trading-education | 01-08-25

Decoding the Trailing Drawdown: Your Roadmap to Funded Trading with Apex in Brazil

In the structured world of proprietary trading, understanding key risk controls is essential. Among these, the Trailing Drawdown stands out as one of the most critical rules for traders looking to secure funded futures accounts through Apex Trader Funding. Whether you’re preparing for your first prop firm evaluation or managing an active funded account, mastering this rule can make the difference between sustained success and forced resets.

This guide explores how the Apex trader trailing drawdown functions within Apex’s platform—including how it moves, when it stops, and how to trade effectively around it. Traders using Apex in Brazil can leverage this knowledge to navigate the platform’s trader assessment Brazil model and confidently work toward real funding.

Why the Live Trailing Threshold Defines Prop Firm Success

Apex Trader Funding operates differently from traditional brokerages. Instead of requiring personal capital to participate in futures trading, it provides access to funded accounts through a one-step evaluation process. This approach gives traders the opportunity to prove their trading consistency in Brazil without risking their own funds.

The live trailing threshold is a cornerstone of this system. Unlike static drawdown models used by some firms, Apex’s rule adjusts dynamically as your account reaches new highs, testing both your profitability and your prop trading risk management Brazil.

This is especially important for traders using Apex’s Rithmic challenges Brazil or Tradovate accounts, as it reflects a realistic trading environment. Apex’s rules are designed to support long-term growth—not just short-term gains—and the drawdown rule is a clear example of how discipline is rewarded.

Understanding the Trailing Drawdown Rule

The apex trailing drawdown is a flexible risk control feature that moves with your highest achieved equity, including unrealized profits. At the start of your evaluation, the drawdown is fixed a set amount below your starting balance. As your account climbs, so does the drawdown level, maintaining a constant margin that tests your ability to protect gains.

This rule is designed not to penalize profitable traders, but to encourage sustainable trading behavior. Apex uses this system to identify traders who not only make money—but also know how to preserve it. For example, the 25K-Rithmic evaluation account starts with a modest trailing drawdown, ideal for traders new to Apex’s platform. Start your 25K-Rithmic evaluation here.

“Discipline isn’t just a trait—it’s a trading edge. The trailing drawdown rewards those who protect capital as fiercely as they pursue gains.”

FAQ : What is the initial drawdown limit for evaluation accounts?

Apex evaluation accounts start with a trailing drawdown based on account size.

- For example:

- $25K account → ~$1,500

- $50K account → $2,500

- The drawdown follows your intraday equity high, including unrealized gains.

- Once the profit target is hit, the drawdown freezes and no longer trails.

- Managing this rule well proves your discipline and readiness to get funded to trade.

💡 Track your highest equity at all times—not just closed trades—to avoid unexpected breaches.

How the Trailing Drawdown Adjusts: A Real-Time Equity Tracker

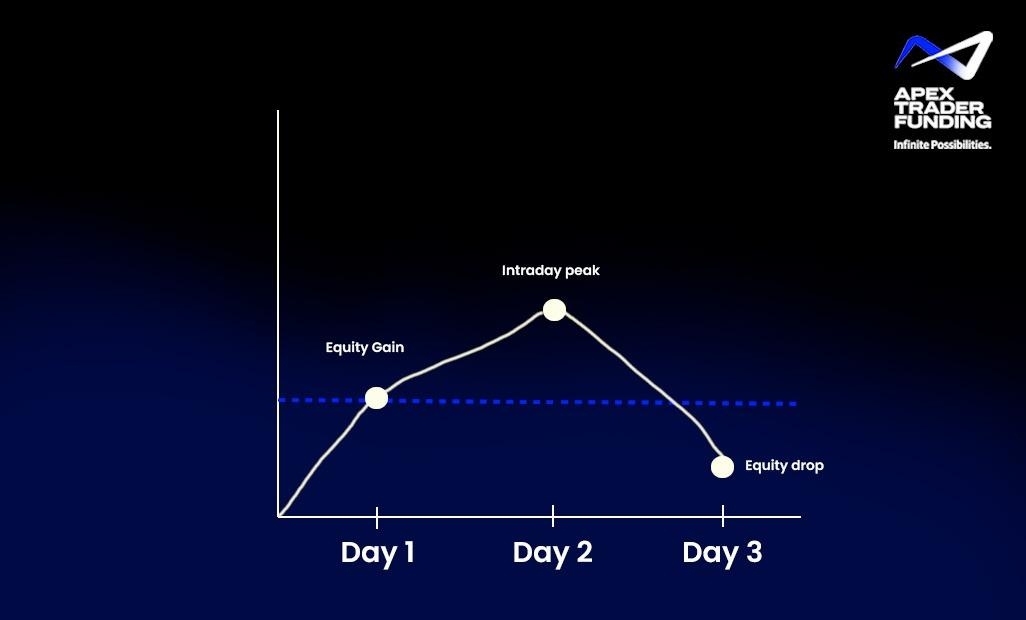

To illustrate, here’s an example based on Apex’s $50,000 Rithmic evaluation account with a $2,500 trailing drawdown:

📌 Important: Apex’s drawdown follows intraday highs, not just closed trade values. Even if profits haven’t been booked, the drawdown level increases when your equity peaks.

For traders using Rithmic performance metrics for prop firm challenges in Brazil, maintaining awareness of your real-time equity is critical. Apex’s interface provides visual performance tools, but manually tracking equity highs using a spreadsheet or journal adds an extra layer of control.

FAQ : Apex Trader Funding trailing drawdown explained

The Apex Trader Funding trailing drawdown is calculated using your intraday equity highs. If your balance peaks at $53,000, your drawdown follows up to $50,500. If you then drop to $49,800 without locking in profit, the account breaches. This reinforces strategic equity management in futures prop firms.

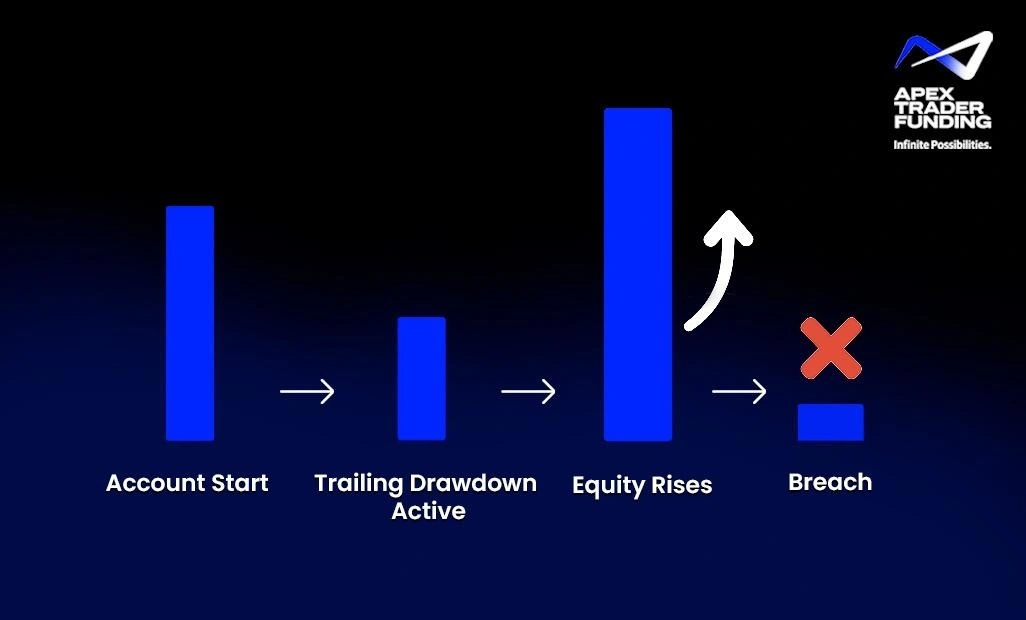

When Your Drawdown Freezes and What That Means for Traders

The apex trader funding rules state that the trailing drawdown continues to follow your highest balance until you hit the profit target. Once the target is reached, the drawdown freezes it no longer trails your equity and provides a static cushion for the rest of the evaluation.

This shift marks a major milestone. It signals to the Apex system that you’ve demonstrated the discipline needed to scale responsibly. From that point forward, your focus shifts from protection to performance.

Pro Tip: Apex does not impose time limits on evaluations. Use this flexibility to let your cushion grow before making riskier moves.

FAQ: What happens after you pass a funded challenge?

- Your trailing drawdown freezes and no longer moves with intraday equity.

- You’re granted access to a live funded account, trading with Apex’s capital.

- You can begin earning payouts based on Apex’s high profit split structure (up to 90%

- You’ll follow post-funding rules, which may differ slightly from evaluation rules—focusing more on consistency than hitting targets.

- Your focus shifts from passing to preserving and scaling profits sustainably.

Common Pitfalls That Lead to Trailing Drawdown Violations

Misunderstanding the trailing drawdown can lead to unexpected breaches. Here are a few key mistakes to avoid:

- Overleveraging early on:

Some traders aim to hit the target in a few trades. But without locking in profits, equity spikes can raise the drawdown too quickly—leading to premature account failures. - Confusing static with trailing drawdown:

Apex uses a live trailing threshold that includes floating profits. Some traders unfamiliar with this approach may assume only closed trades matter. - Not tracking equity highs:

Apex’s dashboard may not always show your exact high-water mark. Manually recording this can prevent surprises when nearing your trailing threshold.

📌 Drawdown Do’s and Don’ts

✅ Do track your equity high manually

✅ Do build a profit cushion before scaling

❌ Don’t assume your dashboard shows the full picture

❌ Don’t rush to hit your target in one trade

FAQ 4: How to pass the prop trading evaluation in São Paulo?

Whether you're trading from São Paulo or abroad, passing a prop firm challenge requires patience, risk control, and discipline. Build a profit cushion, avoid full-risk trades early, and track your high-water mark manually. These tips apply across all platforms, including Apex’s tradovate funded account and WealthCharts.

📝 **Evaluation Prep Checklist**

☑ Understand Apex trader funding rules

☑ Track the live trailing threshold

☑ Use WealthCharts performance in Brazil for data-driven trades

☑ Aim for trading consistency—not speed

FAQ 5: Typical drawdown limits for prop firms in Brazil?

Drawdown rules vary. Some no trailing drawdown prop firm models use fixed limits, while Apex uses a trailing threshold system that adjusts with account performance. Understanding these differences—especially the live trailing threshold—can help traders in Brazil’s proprietary trading career challenges make more informed decisions about risk.

Trailing Drawdown Myths That Could Cost You Your Funded Account

Many traders misunderstand how the trailing drawdown functions, leading to costly mistakes during evaluations. Clearing up these misconceptions is essential for anyone navigating prop firm challenges or preparing for futures contracts trading under evaluation conditions.

Here are some of the most common misunderstandings and the truth behind them:

Misconception 1: “The Drawdown Only Tracks Closed Trades”

Reality: Apex’s live trailing threshold includes unrealized gains—not just closed positions. If your account hits a new intraday equity high due to an open trade, the trailing drawdown adjusts upward accordingly. This means a sudden pullback—even without closing a position—can cause a violation.

Misconception 2: “Once I Pass the Drawdown Level, I’m Safe”

Reality: The drawdown continues to trail your equity until you hit the profit target. Even if you’re comfortably ahead early in the evaluation, one high-leverage trade can reverse your progress. Protecting your equity throughout the process is essential to reach the stage where the drawdown freezes.

Misconception 3: “All Prop Firms Use the Same Drawdown Rules”

Reality: Drawdown rules vary dramatically across futures prop firms. While Apex uses an intraday trailing model, others rely on end-of-day balances or only consider closed trades. Traders comparing firms or planning their proprietary trading career challenges in Rio de Janeiro should always review each firm’s specific structure.

Misconception 4: “Monitoring My Dashboard Is Enough”

Reality: Platforms like Tradovate and Rithmic provide equity data, but they don’t always show the true equity high. Traders aiming to pass the funded trader challenge should manually log their Rithmic performance metrics for prop firm challenges in Brazil to maintain complete control over risk tracking.

Misconception 5: “Scaling Up Fast Is a Smart Strategy”

Reality: Aggressively increasing lot size without building a profit cushion often backfires. The drawdown trails your peak balance, not your logic. Taking a slow, methodical approach helps protect against unwanted breaches especially for traders in WealthCharts apex trading accounts or tradovate funded accounts.

🎓 Educational Note

Understanding the mechanics of the Apex trader trailing drawdown isn’t just about avoiding failure it’s about developing the risk management mindset needed for long-term success in funded futures trading.

Prop Firm Challenge Example: When the Trailing Drawdown Strikes

Let’s take a look at how the live trailing threshold works in a different funding scenario—this time using a $75,000 evaluation account.

- Day 1:

The trader begins cautiously and secures a $1,200 profit.

➤ New Balance = $76,200

➤ Trailing Drawdown = $73,200 (initial buffer of $2,000)

✅ Account remains active.

- Day 2:

Midday trading brings an unrealized equity high of $78,500, but the trader doesn’t close.

➤ TDD adjusts to $76,500 (tracks the peak)

✅ Still compliant.

- Day 3:

The market reverses unexpectedly, and equity drops to $75,400 before any trades are closed.

➤ Since the drawdown is at $76,500, the account falls below threshold.

❌ Evaluation breached — despite the account still showing a net gain.

📌 Key Insight:

Because the apex trader trailing drawdown moves with your intraday highs, even unrealized gains can raise your risk barrier. Without locking in profits, the trader’s floating success ultimately triggered a rule violation. This highlights the importance of monitoring tools, whether through manual tracking or analyzing WealthCharts' performance in Brazil, to stay aligned with the trailing threshold and avoid unexpected breaches.

💡 **Pro Tip**

If your equity spikes but you don’t close the trade, your trailing drawdown still rises. Protect your progress—lock in profits or reduce size when volatility spikes.

How Apex Compares: Trailing Drawdown vs Other Firms

This side-by-side comparison reveals Apex as one of the easiest prop firm challenges to pass—thanks to simple rules, no trading minimums, and fast payouts.

📌 Why Apex Stands Out

- No minimum trading days in evaluations

- Live trailing drawdown simulates real-market pressure

- Platform flexibility with Rithmic, Tradovate, and NinjaTrader

- High profit split (up to 90%)

- 1–2 day funding turnaround after passing

Final Thoughts: Drawdown Mastery Equals Longevity

Apex’s trailing drawdown isn’t just a test it’s a roadmap to capital preservation and consistency. Traders who learn to navigate it are more likely to succeed in both evaluations and live accounts. It’s one of the key factors that separates short-term gains from long-term trading consistency in Brazil, especially for those building a sustainable trading career through prop firm models.

📢 “True discipline isn’t measured by how fast you grow—it’s measured by how well you protect what you’ve earned.”

Ready to Get Funded?

If you’re ready to take the next step, Apex Trader Funding provides the tools, rules, and resources you need to build your futures trading career with confidence. Whether you choose a 25K account or go big with 100K, the support is there.

Use copy code to avail current discounts available on Apex Trader Funding. Explore account types, understand how to fund Tradovate account options, and start your journey with one of the most reliable platforms for day trading futures strategies.

FAQs

Related Blogs

trading-education | 19-04-25

Fast-Track Your Trading Journey with Apex Trader Funding’s Revolutionary One Day to Pass Rule

Fast-Track Your Trading Journey with Apex Trader Funding’s Revolutionary One Day to Pass RuleHow to Get Funded for TradingIn the...

Read more

trading-education | 19-04-25

Mastering the Markets: A Beginner’s Guide to Trading and Apex Trader Funding

Trading for Beginners: Your First Steps Toward Financial MasteryThe world of trading often feels like a maze of jargon, numbers,...

Read more

trading-education | 19-04-25

Mastering Day Trading: Your Path to $500 a Day

Mastering Day Trading: Your Path to $500 a DayDay trading, the practice of buying and selling financial assets within a...

Read more