trading, achieving long-term consistency...

Read more